Trading is full of uncertainties. Markets move fast, sentiment shifts in an instant, and what looked like a winning trade can turn against you before you blink. But if there’s one thing that separates seasoned traders from those who burn out, it’s risk management.

It’s not about playing scared—it’s about staying in the game long enough to win. Because the truth is, no one has a perfect success rate. What really matters is how well you protect your capital, limit your losses, and manage your exposure when things don’t go as planned.

Know How Much You’re Willing to Lose—Before You Trade

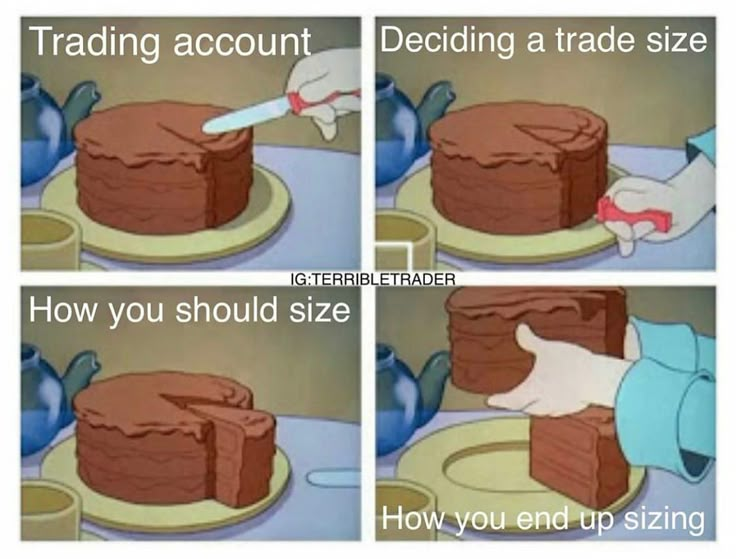

Successful traders don’t take wild bets. They have rules. One of the most important? Never risk more than 1-2% of your capital on a single trade.

It’s simple math. If you go all-in on one trade and it tanks, your entire account takes a hit. But by managing risk, you ensure that a single bad trade doesn’t wipe you out.

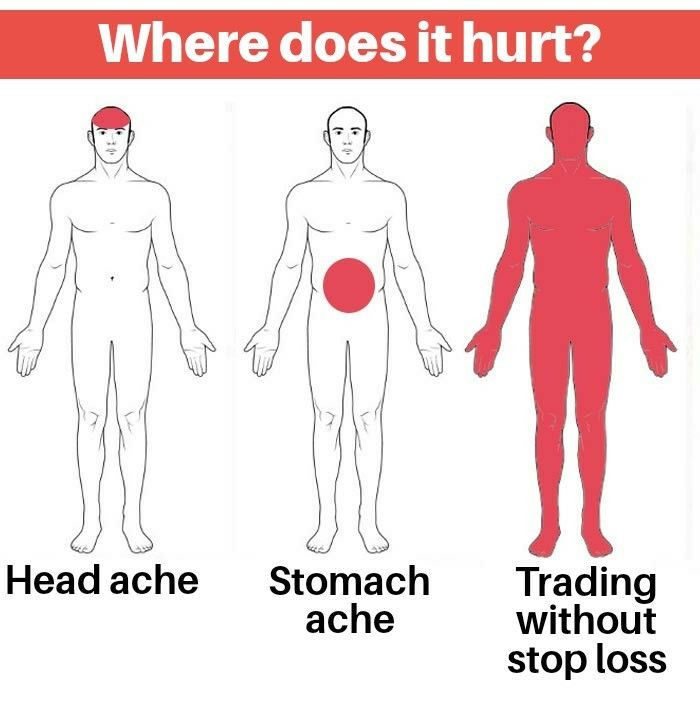

Use Stop-Loss Orders—And Don’t Second-Guess Them

No trader wants to take a loss, but holding onto a bad position, hoping for a reversal, is a fast track to bigger losses. That’s why stop-loss orders aren’t optional—they’re essential.

Set a stop-loss based on technical levels, market conditions, and your personal risk tolerance. Then stick to it. The goal isn’t to be right all the time—it’s to make sure that when you’re wrong, the damage is minimal.

Because markets don’t always move the way you expect.

Putting everything into one asset, one trade, or one strategy might work—for a while. But long-term success comes from spreading risk. That could mean balancing different asset classes, currency pairs, or even trading strategies.

Diversification doesn’t eliminate risk, but it ensures you’re not overly exposed to a single market event.

Make Sure Every Trade is Worth It

A well-planned trade isn’t just about how much you might win—it’s also about how much you’re willing to lose to get there.

A risk-reward ratio of at least 1:2 means that for every $1 you risk, you have the potential to make $2. Sticking to this mindset prevents you from taking impulsive, low-reward trades that aren’t worth the downside.

The Best Traders Know When to Walk Away

Sometimes, the best trade is no trade at all. If market conditions look unpredictable, if a setup isn’t quite right, or if emotions are clouding your judgment, stepping back is the smartest move.

Risk management isn’t just about protecting your money—it’s about protecting your mindset. A trader who burns out or lets emotions take over won’t last long. The ones who do? They trade with discipline, patience, and a clear plan.

No strategy, no indicator, no market insight will work without strong risk management. It’s what keeps you in the game, lets you take opportunities with confidence, and ensures that even on bad days, you live to trade another.

If you’re serious about trading, make risk management your priority. Because in the long run, it’s not just about making money—it’s about keeping it.