Stocks closed lower on Tuesday as investors prepared for upcoming inflation reports and monitored progress on the U.S. debt limit. The S&P 500 and the Nasdaq Composite experienced declines of 0.46% and 0.6% respectively, while the Dow Jones Industrial Average remained relatively flat with a 0.17% decline. President Joe Biden and House Speaker Kevin McCarthy held a meeting to discuss the debt limit, but no definitive progress was expected as the two remain divided on tying the debt ceiling increase to spending cuts. Treasury Secretary Janet Yellen warned of the economic catastrophe that could result from failing to raise the debt ceiling, and concerns over inflation and the banking sector also weighed on investor sentiment.

In the market, PacWest shares experienced volatility but closed up 2.4%, while the SPDR S&P Regional Banking ETF ended the day down slightly. Lucid, PayPal, and Skyworks saw declines following the release of their quarterly reports, while Palantir saw a significant jump of 23% after reporting strong earnings and positive guidance. Traders are now eagerly awaiting the consumer price index report for April and the producer price index report for the newest data on inflation. Economists anticipate a 0.4% month-over-month increase in inflation for April and a 5% year-over-year increase, with core prices expected to have risen by 0.4%, excluding food and energy components.

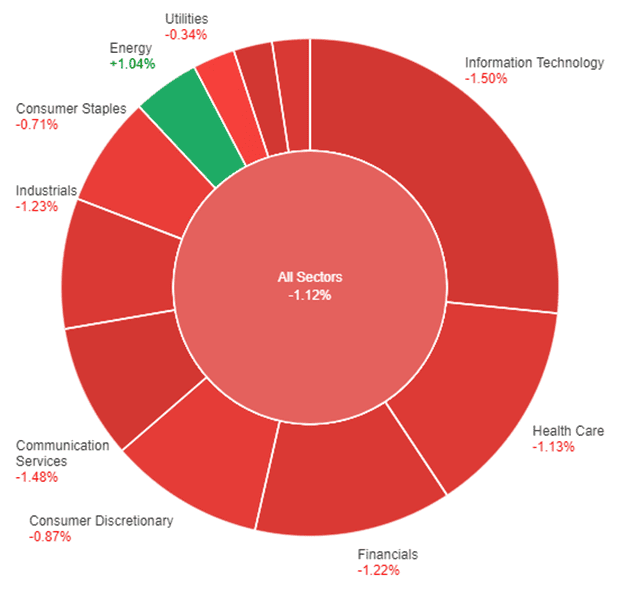

On Tuesday, the overall stock market experienced a decline of 0.46%. Among the sectors, there were mixed performances. Industrials showed a slight increase of 0.17%, while energy and consumer discretionary sectors saw minor gains of 0.03% and 0.02% respectively. Utilities and consumer staples sectors experienced modest declines of 0.20% and 0.30%. Financials, real estate, communication services, health care, information technology, and materials sectors all faced greater declines ranging from 0.37% to 0.93%.

Major Pair Movement

The dollar index saw a 0.2% increase as the euro weakened due to concerns over Chinese trade data. Despite tightening credit, New York Fed President John Williams expressed reluctance towards policy easing, suggesting that the worst phase of stress in the banking sector may be over. The eurozone and German data have taken a negative turn recently, causing the EUR/USD to fall by 0.3% and reach last week’s lows. The yield spreads between two-year bonds and Treasuries have become 21 basis points more damaging compared to April’s peak.

Although the market still anticipates 66 basis points of Federal Reserve rate cuts by the end of the year, 6-month Treasury yields increased by 5 basis points on Tuesday, reflecting the ongoing refunding and the risk associated with the unresolved debt ceiling issue. The recent reports from the Fed on lending standards and financial stability provided some relief as they indicated less tightening of lending standards than expected and lower loan demand despite recent regional bank failures. The April NFIB report revealed the weakest conditions in over a decade but attributed the restraint not to tighter credit but rather to a persistent shortage of workers. The performance of U.S. regional bank stock indexes and Wednesday’s inflation data will be influential in determining the direction of Treasury yields and the dollar.

The safe-haven yen remained steady against the euro and the Australian dollar, which was negatively impacted by declining Chinese imports and de-risking. Japan’s unexpected decrease in household spending and real wage decline had minimal impact, as the focus remained on the Bank of Japan’s policy review. The British pound recovered slightly after a brief setback from Monday’s one-year peak in anticipation of U.S. CPI data and the upcoming Bank of England meeting on Thursday.

