After Netflix’s stellar fourth-quarter performance, Nasdaq 100 futures experienced a significant boost in Tuesday evening trading. Fueled by Netflix’s impressive subscriber growth of 13 million, reaching a record 260.8 million, tech-heavy Nasdaq 100 futures rose by 0.28%, contributing to the broader strength of mega-cap tech stocks and propelling the S&P 500 to record highs. While the Dow Jones Industrial Average futures showed a more restrained response, Netflix’s positive performance extended beyond subscriber gains, with an 8.6% surge in extended trading. The article delves into the factors driving Netflix’s success and the resilience of tech stocks amid mixed market performances, offering insights into currency market dynamics and the potential impact on various economies, particularly Japan, as they navigate higher rates and potential rate cuts. The narrative also previews upcoming economic data, emphasizing the market’s focus on the European Central Bank meeting, U.S. Q4 GDP, and core PCE readings for further guidance on Fed and dollar pricing.

Stock Market Updates

In the wake of Netflix’s strong fourth-quarter performance, futures linked to the Nasdaq 100 experienced a notable uptick during Tuesday evening trading. The tech-heavy Nasdaq 100 futures rose by 0.28%, driven by Netflix’s robust results, which revealed a record-breaking subscriber count of 260.8 million, an increase of over 13 million in the last quarter. The streaming giant’s impressive gains contributed to the broader strength of mega-cap tech stocks in 2024, propelling the S&P 500 to record highs and confirming the onset of a new bull market. However, the Dow Jones Industrial Average futures only edged up by 0.05%, with a marginal increase of 19 points, reflecting a more subdued response possibly influenced by disappointing earnings and guidance from certain blue-chip companies during the main trading session.

Netflix’s positive performance extended beyond subscriber growth, as its shares surged by 8.6% in extended trading. The company not only exceeded revenue expectations but also provided optimistic earnings guidance for the current quarter, surpassing Wall Street forecasts. Analysts attribute Netflix’s success to the strength of its ad-tier business scaling, particularly in the latter part of the previous year, and its efforts to curb password sharing. As traders keep an eye on upcoming economic data, including U.S. manufacturing and services statistics for January and fourth-quarter gross domestic product figures, the broader market dynamics underscore the resilience of tech stocks amid mixed performances in other sectors, as exemplified by the Dow’s slight retreat during the main trading session.

Data by Bloomberg

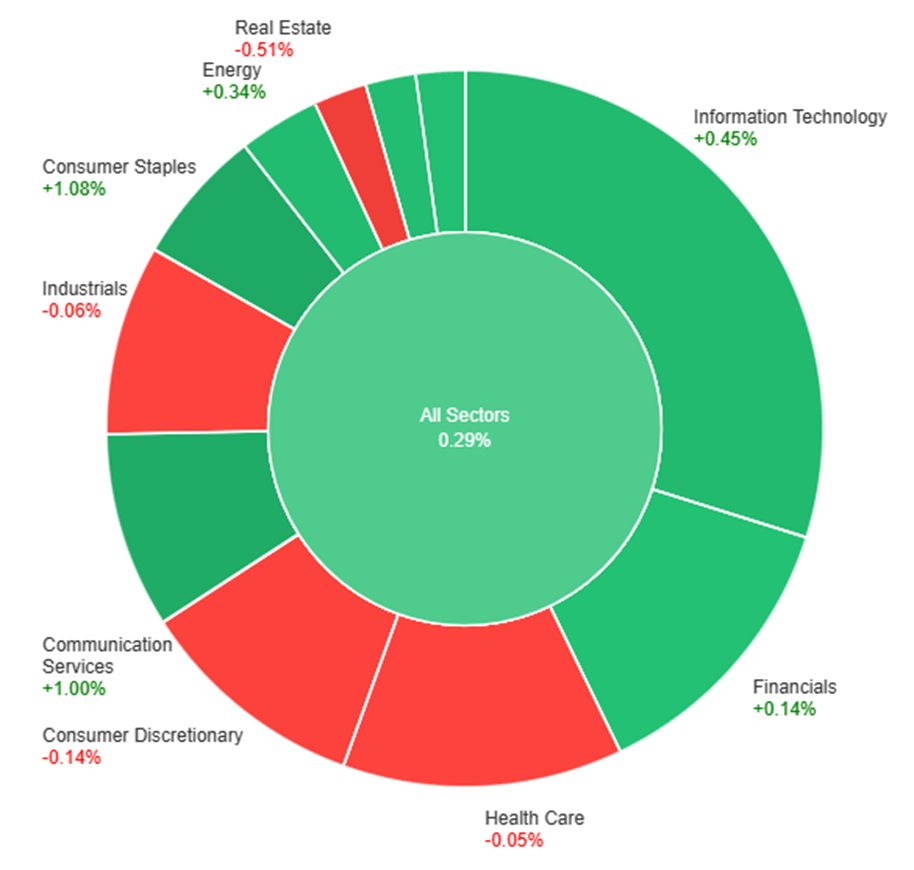

On Tuesday, the overall market experienced a modest gain of 0.29%. Noteworthy performances were observed in the Consumer Staples (+1.08%), Communication Services (+1.00%), and Information Technology (+0.45%) sectors, contributing positively to the overall uptrend. However, the healthcare sector showed a slight decline with -0.05%, while Industrials (-0.06%), Consumer Discretionary (-0.14%), and Real Estate (-0.51%) sectors exhibited marginal losses, indicating a mixed day for different segments of the market. The Financials (+0.14%), Energy (+0.34%), and Materials (+0.32%) sectors also contributed to the overall positive sentiment with modest gains.

