Daily Market Analysis

Market Focus

U.S. stocks eked out another all-time high and Treasury yields declined after a report showed consumer sentiment fell to the lowest level in nearly a decade. The dollar weakened and crude oil slumped. The S&P 500 closed at a record for fourth consecutive session while trading within a 0.2% range Friday. The consumer staples and real estate sectors led gains, while energy and financial shares declined. The benchmark index has almost doubled since the pandemic lows reached in March 2020, with the energy sector the biggest gainer during that period. Walt Disney rose after its streaming subscriptions beat estimates. European stocks posted the longest winning streak since 1999.

The U.S. equity rally slowed Friday after data showed the University of Michigan’s preliminary sentiment index fell by 11 points to 70.2, the lowest since December 2011. The slump in confidence risks a more pronounced slowing in economic growth in coming months should consumers rein in spending. The recent deterioration in sentiment highlights how rising prices and concerns about the delta variant’s potential impact on the economy are weighing on Americans.

The easing in the energy sector rally has also raised concern. On Tuesday, the energy sector capped a 19-day streak in which no member of the index traded above its 50-day moving average, the second-longest span since the late-1950s, data compiled by Sentiment Trader show. That’s something that hasn’t happened since the summer of 2001 when Enron and its ensuing bankruptcy was pressuring the energy complex.

Main Pairs Movement:

Crude oil futures eased in New York. The latest Covid-19 wave is leading to tighter curbs on movement across the globe, though there are mixed assessments on its impact. The International Energy Agency reduced its demand forecasts for the rest of the year, while Goldman Sachs Group Inc. predicts only a transient hit to consumption.