Technical Analysis

EUR/USD (4 Hours)

EUR/USD Extends Decline as US Dollar Strengthens Ahead of Crucial Data

The EUR/USD currency pair continued to retreat on Tuesday, falling below 1.1000 and extending its decline from monthly highs. Despite hawkish comments from European Central Bank (ECB) members, the Euro underperformed, while the US Dollar gained strength supported by higher US Treasury yields in anticipation of important data releases. ECB members, including Martins Kazaks and Peter Kazimir, spoke about the possibility of further rate hikes, while Isabel Schnabel highlighted the need for more efforts to bring inflation back to target. Mario Centeno is also scheduled to speak on Wednesday. The Euro remained the weakest currency among the G10 currencies. The market focus now turns to the upcoming US April Consumer Price Index (CPI), which is expected to show an acceleration in headline inflation and could influence the Federal Reserve’s monetary policy expectations. The ongoing debt ceiling issue is also gaining attention, adding to market uncertainty.

According to technical analysis, the EUR/USD pair is currently trending lower, reaching the lower band of the Bollinger band. It is expected that the EUR/USD will continue to move back lower but need to move slightly higher to reach the middle band of the Bollinger band. The Relative Strength Index (RSI) is presently at 42, suggesting a neutral trend but lower in the EUR/USD market.

Resistance: 1.0990, 1.1032

Support: 1.0965, 1.0939

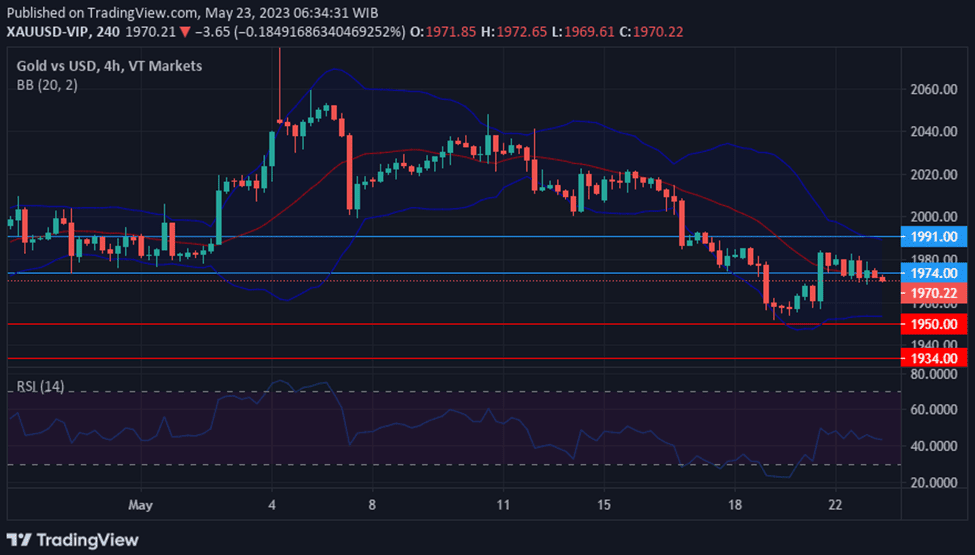

XAU/USD (4 Hours)

XAU/USD Consolidates as Risk-Aversion Persists, US Dollar Gains Ground

Gold (XAU/USD) remained consolidated around $2,030 per troy ounce as risk aversion persisted, driving demand for both gold and the US Dollar. The US Dollar gained strength against other currencies, supported by concerns about the banking system’s health and the release of the Federal Reserve’s Senior Loan Officer Opinion Survey, which showed tightened lending standards and weakened credit demand in the US. Wall Street closed in the red, reflecting the negative market sentiment. Traders are now focused on the upcoming release of the April Consumer Price Index (CPI), with expectations of a 5% annualized increase in inflation. A lower-than-expected CPI could fuel speculation of a potential rate cut by the Federal Reserve.

The technical analysis indicates that XAU/USD is moving higher on Monday. The price is currently just above the middle band of the Bollinger Band, indicating the potential for a consolidating movement with higher potential. Moreover, the Relative Strength Index (RSI) is currently at 56, meaning that XAU/USD is considered neutral but slightly bullish.

Resistance: $2,038, $2,052

Support: $2,015, $2,003

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Consumer Price Index (Monthly) | 20:30 | 0.4% |

| USD | Consumer Price Index (Yearly) | 20:30 | 5.0% |

| USD | Core Consumer Price Index (Monthly) | 20:30 | 0.3% |