On Wednesday, S&P 500 futures and Dow Jones Industrial Average futures both fell, by 0.2% and 0.2%, respectively, while Nasdaq 100 futures remained flat, up 0.06%. The drop was attributed to the Federal Reserve’s decision to increase rates by 25 basis points and concerns over contagion in the regional bank sector. PacWest’s shares plummeted more than 50% after news broke that the California bank was assessing strategic options, including a possible sale. Other regional banks, such as Western Alliance and Zions Bancorporation, also experienced sharp declines.

During a post-meeting press conference, Fed Chair Jerome Powell indicated that the committee viewed inflation as unlikely to decrease rapidly, making it inappropriate to cut rates. Stocks closed lower on Wednesday, with the Dow dropping 0.8%, the S&P 500 losing 0.7%, and the Nasdaq Composite declining by approximately 0.5%. Upcoming key economic reports, including Thursday’s initial jobless claims and Friday’s April payrolls report, will help inform the Fed’s next steps.

In addition to economic reports, investors will be closely watching several companies’ earnings releases, including Moderna’s results before the opening bell on Thursday, and after-market earnings from Apple, Lyft, DraftKings, and Coinbase.

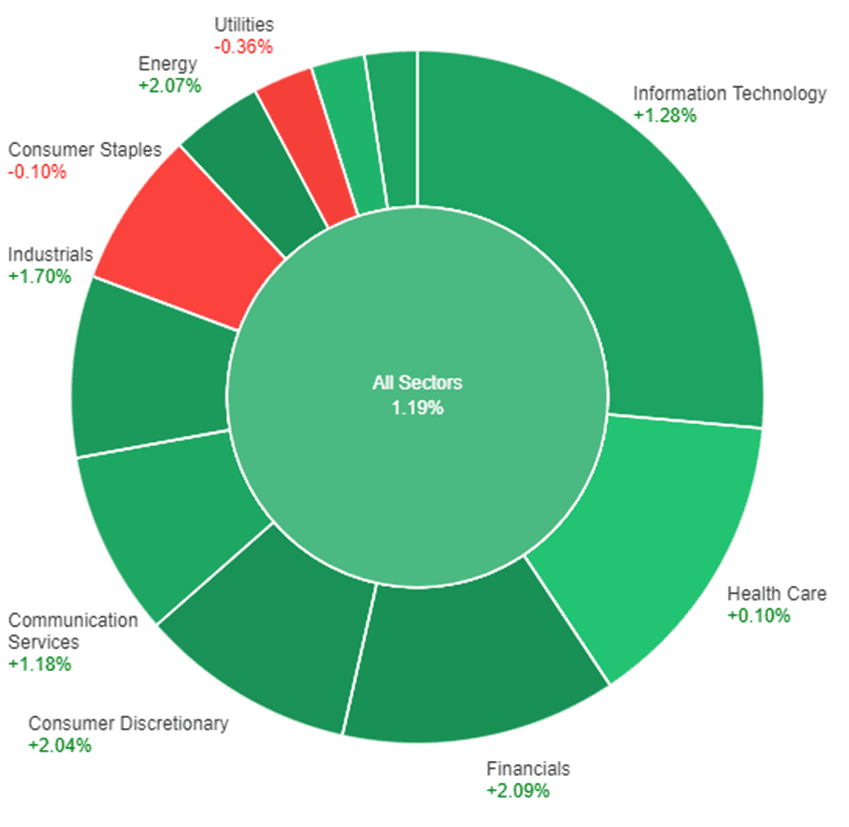

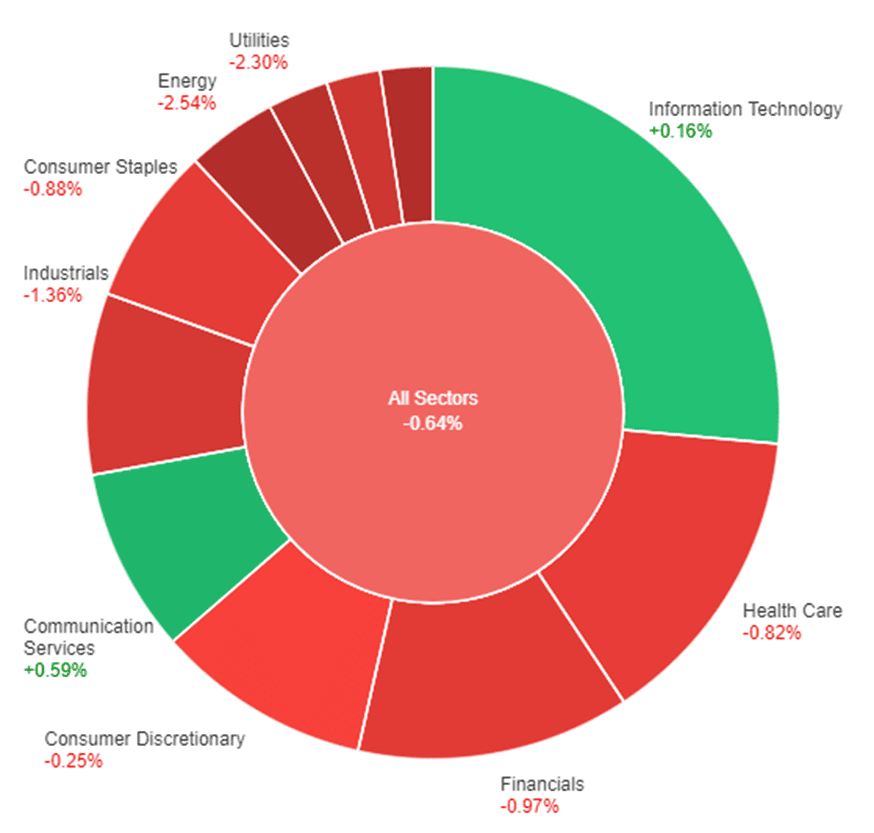

On Wednesday, all sectors experienced a 0.7% decrease, with the energy sector seeing the largest decline of 1.92%. The financial sector followed closely behind, falling by 1.19%. The information technology and materials sectors also experienced significant declines of 0.83% and 1.11%, respectively. Other sectors, such as healthcare, communication services, and utilities, saw smaller declines ranging from 0.11% to 0.31%. The consumer staples and real estate sectors both fell by 0.79% and 0.59%, respectively, while the consumer discretionary and industrials sectors saw declines of 0.71% and 0.38%, respectively.

Major Pair Movement

On Wednesday, the US dollar fell against major currencies including the euro, yen, and sterling following the Federal Reserve’s meeting where Chair Jerome Powell raised the bar for further tightening to combat high inflation despite the restrictive policy and increasing financial and economic risks. Powell reiterated that inflation remains high and the labor market tight, leaving the Fed’s policy options open. The ISM non-manufacturing index was large as forecast, with prices paid remaining high and new orders likely driven by export orders surging.

Investors are now awaiting Friday’s employment report to assess whether ADP’s report of 296k jobs in April versus March’s 142k is valid or whether other factors like falling job openings and rising layoffs point to a decline in non-farm payrolls forecasted at 180k. In addition, jobless claims are set to be released on Thursday, while the European Central Bank is expected to hike rates twice by year-end.

Meanwhile, the dollar index and Treasury yields dropped to new session lows after the Fed replaced the line suggesting further rate hikes with watching incoming data to determine if more hikes “may be appropriate.” Sterling managed a 0.78% gain despite coming off 11-month highs, while EUR/USD rose by 0.56% after approaching April’s trend highs. There was also news from the Kremlin claiming Ukraine had attempted to kill President Putin in a drone attack, introducing a new risk curve ball.