Currency Market Updates

In Tuesday’s currency market updates, the dollar index exhibited a 0.36% increase, recovering from earlier losses spurred by a brief yen rise following a somewhat more hawkish Bank of Japan (BoJ) meeting. The EUR/USD pair broke below key support from the previous week as Treasury yields outpaced bund yields. Despite the BoJ expressing confidence in ending its negative rates policy later in the year and the market leaning towards a 10-basis point June hike to zero, 2-year Japanese Government Bond (JGB) yields only rose to 0.06%. The article highlights how various economies, particularly Japan, can manage higher rates or a gradual retreat from previous rate hikes. The U.S. appears more resilient, having raised rates more than other major central banks, with futures markets not fully pricing in a Federal Reserve rate cut until May.

EUR/USD experienced a 0.45% decline, breaking key technical supports such as the daily cloud top and the 200-day moving average. USD/JPY initially dropped to 146.99 lows in response to the BoJ meeting but found support near the 10-day moving average and 147, leading to a 0.3% increase on the day. The article points out the potential challenge of testing the Ministry of Finance’s desire to prevent the yen from falling below 2022/23 lows at 151.94/92 if U.S. data continues to suggest fewer Fed rate cuts. Meanwhile, sterling fell 0.35%, despite rising Gilt-Treasury yield spreads, and is closely watched ahead of the Bank of England’s meeting on February 1. The focus for the rest of the week includes the European Central Bank meeting, U.S. Q4 GDP, and Friday’s core PCE for further Fed and dollar pricing guidance, with the flash January PMI readings as a key data feature on Wednesday.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Hits Multi-Week Lows as Greenback Gains Strength Amid ECB Caution

On Tuesday, the EUR/USD pair extended its decline, reaching fresh multi-week lows in the 1.0820 zone as the selling bias persisted in the risk complex. The USD Index (DXY) soared to a new yearly high of 103.80, driven by a robust buying bias in the greenback, higher US yields, and an overarching risk-off sentiment. The upcoming ECB event is marked by a growing debate between market participants and rate-setters regarding the timing of potential rate cuts, with President Lagarde hinting at a possible move in the summer. Despite inflation surpassing the ECB target, cautious policymaking in the face of weak economic fundamentals continues to limit the Euro’s potential for strengthening.

On Tuesday, the EUR/USD moved lower, able to reach the lower band of the Bollinger Bands. Currently, the price is moving just above the lower band, suggesting a potential upward movement to reach the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 41, signaling a neutral but bearish outlook for this currency pair.

Resistance: 1.0890, 1.0954

Support: 1.0814, 1.0745

XAU/USD (4 Hours)

XAU/USD Holds Steady Above $2,020 Amidst Market Volatility and Economic Indicators

Gold (XAU/USD) maintained a tight trading range just above $2,020 per troy ounce on Tuesday, propelled initially by a weakening US Dollar in response to record highs in the S&P 500 and Dow Jones Industrial Average. The precious metal’s rally in the first half of the day was influenced by market optimism regarding a potential interest rate cut by the Federal Reserve. However, the USD regained strength later in the day as equities faced losses, driven by caution ahead of earnings reports and concerns about macroeconomic events in the coming days. Despite disappointing US data, gold remained resilient, with attention turning to the Bank of Canada’s upcoming monetary policy decision.

On Tuesday, XAU/USD moved higher and was able to reach the upper band of the Bollinger Bands. Currently, the price is moving just above the middle band suggesting a potential upward movement to reach the upper band. The Relative Strength Index (RSI) stands at 50, signaling a neutral outlook for this pair.

Resistance: $2,035, $2,052

Support: $2,010, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 16:15 | 42.5 |

| EUR | French Flash Services PMI | 16:15 | 46.1 |

| EUR | German Flash Manufacturing PMI | 16:30 | 43.7 |

| EUR | German Flash Services PMI | 16:30 | 49.3 |

| GBP | Flash Manufacturing PMI | 17:30 | 46.7 |

| GBP | Flash Services PMI | 17:30 | 53.1 |

| CAD | BOC Monetary Policy Report | 22:45 | |

| CAD | BOC Rate Statement | 22:45 | |

| CAD | Overnight Rate | 22:45 | 5.00% |

| USD | Flash Manufacturing PMI | 22:45 | 47.6 |

| USD | Flash Services PMI | 22:45 | 51.4 |

| CAD | BOC Press Conference | 23:30 |