On Thursday, major stock indices experienced a subdued performance with the Nasdaq Composite settling at 14,970.19, the Dow Jones Industrial Average gaining 0.04%, and the S&P 500 dipping 0.07%. The release of December’s consumer price index (CPI) report, revealing a 0.3% increase in consumer prices, impacted market sentiment, influencing expectations for future interest rate cuts. Investors also remained cautious about the Federal Reserve’s rate cut timeline and upcoming fourth-quarter earnings reports. Meanwhile, the cryptocurrency market saw positive momentum, marked by the rise of bitcoin exchange-traded funds (ETFs) following recent SEC-approved rule changes. The currency market experienced volatility driven by higher-than-expected US inflation figures, with the USD Index surging initially but later losing momentum. The Euro, Pound, Yen, Aussie, and Canadian Dollar showed varied responses to the economic landscape, reflecting the uncertainties surrounding inflation dynamics and corporate earnings.

Stock Market Updates

Stocks experienced a relatively flat performance on Thursday, as reflected in the closing numbers of major indices. The Nasdaq Composite settled at 14,970.19, while the Dow Jones Industrial Average gained a modest 0.04%, closing at 37,711.02. The S&P 500 saw a slight dip of 0.07%, ending the session at 4,780.24, briefly surpassing its record closing high earlier in the day. The market was influenced by the release of December’s consumer price index (CPI) report, which showed a slightly higher-than-expected increase of 0.3% in consumer prices, pushing the annual rate to 3.4%. The data hinted at persistent but easing inflation pressures, impacting expectations for future interest rate cuts. Yields on the 10-year note initially rose in response to the CPI data, reaching a high of 4.068% before settling around 3.98%.

The market’s movements on Thursday were also shaped by cautious sentiments surrounding the Federal Reserve’s rate cut timeline and concerns about upcoming fourth-quarter earnings reports. Investors are closely monitoring earnings releases from major banks such as Bank of America, Wells Fargo, and JPMorgan Chase. Additionally, the cryptocurrency market saw positive momentum, with bitcoin exchange-traded funds (ETFs) rising on their first day of trading following recent rule changes approved by the U.S. Securities and Exchange Commission. Despite a winning session on Wednesday, uncertainties in the economic landscape, including inflation dynamics and corporate earnings, continue to influence market sentiment.

