Daily Market Analysis

Market Focus

Stocks climbed to all-time highs after President-elect Joe Biden said he’ll lay out the details of trillions of dollars in further aid to revive the world’s largest economy. The S&P500 notched its fourth straight da of gains, led by retailers and real-estate companies. The Nasdaq 100 outperformed, with Tesla Inc. surging for an 11th consecutive session. Meanwhile, the KBW Bank Index halted a rally that drove the gauge up more than 10% in three days. Miners joined a selloff in gold and silver.

In a week marked by a siege of the US Capitol and Democratic sweep of Congress, all major equity benchmarks notched records as investors focused on the prospect for more fiscal aid. Biden made the call for new assistance – including $2000 stimulus checks – after a dismal December jobs report. The 140,000 slumps in payrolls highlighted how surging coronavirus infections are taking a greater toll on parts of the economy.

Federal Reserve Vice Chair Richard Clarida said he doesn’t expect the central bank to begin tapering its asset purchases this year despite an expected strengthening of the economy as the pandemic fades. A few policy makers, including Chicago Fed President Charles Evans and Atlanta’s Raphael Bostic, said this week they might support reducing the pace of buying by year-end if the economy bounced back strongly enough.

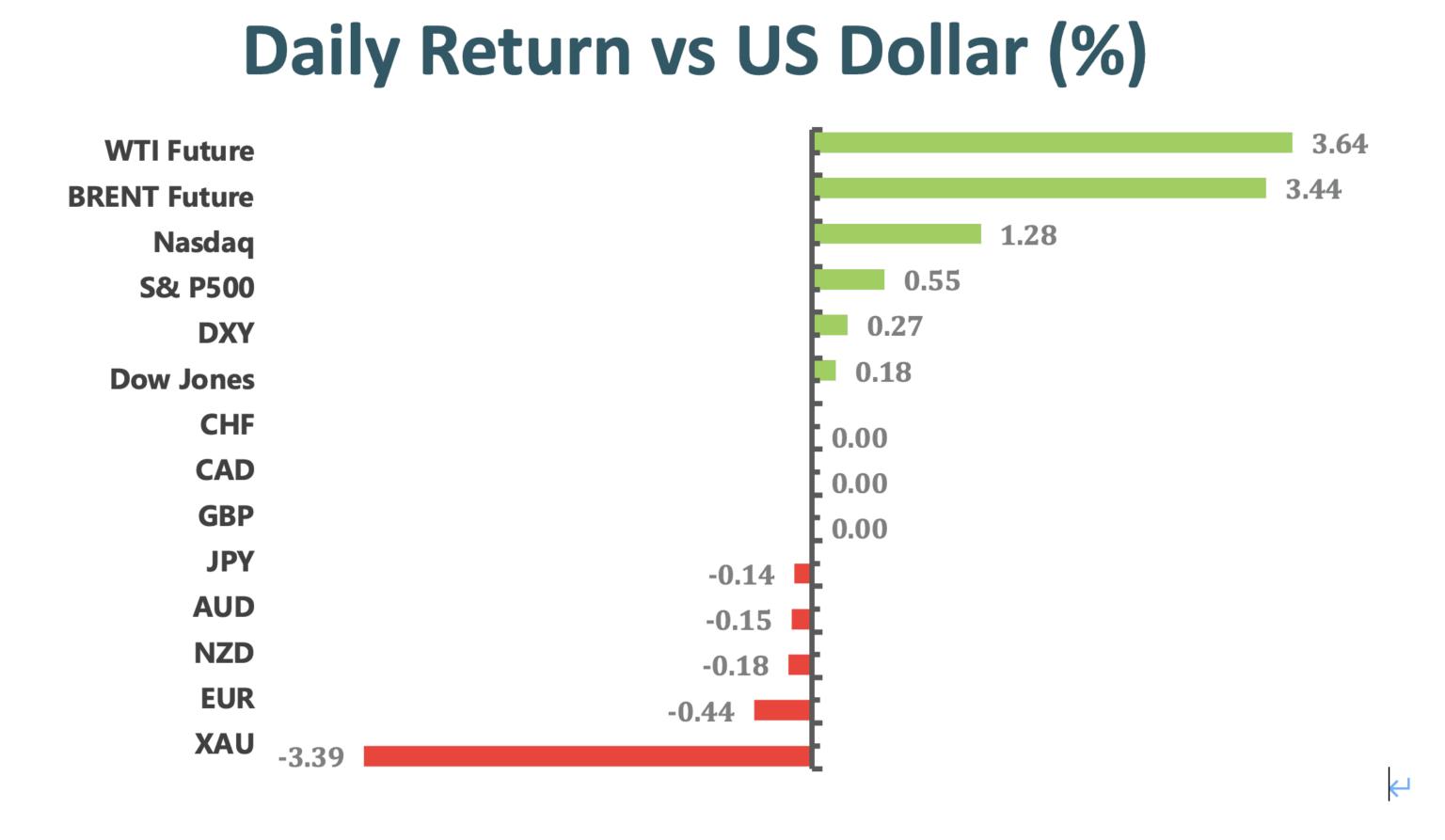

Market Wrap

Main Pairs Movement

USDJPY is holding on to weekly gains, but still unable to advance beyond 104. The Aussie climbed to 0.7800 area in the early American session, but retreated back towards the lower 0.7730 region after the greenback regained its strength as the DXY advanced back above the 90 thresholds. For EURUSD, the USD strength and the modest EUR underperformance dragged the Fiber pair below 1.2200 level despite the good news of EU managed to secure an additional 300M Pfizer/BioNTech vaccine doses and the better-than-expected German trade numbers and German and French industrial output number.

The yield on 10-year Treasuries climbed four basis points to 1.12%. The Germany’s 10-year yield rose less than one basis point to -0.52%. The Britain’s 10-year yield rose less than one basis point to 0.288%.

The buying interest around WTI remains unabated, as the bull’s probe eleven-month highs above the $51 mark ahead of the US payrolls and rigs count data.

Technical Analysis:

