The S&P 500 achieved a new record high, climbing to 4,927.93, driven by anticipation of major tech company earnings and the upcoming Federal Reserve rate policy decision. This week is pivotal with 19% of S&P 500 companies, including tech giants like Microsoft and Apple, due to report earnings. The Dow Jones and Nasdaq also saw significant gains. Concurrently, the Federal Open Market Committee is expected to maintain steady rates, with a 97% probability against a rate cut. In currency markets, the dollar index rose, influenced by various global events and market uncertainties. The Euro and Japanese yen weakened against the dollar, while the Sterling remained stable. These financial movements occur amidst global geopolitical tensions and economic concerns, notably in China and the Eurozone.

Stock Market Updates

On Monday, the S&P 500 achieved a new record high, driven by anticipation of tech giant earnings reports and the upcoming Federal Reserve rate policy decision. The index rose 0.76% to 4,927.93, surpassing its previous record close of 4,894.16 set on January 25. Similarly, the Dow Jones Industrial Average increased by 224.02 points (0.59%) to close at 38,333.45, while the Nasdaq Composite gained 1.12%, ending at 15,628.04. This marked the sixth record close for both the S&P 500 and the Dow.

The focus this week is on the earnings season, with 19% of the S&P 500 companies set to report their earnings. High-profile tech companies such as Microsoft, Apple, Meta, Amazon, and Alphabet, which have significantly contributed to this year’s market rally, are among those scheduled to release their results. Additionally, investors are keeping a close watch on earnings from major Dow components like Boeing and Merck. Meanwhile, the Federal Open Market Committee is commencing its two-day policy meeting, with market participants almost certain that the Fed will maintain steady rates. According to the CME Group, there’s approximately a 97% probability that the Fed will not reduce rates in the upcoming meeting.