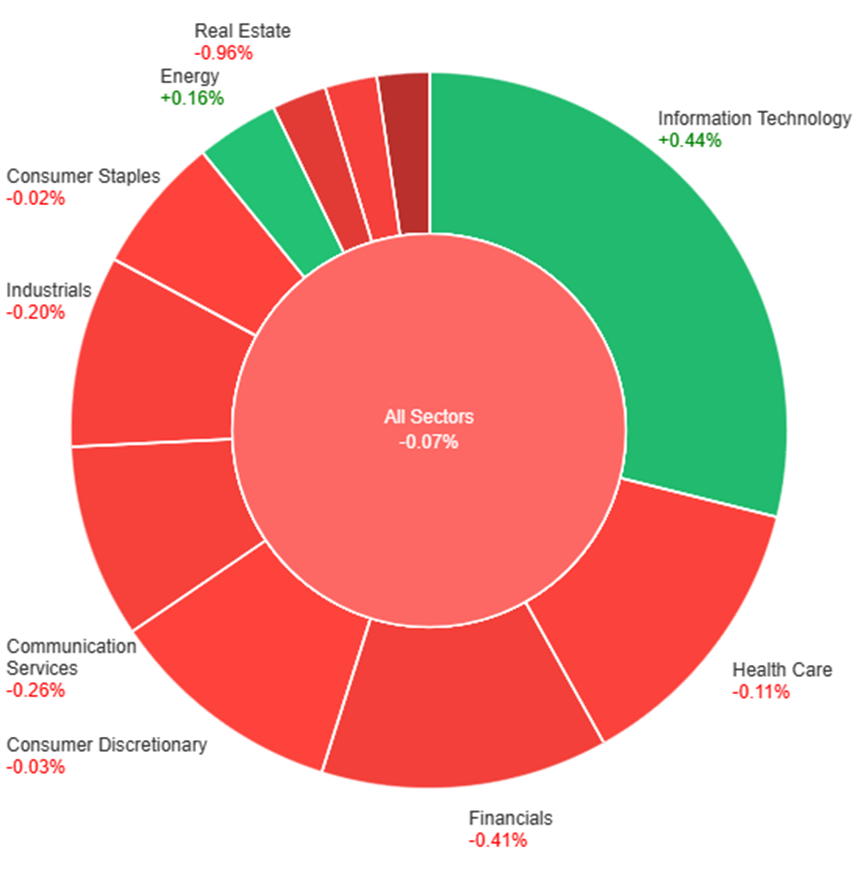

Data by Bloomberg

On Thursday, market performance across various sectors showed mixed results. The overall market experienced a marginal decline of 0.07%. The Information Technology sector outperformed others with a positive growth of 0.44%, while Energy and Consumer Staples also exhibited modest gains of 0.16% and 0.02%, respectively. On the downside, Utilities suffered the most significant setback with a substantial decrease of 2.35%. Real Estate also faced a notable decline of 0.96%. Other sectors, including Consumer Discretionary, Health Care, Industrials, Communication Services, Materials, and Financials, reported slight decreases ranging from 0.03% to 0.41%. The diverse performance across sectors reflects a nuanced market landscape on Thursday.

Currency Market Updates

The currency market experienced heightened volatility driven by the release of higher-than-expected US inflation figures in December. The USD Index (DXY) initially surged to new highs near 102.80 as investors reevaluated the possibility of the Federal Reserve reducing interest rates in the second quarter. However, the momentum waned as the session concluded.

EUR/USD briefly touched the 1.1000 mark before a US CPI-driven pullback dragged it down to the 1.0930 zone. Despite the initial setback, the pair managed to recover along with other risk-associated assets. GBP/USD continued its upward momentum, reaching the 1.2770/75 level, approaching the highs seen in 2024. USD/JPY, on the other hand, couldn’t sustain its early gains, retreating to the 145.60 region by the closing bell, influenced by a late corrective decline in the greenback and mixed US yields. In contrast, AUD/USD faced persistent selling pressure, leading to new weekly lows near 0.6650 amid a volatile session in the greenback and mixed activity in the commodity space. USD/CAD advanced to new four-week highs near 1.3440 despite tepid gains in the greenback.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Retreats Below 1.1000 Amidst Surging US Inflation and Fed’s Caution

In Thursday’s trading, the EUR/USD pair faced resistance in breaching the critical 1.1000 level, triggering a notable corrective move following a higher-than-expected rise in US inflation figures for December 2023. The robust US Consumer Price Index (CPI) bolstered the greenback, leading investors to adjust their expectations regarding the Federal Reserve’s potential interest rate cuts in the second quarter. The pair’s downward trend was also influenced by varied performances in US yields across different maturities, prompting investors to reevaluate their bets on potential rate adjustments. Federal Reserve’s L. Mester from Cleveland emphasized that the central bank is not yet considering rate cuts, underlining the necessity for additional evidence of economic progress. Mester highlighted the importance of the Fed fine-tuning its policy for a soft landing, contingent upon sustained declines in inflation. Despite the absence of notable domestic data releases, the US docket revealed a 3.4% year-on-year increase in headline CPI for December and a 3.9% rise in Core CPI. Additionally, weekly Initial Claims climbed by 202,000 in the week ending January 6.

On Thursday, the EUR/USD moved slightly lower, unable to reach the lower band then went back higher and reached the upper band of the Bollinger Bands. Currently, the price moving just around the upper band, suggesting another potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 59, signaling a neutral but bullish outlook for this currency pair.

Resistance: 1.1000, 1.1068

Support: 1.0950, 1.0892

XAU/USD (4 Hours)

XAU/USD Faces Pressure as Stronger-than-Expected US Inflation Boosts Dollar

Stronger-than-anticipated US inflation figures led to a surge in the US Dollar, exerting mild pressure on Gold (XAU/USD) ahead of Wall Street’s opening. Despite hopes for positive figures, the Consumer Price Index rose to 3.4% YoY in December, surpassing both the previous 3.1% and the expected 3.2%. This unexpected inflation surge bolstered the US Dollar in a risk-averse environment, as investors anticipated the Federal Reserve maintaining higher rates for a longer period. The increased likelihood of prolonged rate hikes weighed on the prospects of a rate cut in March, causing stocks to dip and government bond yields to rise, impacting the gold market.

On Thursday, XAU/USD moved lower and was able to reach the lower band of the Bollinger Bands. Currently, the price moving higher above the middle band and trying to reach the upper band. The Relative Strength Index (RSI) stands at 50, signaling a neutral outlook for this pair.

Resistance: $2,050, $2,070

Support: $2,023, $2,002

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Gross Domestic Product m/m | 15:00 | 0.2% |

| USD | Core Producer Price Index m/m | 21:30 | 0.2% |

| USD | Producer Price Index m/m | 21:30 | 0.1% |