On Wednesday, the stock market witnessed a significant rebound, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average posting notable gains, driven in part by Lyft’s shares soaring 35% after reporting impressive fourth-quarter earnings. This rally followed a sharp downturn on Tuesday, spurred by concerns over inflation and the Federal Reserve’s interest rate policies. The market’s recovery was also reflected in the currency markets, where the dollar index dipped slightly, and currency pairs like EUR/USD saw modest gains. These movements came in the wake of comments from Federal Reserve officials and the latest CPI data, which led to a recalibration of expectations regarding the timing of potential rate cuts, now more likely in the second half of 2024, and influenced currency market dynamics significantly.

On Wednesday, the stock market saw a positive shift as major indexes rebounded from the significant losses experienced in the prior session. The S&P 500 increased by 0.96% to close at 5,000.62, the Nasdaq Composite rose by 1.3% to end at 15,859.15, and the Dow Jones Industrial Average grew by 0.4%, adding 151.52 points to finish at 38,424.27. This recovery was notably led by shares of Lyft, which surged by 35% following the ride-hailing company’s announcement of better-than-expected earnings for the fourth quarter. However, not all shares experienced gains, as Airbnb’s stock fell by 1.7% despite the company surpassing revenue expectations in its latest quarter.

The upward movement in the stock market came after a tumultuous Tuesday, where indexes such as the Dow, S&P 500, and Nasdaq Composite all slumped by more than 1%, marking the Dow’s worst day since March 2023. This sell-off was triggered by a hotter-than-anticipated inflation report, causing concern among traders that the Federal Reserve might delay cutting interest rates, a move previously anticipated by some to occur as early as March. The January CPI report has adjusted expectations, suggesting that any potential rate cuts by the Fed are more likely to happen in the second half of 2024, reflecting investors’ recalibrated outlooks on monetary policy amidst ongoing inflation concerns.

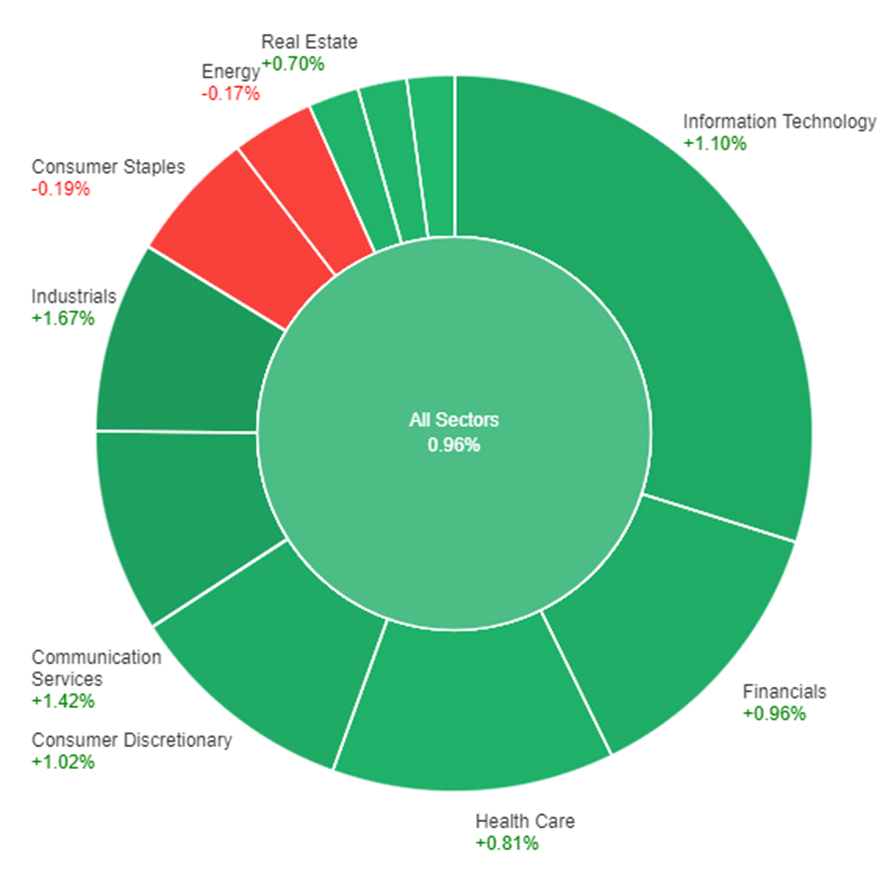

Data by Bloomberg

On Wednesday, the stock market experienced broad gains across most sectors, with the overall sectors index rising by 0.96%. Industrials led the charge with a significant increase of 1.67%, followed closely by Communication Services and Information Technology, which saw gains of 1.42% and 1.10%, respectively. Other sectors showing notable performance included Consumer Discretionary, Financials, and Health Care, with increases of 1.02%, 0.96%, and 0.81%, respectively. Real Estate, Materials, and Utilities also experienced positive movement, albeit at a slower pace. In contrast, the Energy and Consumer Staples sectors faced slight declines, dropping by 0.17% and 0.19%, respectively, indicating a mixed but predominantly positive day in the market.