Data by Bloomberg

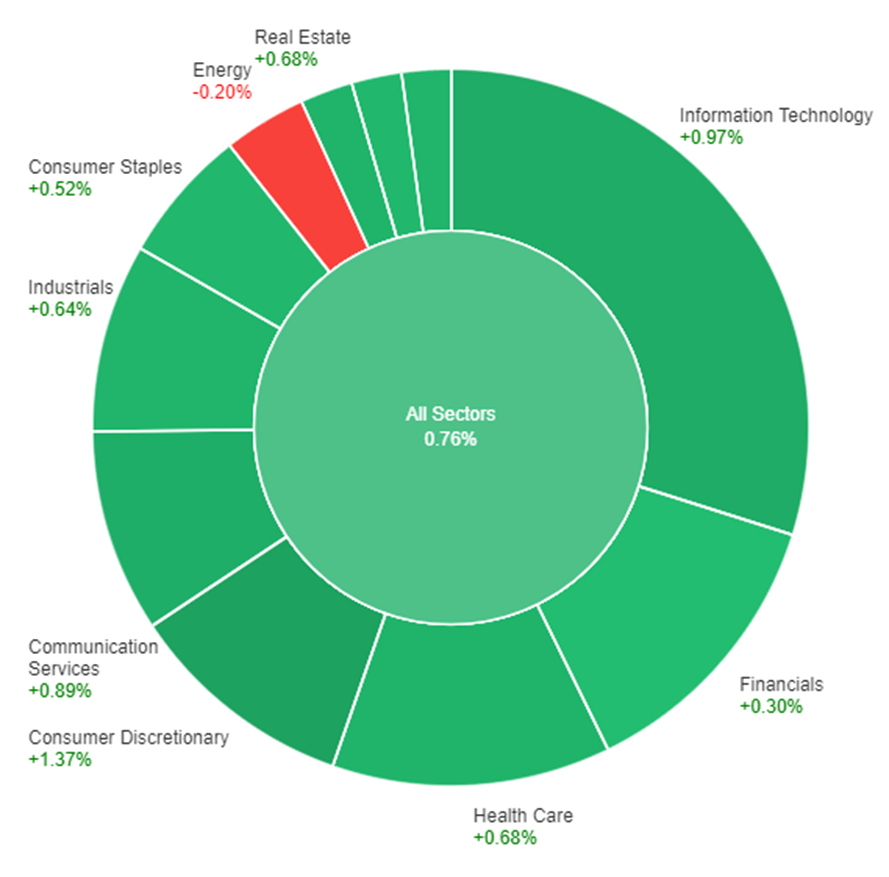

On Monday, the stock market experienced overall positive movement, with all sectors combined showing a gain of +0.76%. Notably, the Consumer Discretionary sector led the advances with a +1.37% increase, followed closely by Information Technology and Communication Services, which rose by +0.97% and +0.89% respectively. Health Care, Real Estate, Utilities, and Industrials also saw moderate gains, each climbing by approximately +0.68% and +0.64%. More modest growth was observed in Consumer Staples and Materials, both up by +0.52%, while Financials lagged slightly behind with a +0.30% increase. In contrast to the general upward trend, the Energy sector was the only one to experience a decline, dropping by -0.20%.

Currency Market Updates

In the recent currency market update, the dollar index experienced a 0.25% rise, largely driven by gains against major currencies, with the notable exception of the Japanese yen. This shift in the currency market comes amidst a variety of global events contributing to a heightened sense of risk. These include uncertainties surrounding key U.S. labor data, Eurozone inflation reports, and upcoming policy meetings of the Federal Reserve and the Bank of England. Additionally, increasing tensions in the Middle East and concerns over China’s economic future have added to the market’s cautious sentiment.

The Euro to U.S. Dollar (EUR/USD) pair saw a notable decline of 0.35%, significantly contributing to the dollar’s overall strength. This decline was influenced by weak economic conditions in Germany and a mild recession in the Eurozone. Moreover, a growing number of dovish European Central Bank policymakers has led the market to anticipate a 25 basis point rate cut by the ECB in April. The USD/JPY pair also experienced a 0.33% fall, influenced by a decrease in Treasury yields and a slight increase in Japanese Government Bond yields, challenging the uptrend driven by speculations and expectations of policy convergence between the Federal Reserve and the Bank of Japan. In addition to these currency movements, Sterling displayed a modest drop of 0.19%, maintaining its range for the seventh consecutive week, while oil prices fluctuated amid geopolitical tensions and concerns over Chinese economic stability.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Decline Amidst Dovish ECB Stance and Strong USD

The EUR/USD pair experienced a notable decline, falling below 1.0800 for the first time since mid-December, primarily due to the persistent strength of the US dollar and dovish signals from the European Central Bank (ECB). The ECB’s decision to leave policy rates unchanged, coupled with President Lagarde’s emphasis on a data-dependent approach and potential interest rate cuts in the summer, contributed to a subdued Euro. Contrasting views within the ECB, such as Board member Centeno’s unexpected support for earlier rate cuts, failed to reverse the Euro’s downward trend. Additionally, anticipation of the upcoming Federal Reserve meeting, with expectations of maintaining the Federal Funds Target Rate (FFTR) between 5.25%–5.50%, further pressured the EUR/USD. Investors are now focusing on the possibility of a US rate cut, potentially delayed to May, as indicated by the CME Group’s FedWatch Tool.

On Monday, the EUR/USD moved lower, able to reach the lower band of the Bollinger Bands. Currently, the price is moving higher near the middle band, suggesting a potential upward movement to reach the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 42, signaling a neutral but bearish outlook for this currency pair.

Resistance: 1.0890, 1.0954

Support: 1.0814, 1.0745

XAU/USD (4 Hours)

XAU/USD React to Geopolitical Tensions and Economic Anticipations

Gold experienced a notable rise, reaching $2,037.46, influenced by a weakening US dollar and escalating tensions in Asia, particularly due to a drone attack on US troops in the Middle East, attributed to Iran. This geopolitical unrest, coupled with mixed stock market performances and anticipation of key economic events such as the Eurozone and German GDP reports, US employment data, and the US Federal Reserve’s monetary policy decision, kept investors on edge. Additionally, the market’s reaction to European Central Bank officials’ comments on interest rate expectations further shaped the trading landscape, maintaining a cautious but vigilant environment in the financial markets.

On Monday, XAU/USD moved higher and was able to reach the upper band of the Bollinger Bands. Currently, the price is moving higher slightly below the upper band suggesting a potential upward movement to reach above the upper band. The Relative Strength Index (RSI) stands at 57, signaling a neutral with a slightly bullish outlook for this pair.

Resistance: $2,035, $2,052

Support: $2,010, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | CB Consumer Confidence | 23:00 | 114.2 |

| USD | JOLTS Job Openings | 23:00 | 8.73M |