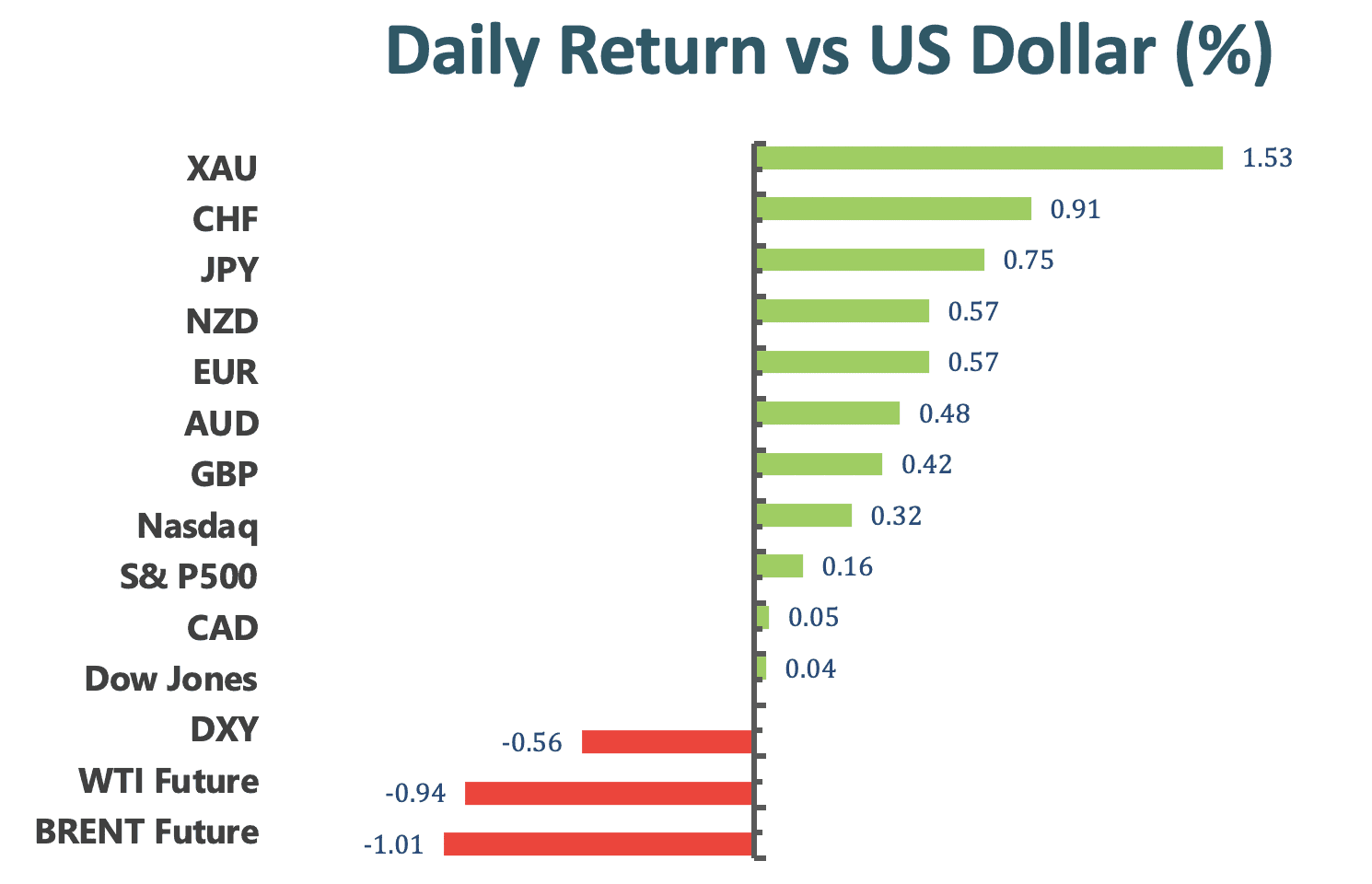

A gauge of the dollar retreated most in a month while haven currencies held on to broad gains as investors grew more concerned about economic prospects after a report showed U.S. consumer sentiment fell to the lowest level in nearly a decade.

Dollar remained weak as investors weighed whether the Federal Reserve may continue with its dovish stance following a plunge in consumer sentiment Friday and a drop in inflation earlier this weekFed officials including San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans had earlier said conditions for tapering may soon be achieved. A measure of currency-market volatility declined to a two-month low on Friday

The Norwegian krone outperformed most peers as next week’s Norges Bank meeting comes into focus.

Technical Analysis:

GBPUSD (4-hour Chart)

GBP/USD pair extend daily rebound during the U.S. trading session after following a consolidation phase around 1.38 in earlier session, as of writing the pair was up 0.44% in the day at 1.3869. The renewed greenback on disappointing consumer confidence data from the U.S. deem to be fueling pound for upside traction.

For technical aspect, RSI indicator 54 figures as of writing, suggesting tepid bull-movement ahead. For moving average side, 15 long SMA indicator slightly head north and 60 long SMA indicator show flat movement in recently.

In lights of aforementional, we think market will successive choppy in range between 1.3896 and 1.38 level.

Resistance: 1.3896, 1.395, 1.4

EURUSD (4- Hour Chart)

The euro dollar rose forward and printed a weekly high at 1.1800 after yesterday miserable performance, as of writing, EUR/USD under 1.18 threshold at 1.1795 around with 0.56% gains in the day market. The pair is propping up as the U.S. dollar remains under pressure across the board. The University of Michigan Consumer Sentiment report, it is kicking off to accelerate to downside. The index tumble unexpectedly to 70.2, the lowest level since 2011.

From the technical perspective, RSI indicator has reached 66 figures, suggesting bullish momentum ahead. For moving average side, 15 long SMA indicator has change it way to upside and 60 long SMA indicator remaining negative way.

For the market movement, euro dollar finally breakthrough the upside resistance at 1.1755 level in the daily market which we expect a critical barricade. Moreover, short term SMA indicator support short term upside traction momentum for the pair. All in all, we expect market will continue bullish expectation and movement at least for short term. On upside, 1.18 level will be the psychological resistance for the pair, and 1.1848 following. On sideway, 1.1755 remain a critical price area for euro fiber. If price reverse to the bottom side below 1.1755, next critical support level will be 1.17

Resistance: 1.18, 1.185

Support: 1.1755, 1.17

XAUUSD (4- Hour Chart)

Gold price edged up by more than 1.4% on Friday, boosted by lower U.S. yields and weaker greenback. Gold trading at $1776.6 after resisted by 1780 threshold, the highest level in a week. U.S. yields tumble after the latest economic numbers. The 10-year dropped under 1.3% at 1.293 with 5% losses. In the late of the week, gold has erased weekly losses and is in positive territory after a reversal of $100 from the Monday flash plummet low.

For technical side, RSI indicator record 69 figures as of writing, suggesting bullish momentum at current stage. For moving average perspective, 15 long SMA indicator toward it slope to upward movement and 60 long SMA indicator retaining south way movement.

For current stage, RSI indicator is showing close to over bought territory that will restrict the upside traction. Therefore, we expect 1792 level is a pivotal resistance for the sell side position. For down side, we think short term support level will be 1761 and 1730 following behide.

Resistance: 1792, 1830,5

Support: 1761, 1730,1700

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

JPY |

GDP (QoQ)(Q2) |

07:50 |

0.2% |

||||

|

CNY |

Industrial Production (YoY)(Jul) |

10:00 |

7.8% |

||||