The currency market experienced notable movements as the dollar index saw a decrease of 0.25%, influenced by a mix of factors including the consolidation of gains post-Tuesday’s Consumer Price Index (CPI) announcement and remarks from Chicago Fed President Austan Goolsbee, who suggested that the market’s reaction to the inflation data might have been excessive. Goolsbee’s comments, emphasizing that the recent CPI report does not alter the ongoing downtrend in inflation, were particularly impactful despite the core CPI’s 3-month annualized rate climbing to its highest since June. This dovish perspective from Goolsbee, alongside a drop in Treasury yields, led to a shift in market expectations, increasing the probability of a Federal Reserve rate cut in May and adjusting the outlook for 2024 cuts.

In currency pairs, the EUR/USD pair experienced a slight recovery, rising 0.2% after initially dropping below 1.0700, reacting to the surging U.S. Treasury yields and the recalibration of Federal Reserve rate cut expectations following the U.S. CPI data. This movement underscores the sensitivity of currency markets to interest rate expectations and inflation data, with the euro finding some support despite facing pressure from the anticipated earlier and more significant rate cuts by the European Central Bank compared to the Fed. Meanwhile, other major currencies like the British pound and the Japanese yen also showed varied reactions to the shifting economic indicators and central bank sentiments, highlighting the intricate dynamics influencing the currency markets amidst evolving economic landscapes.

EUR/USD Rebounds Amid USD Pullback and Fed Rate Cut Speculation

The EUR/USD pair witnessed a rebound as the US dollar experienced a modest retracement, driven by a pullback in US yields and profit-taking after recent gains. This movement was influenced by the anticipation of potential Federal Reserve monetary easing, possibly starting in June, in response to higher-than-expected US inflation figures. Market odds, according to the CME Group’s FedWatch Tool, suggest a growing probability of a Fed rate cut, with significant expectations for a reduction by the June meeting. Meanwhile, Federal Reserve and ECB officials highlighted the importance of cautious monetary policy adjustments amidst inflation concerns and geopolitical risks, indicating a complex environment for future rate decisions and their implications for currency movements.

On Wednesday, the EUR/USD moved higher and reached near the middle band of the Bollinger Bands. Currently, the price is moving just below the middle band, suggesting a potential slightly upward movement to reach above the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 44, signaling a neutral outlook for this currency pair.

Resistance: 1.0744, 1.0796

Support: 1.0713, 1.0662

XAU/USD Recovery Amid Weakening USD and Optimistic Market Sentiments

Gold (XAU/USD) witnessed a dip to its lowest since last December at $1,984.03, only to rebound above the $1,900 threshold as the US Dollar weakened due to improved market sentiments and a rally on Wall Street. This shift came despite the global central banks’ firm stance against easing monetary policy, underscored by recent macroeconomic data indicating persistent inflation and tight labor markets, especially in the US. The unexpected rise in January’s inflation and strong Nonfarm Payrolls report has quashed immediate hopes for a Federal Reserve rate cut, as affirmed by Fed Chairman Jerome Powell, emphasizing a cautious yet optimistic outlook for the economy.

On Wednesday, XAU/USD moved flat and moved between the lower and middle bands of the Bollinger Bands. Currently, the price is moving above the lower band, suggesting a potential upward movement to reach the middle band. The Relative Strength Index (RSI) stands at 32, signaling a bearish outlook for this pair.

Resistance: $2,004, $2,023

Support: $1,988, $1,973

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 08:30 | 0.5K (Actual) |

| AUD | Unemployment Rate | 08:30 | 4.1% (Actual) |

| GBP | GDP m/m | 15:00 | -0.2% |

| USD | Core Retail Sales m/m | 21:30 | 0.2% |

| USD | Empire State Manufacturing Index | 21:30 | -13.7 |

| USD | Retail Sales m/m | 21:30 | -0.2% |

| USD | Unemployment Claims | 21:30 | 219K |