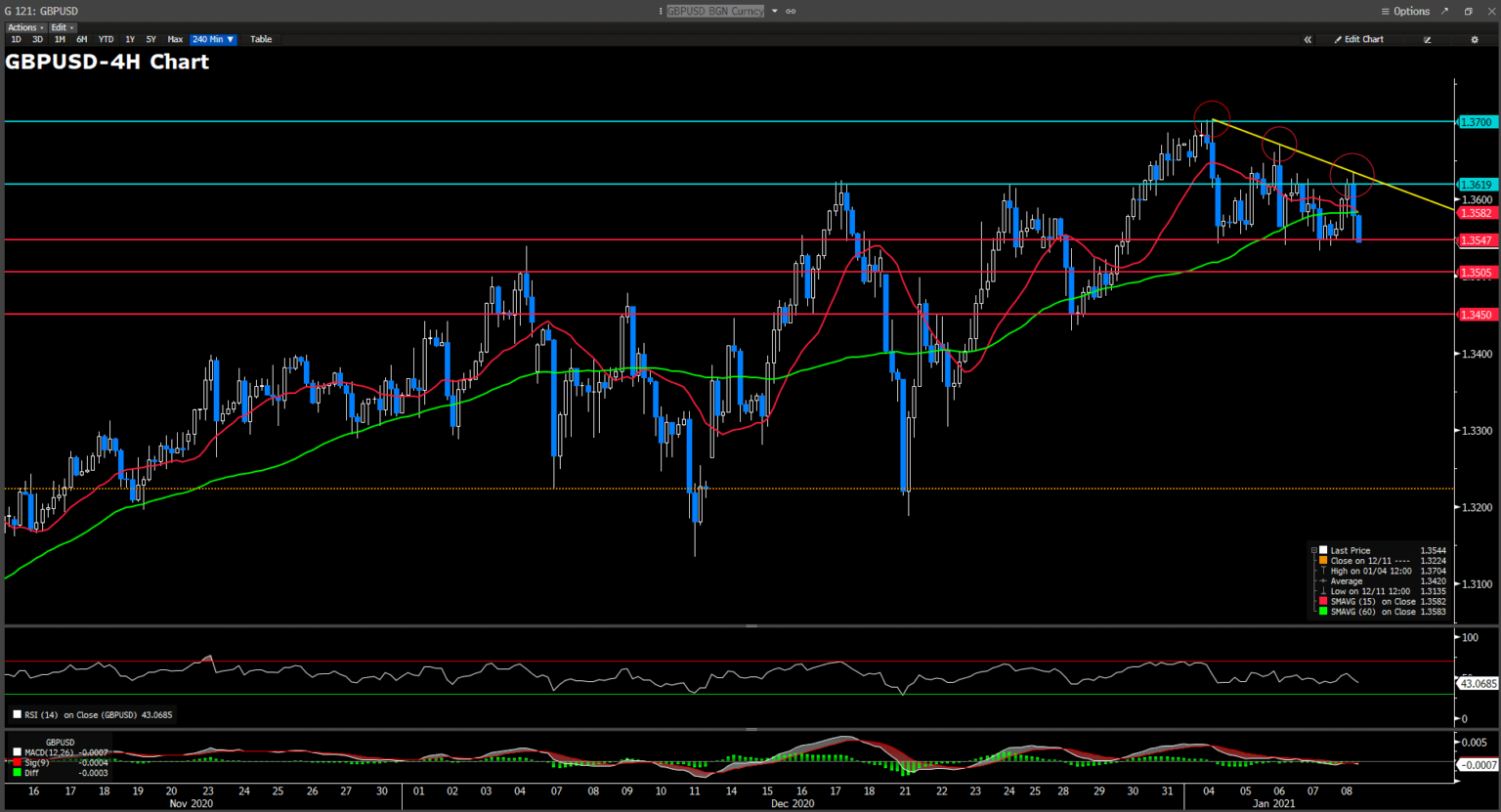

GBPUSD (4 Hour Chart)

After the US worse-than-expected labour market data was released, the GBPUSD seems broadly unresponsive because the pair only reclaimed its 1.36 price level temporarily and dived down to around 1.3547 at the time of writing. This is probably because while the US labour market data in Dec is unexpectedly low, the markets are seeing this number as out-of-date since mass vaccines and more fiscal stimulus from a Democrat-controlled government are prompting a much better US economic growth prospect.

From a technical perspective, a descending triangle and an upcoming death cross from the pair’s 15-Day and 60-Day SMAVG are both indicating that the Cable is now forming a downward sloping price action. If the Cable makes a confirmative breakthrough below the 1.3547 support, the bears can expect to see the next support at 1.3505. On the flip side, the bulls are awaiting a breakthrough above the 1.3620 resistance level, so they can be released from the declining lower-highs situation.

