Thursday witnessed a strong comeback for stocks, with the S&P 500, Dow Jones, and Nasdaq rebounding significantly, nearing their record highs. Micron Technology’s stellar performance fueled tech stocks, while companies like Salesforce contributed to the climb. This turnaround followed a recent market dip attributed to profit-taking after a sustained period of gains. Meanwhile, the currency market saw the dollar index decline due to weaker U.S. economic data, impacting Treasury yields, while EUR/USD faced resistance and USD/JPY retreated within a defined range. Attention now turns to pivotal economic releases that could influence market dynamics, including the US core PCE and Japan CPI data.

Stock Market Updates

Stocks rebounded on Thursday after a recent dip, marking a robust resurgence in the year-end rally. The S&P 500 recovered from its recent decline, edging up by 1.03% to 4,746.75, inching within 1% of its closing high and 1.5% of its intraday record. The Dow Jones Industrial Average soared by 0.87% to 37,404.35, and the Nasdaq Composite surged 1.26% to 14,963.87. The market’s upward trajectory was widespread, with over 450 companies in the S&P 500 index witnessing gains. Micron Technology notably stood out, jumping by 8.6% following its quarterly performance surpassing expectations, bolstered further by an optimistic current-quarter guidance. Chip stocks broadly surged, with Intel and Advanced Micro Devices rising by 2.9% and 3.3%, respectively. Salesforce also contributed to the Dow’s climb, rising by 2.7% after receiving an upgrade from Morgan Stanley.

This upward swing followed a recent downtrend where Wall Street faced losses due to profit-taking after a streak of gains. The prior session marked the Dow and Nasdaq’s worst performance since October, breaking nine-day winning streaks, while the S&P 500 experienced its most significant decline since September. Rhys Williams, chief strategist at Spouting Rock Asset Management, attributed this shift to a technical correction following a robust market period. Since late October, the Dow and S&P 500 have surged over 15%, while the Nasdaq Composite saw an impressive 18% surge during the same period, reflecting a substantial upward momentum in the market.