Technical Analysis

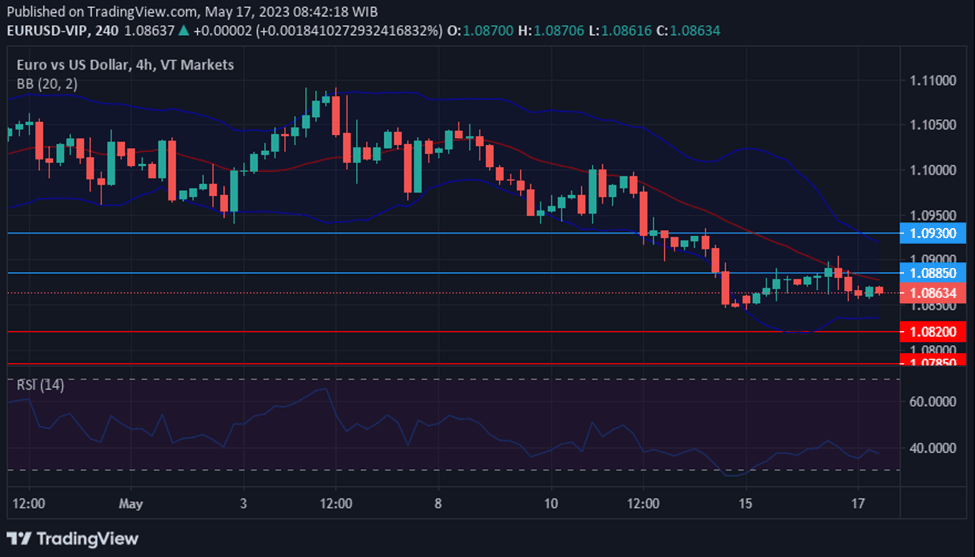

EUR/USD (4 Hours)

The EUR/USD pair reached a high of 1.1091 after the Federal Reserve raised interest rates to 5.00-5.25%, the highest since 2007. However, the dollar then recovered as the Fed signaled a potential pause in further tightening. Data released on Wednesday showed the Euro area’s unemployment rate unexpectedly dropped to 6.5%. The European Central Bank (ECB) meeting, where a 25 basis points interest rate hike is expected, will likely overshadow upcoming data releases, including the final readings of the HCOB Services and Composite PMI and the Euro area’s March Producer Price Index.

Following the ECB meeting, attention will shift to the US Non-Farm Payrolls (NFP) on Friday. The ADP Employment report showed an increase in private payrolls of 296,000 in April, surpassing expectations. Q1 Unit Labor Costs and the weekly Jobless Claims are also due on Thursday.

Based on technical analysis, the EUR/USD pair is continuing to move higher and has been able to break above the 1.1000 level, with an attempt to reach the 1.1100 level. Currently, the price has moved higher, pushing the upper band of the Bollinger band to a higher level. It is anticipated that the EUR/USD will reach the resistance level at 1.1095. The Relative Strength Index (RSI) is currently at 66, indicating that the market is bullish on the EUR/USD.

Resistance: 1.1095, 1.1129

Support: 1.1054, 1.1018

XAU/USD (4 Hours)

Gold (XAU/USD) prices continued to climb, reaching $2,026.80 per troy ounce, as the US dollar weakened ahead of the Federal Reserve’s monetary policy announcement. The US reported positive job creation numbers with the private sector adding 296,000 new positions in April, double the market’s expectations, and the ISM Services PMI printing at 51.9 in April, higher than anticipated. However, the S&P Global downwardly revised the US Services PMI and Composite PMI. Wall Street remains in wait-and-see mode, with the three major indexes in the green, while Treasury yields retreat for the second day, adding pressure on the US dollar. Analysts expect the Fed to hike rates by 25 basis points and signal a pause in its tightening cycle, but most anticipate Chairman Jerome Powell to leave the door open for additional tightening depending on macroeconomic data.

The technical analysis suggests that XAU/USD is showing signs of moving lower after reaching a high of $2,084. The price is currently inside the Bollinger Band and below the upper band, indicating the potential for a downward movement. Additionally, the Relative Strength Index (RSI) is currently above 70, indicating that XAU/USD is overbought.

Resistance: $2,068, $2,058

Support: $2,033, $2,020

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| EUR | Main Refinancing Rate | 20:15 | 3.75% |

| EUR | Monetary Policy Statement | 20:15 | |

| USD | Unemployment Claims | 20:30 | 239K |

| EUR | ECB Press Conference | 20:45 | |

| CAD | BOC Gov Macklem Speaks | 00:50 (5th May) | 51.8 |