Resistance: 1.3620, 1.3700

Support: 1.3547, 1.3505, 1.3450

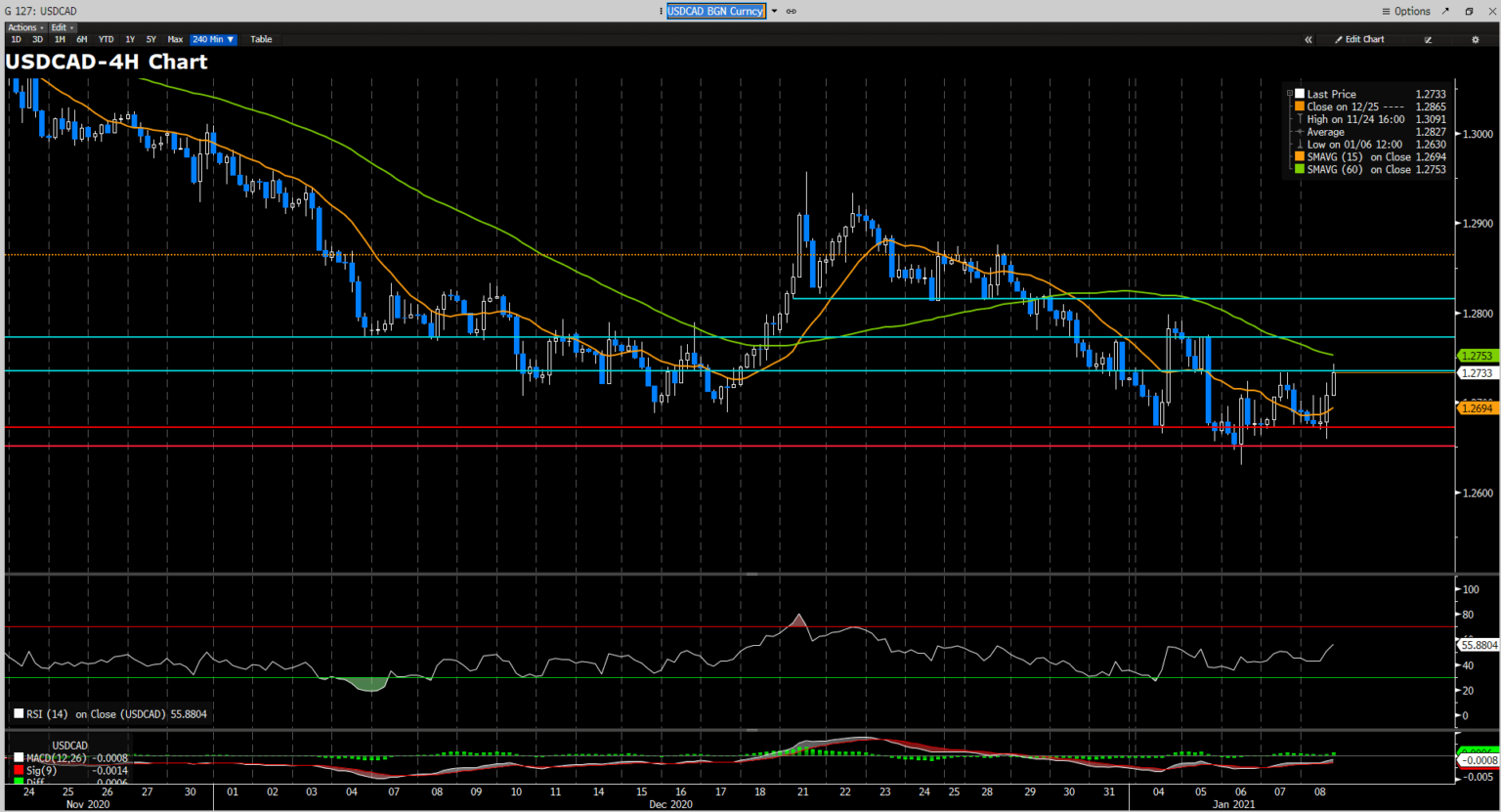

USDCAD 4 (Hour Chart)

The Loonie raised extensively in the early American session and even managed to break above the 1.2740 threshold at one point, but the worse-than-expected US labor market data put a cap on the Loonie’s rally. At the moment, the Loonie is trading slightly off the daily highs around 1.2725. The markets’ initial response after learning the numbers pushed the DXY above 90 but that quickly turned south as markets began to think that these numbers would likely to keep the Fed’s future decision dovish.

From a technical perspective, the Loonie remained on the back foot with the 60-Day SMAVG continually suggesting a bearish trend on the pair. On top of that, even though the pair staged an extensive surge over the day, the RSI is still hovering around the lower 50, suggesting that no trading bias was formed. On the upside, the Loonie bulls must first find acceptance above 1.2735 resistance before capping their gains at 1.2770. On the flip side, the bears would need to bring the price back down to 1.2673 support before pull the Loonie back to its multi-year lows at 1.2650.

Resistance: 1.2735, 1.2770, 1.2815

Support: 1.2673, 1.2650

XAUUSD (4 Hour Chart)

XAUUSD plummeted substantially today as the pair bottomed at $1828 (a price that was last seen in the early 2020 Dec) at one point and is now trading around $1840. The drastic decline accelerated after the sellers broke below the psychological resistance $1900, and the broad-based weakness of the XAUUSD is believed to be triggered by the rally in longer-dated US real bond yields, which also attributed to a strengthened greenback. Technically speaking, the short-term SMAVG is still supporting the bullish trend of XAUUS; and at the same time, with the RSI now touching the oversold territory, the Gold is likely to stage an upward correction in the short-term. The short-term upward correction is also backed by the fact that with the 0.618 Fibonacci retracement sitting close to the $1843 resistance level that the Gold is battling around at the moment.

Resistance: 1865, 1878, 1900

Support: 1843, 1827, 1814

Economic Data

Click here to view today’s important economic data.