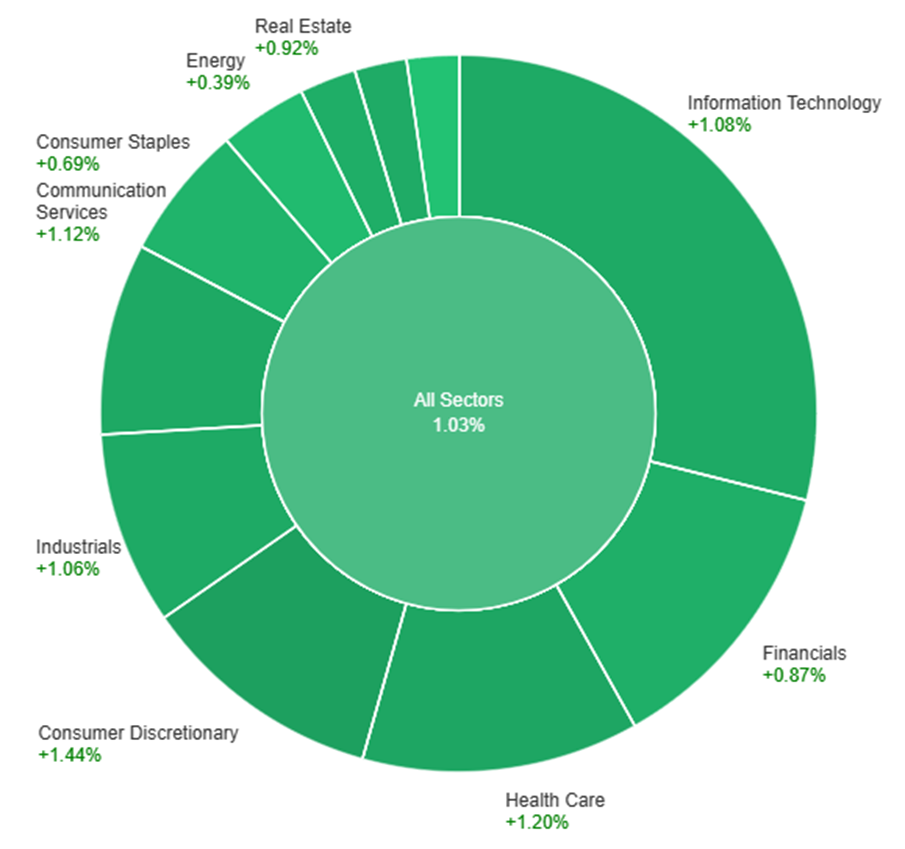

Data by Bloomberg

On Thursday, across various sectors, the market showed a general upward trend with an overall increase of 1.03%. Consumer Discretionary saw the highest surge at 1.44%, followed closely by Health Care at 1.20% and Communication Services at 1.12%. Information Technology and Industrials also experienced notable gains at 1.08% and 1.06%, respectively. Meanwhile, Energy and Utilities demonstrated the smallest upticks, with Energy rising by 0.39% and Utilities by 0.13%. Real Estate and Financials fell within the mid-range increases, with Real Estate at 0.92% and Financials at 0.87%. Consumer Staples trailed behind with a rise of 0.69%.

Currency Market Updates

The currency market saw notable shifts as the dollar index declined by 0.4% due to weaker-than-expected U.S. economic data, impacting Treasury yields. Despite a solid 4.9% annualized GDP increase in Q3, downward revisions in GDP and core PCE figures influenced market sentiment. Core PCE rose only 2.0% year-on-year, signaling a potential downside miss, which could favor dollar bears. The upcoming release of November’s core PCE, income, and spending figures was highlighted as pivotal for Treasuries, risk, and the dollar, with indications pointing towards a possible downward trend in core PCE, impacting market dynamics.

EUR/USD observed a 0.4% rise, facing resistance near 1.1000 due to ongoing weak economic data and outlooks in the eurozone, particularly in Germany. USD/JPY, on the other hand, experienced a 0.8% fall, retracting all weekly gains but maintaining a recovery pattern within the 140.95-4.95 range following dovish meetings from both the Fed and BoJ. With the upcoming Japan CPI and U.S. core PCE releases, attention is on the 200-day moving average at 142.72, potentially signaling a retest of 140.95. Sterling saw a marginal 0.25% rise amidst a pessimistic UK CBI retail sales survey and below-forecast UK CPI, with further market focus on impending UK retail sales and Q3 GDP announcements.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD USD Gains Ground Amid Dollar Weakness Despite Mixed US Data; Eyes on Inflation Figures

The EUR/USD edged higher, reaching the 1.1000 mark as the Dollar struggled despite increased Treasury yields. US economic indicators presented a mixed picture, with declines in the Philadelphia Fed Index and a revision in Q3 GDP, while Jobless Claims remained steady. Investors await the crucial Core PCE inflation data, anticipating a 0.2% rise for November. Despite the rebound in US yields, the Dollar remains subdued, limiting the EUR/USD upside potential amidst thinner market conditions.

On Thursday, the EUR/USD moved higher and reached the upper band of the Bollinger Bands. Currently, the price moving slightly below the upper band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 66, signaling a neutral outlook for this currency pair.

Resistance: 1.1017, 1.1138

Support: 1.0946, 1.0830

XAU/USD (4 Hours)

XAU/USD Resilient Above $2,040 Despite USD Swings Amidst Mixed US Economic Data

In fluctuating market sentiment driven by a resilient US Dollar and mixed economic indicators, spot Gold managed to maintain its position above $2,040 per troy ounce. The Dollar initially gained traction, favored by Wall Street’s lackluster performance and softer Treasury yields, but a shift in direction followed mixed US data. Despite GDP figures slightly below estimates and declining bond yields, investor confidence bounced back on Wall Street. With attention now turning to upcoming US economic releases, including the Core PCE Price Index and Michigan Consumer Sentiment Index, Gold remains resilient amidst the market’s uncertain landscape.

On Thursday, XAU/USD moved slightly higher and reached the upper band of the Bollinger Bands. Currently, the price moving just below the upper band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 63, signaling a neutral outlook for this pair.

Resistance: $2,050, $2,068

Support: $2,031, $2,008

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Retail Sales m/m | 15:00 | 0.4% |

| CAD | GDP m/m | 21:30 | 0.2% |

| USD | Core PCE Price Index m/m | 21:30 | 0.2% |

| USD | Revised UoM Consumer Sentiment | 23:00 | 69.4 |