On Monday, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average rebounded, breaking a four-day losing streak, with the 10-year Treasury yield reaching its highest level since 2007. Dow Inc. led gains, spurred by an upgrade from JPMorgan, while energy sectors thrived, notably with Amazon’s $4 billion investment in an AI firm. Despite September’s challenges, including signals of higher interest rates and a strengthening U.S. dollar, the energy sector emerged as the top performer. Investors kept a close watch on developments in Washington, with Moody’s warning of the “credit negative” impact of a government shutdown. In the currency market, the U.S. dollar strengthened, while the euro struggled due to bearish sentiments from central banks and weaker German economic data. Other currency pairs experienced fluctuations driven by rising Treasury yields and central bank policies. The outlook remained uncertain, with a keen eye on upcoming economic data and concerns about a potential government shutdown.

Stock Market Updates

In the stock market update, the S&P 500 showed resilience as it gained 0.4% to reach 4,337.44, marking a positive start to the final week of September. The Nasdaq Composite also closed higher, rising by 0.45% to 13,271.32, while the Dow Jones Industrial Average added 43.04 points (0.13%) to close at 34,006.88. This positive momentum broke a four-day losing streak for all three major indices. Notably, the 10-year Treasury yield increased by 10 basis points to 4.542%, its highest level since 2007. Despite the bond market movements, stocks demonstrated strength, with Dow Inc. as the top-performing stock, surging 1.7% following an upgrade from JPMorgan. Energy led the gains in eight of the 11 S&P 500 sectors, with Amazon announcing plans to invest up to $4 billion in an artificial intelligence firm, Anthropic. Investors cited technical support at the 4,300 level and anticipation of rejoining the artificial intelligence (AI) boom trade as factors supporting the market’s robust performance.

Throughout September, the stock market faced challenges, including signals from the Federal Reserve about prolonged higher interest rates, resulting in increased bond yields. These challenges also included a rally in crude oil prices and a strengthening U.S. dollar during the seasonally weaker trading month. The energy sector was the top performer in September, showing a gain of over 2%. The S&P 500 declined by nearly 4% this month, potentially heading for its second consecutive losing month and its most challenging month since December. The Nasdaq Composite, primarily composed of growth stocks, experienced a 5.4% decline in September, marking its largest monthly loss since December. In contrast, the Dow experienced a more modest 2% decline this month. Investors remained watchful of developments related to a budget resolution in Washington, as lawmakers exhibited limited progress on a deal to fund the U.S. government for the remainder of the fiscal year. Moody’s Investors Service warned that a government shutdown would have a “credit negative” impact on the U.S. economy.

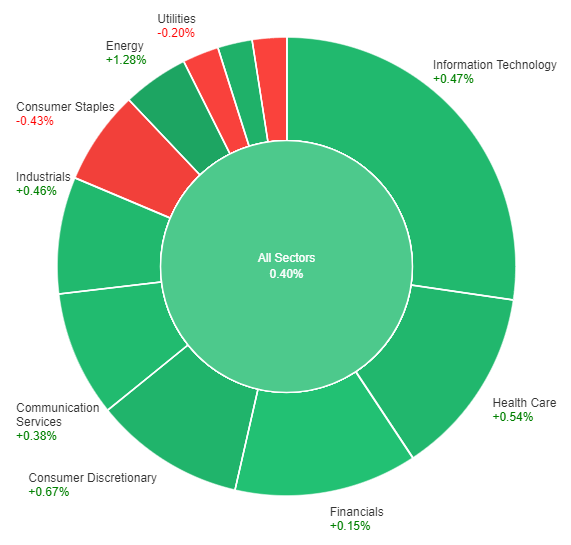

Data by Bloomberg

On Monday, across all sectors, the market saw a positive gain of 0.40%. The energy sector experienced the most significant increase with a rise of 1.28%, followed by materials at 0.80%, consumer discretionary at 0.67%, and health care at 0.54%. Information technology and industrial sectors gained 0.47% and 0.46%, respectively, while communication services and financials saw more modest gains of 0.38% and 0.15%. However, the real estate and utilities sectors declined, with decreases of -0.17% and -0.20%, respectively. Consumer staples experienced the most significant decline at -0.43%.

Currency Market Updates

The currency market updates reveal a strengthening US dollar, which reached new highs in 2023 as the dollar index rose by 0.32%. This surge was partly driven by the Federal Reserve’s commitment to maintain higher interest rates for an extended period. On the other side, the euro struggled as EUR/USD fell by 0.46%, breaking key support levels. This decline was influenced by bearish sentiment from both the Fed and the European Central Bank (ECB) and weaker German economic data. The outlook for the eurozone suggests limited potential for rate hikes in the current cycle. Additionally, the US dollar’s strong performance was driven by favorable economic data and concerns about yield spreads between US Treasuries and German Bunds.

In the broader market, USD/JPY saw a 0.28% increase, mainly due to rising Treasury yields. Meanwhile, the Bank of Japan (BoJ) appeared to maintain its ultra-loose monetary policy, though it expressed concerns about FX moves and intervention risks. Sterling fell by 0.2% as the Bank of England (BoE) put an end to its consecutive rate hikes, following the hawkish stance of the Federal Reserve. The USD/CNH pair rose by 0.23%, influenced by concerns about the property sector and increased bond yields globally. The upcoming release of US consumer confidence and housing data will be closely watched, along with concerns about a potential US government shutdown, which Moody’s has warned could have a “credit negative” impact.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Hits Lowest Since March Amidst Euro’s Decline and ECB’s Inflation Control Efforts

The EUR/USD pair broke below 1.0630, plummeting to 1.0574, marking its lowest point since March. This decline represents the Euro’s fifth consecutive daily loss, primarily due to a strong US Dollar and European Central Bank (ECB) President Christine Lagarde’s commitment to maintaining elevated interest rates for inflation control. Meanwhile, the US Dollar Index reached levels above 106.00, supported by higher US Treasury yields, reaching its highest point since March. US economic data released showed mixed results, with attention turning to housing prices, consumer confidence, and New Home Sales in the upcoming schedule.

According to technical analysis, the EUR/USD moved in high volatility on Monday and was able to reach the lower band of the Bollinger Bands. This movement suggests the possibility of further lower movement. The Relative Strength Index (RSI) is currently at 31, indicating that the EUR/USD is in bearish sentiment.

Resistance: 1.0635, 1.0687

Support: 1.0565, 1.0523

XAU/USD (4 Hours)

XAU/USD Faces Selling Pressure Above $1,900 Amid Stronger USD and Rising Treasury Yields

Gold is struggling to maintain its value above $1,900 as it faces selling pressure during the early Asian session. The stronger US Dollar, with the Dollar Index reaching its highest level since November, and rising Treasury yields have contributed to this downward pressure. Technical indicators favor a bearish outlook for XAU/USD, with support at $1,915 and a potential downtrend if it breaks lower. The recent strength of the US Dollar, supported by a strong US economy and elevated Treasury yields, continues to impact the price of Gold as market participants await key US consumer inflation data.

According to technical analysis, XAU/USD moved lower on Monday and was able to move near the lower band of the Bollinger bands. Currently, the price is moving slightly above the lower band showing a potential of moving back higher. The Relative Strength Index (RSI) is currently at 38, indicating that the XAU/USD pair is in a neutral stance with a slight bear bias.

Resistance: $1,920, $1,930

Support: $1,913, $1,903

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | CB Consumer Confidence | 22:00 | 105.5 |