On Monday, the S&P 500 index experienced minimal change as investors awaited a crucial debt ceiling meeting and officials worked to prevent a default. The index slightly increased by 0.02% to close at 4,192.63, while the Dow Jones Industrial Average fell by 0.42% to end at 33,286.58. In contrast, the Nasdaq Composite rose by 0.5% to settle at 12,720.78, reaching its highest closing and intraday levels since August. President Joe Biden and House Speaker Kevin McCarthy were scheduled to hold talks concerning the debt ceiling, with only 10 days remaining before a potential U.S. default. Negotiations faced hurdles due to disagreements over government spending cuts and tax increases.

Despite uncertainties in Washington and concerns about inflation, the stock market continued to rise, particularly driven by technology stocks, resulting in a winning week for major averages. The S&P 500 approached the 4,200 level, but market analysts emphasized the need for broader market participation to sustain the rally in the long term. Sylvia Jablonski, CEO at Defiance ETFs, suggested that stronger market breadth might come after the Federal Reserve’s June meeting. Economic data for the week included the second reading for first-quarter GDP on Thursday and the release of the Fed’s preferred inflation measure, the personal consumption expenditures gauge, on Friday. Additionally, investors awaited the Fed minutes from the May meeting, which could provide insights into the central bank’s stance on potential interest rate hikes. Notable upcoming reports included earnings announcements from Zoom Video, Lowe’s, and Dick’s Sporting Goods, signaling the winding down of the first-quarter earnings season.

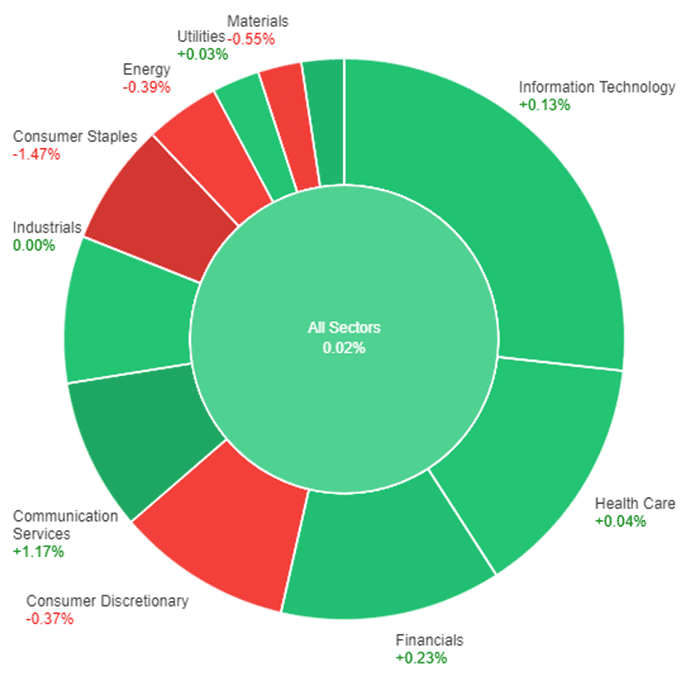

Data by Bloomberg

On Monday, the overall market showed a slight increase of 0.02%. Among the sectors, Communication Services performed the best, with a gain of 1.17%, followed by Real Estate, which rose by 0.67%. Financials experienced a modest increase of 0.23%, while Information Technology and Health Care sectors saw smaller gains of 0.13% and 0.04% respectively. Utilities and Industrials sectors remained relatively stable with minimal changes at 0.03% and 0.00% respectively. However, Consumer Discretionary, Energy, Materials, and Consumer Staples sectors all recorded declines, with Consumer Staples suffering the most significant loss at 1.47%.

Major Pair Movement

The US dollar index experienced a rise after comments from Minneapolis Fed President Neel Kashkari and St. Louis Fed President James Bullard suggested a hawkish stance. Kashkari indicated the possibility of interest rates exceeding 6%, while Bullard mentioned the potential for additional rate hikes in 2023. However, San Francisco Fed President Mary Daly took a more cautious approach, awaiting further data and suggesting that tighter credit conditions may be equivalent to one or two rate hikes. Atlanta Fed President Raphael Bostic expressed comfort in observing the economy’s performance given the significant tightening measures implemented thus far. Traders remained cautious due to ongoing debt ceiling negotiations aiming to prevent a US default before the June 1 deadline.

The EUR/USD pair experienced a slight dip, while front-end futures rates saw a modest increase in December 2023 rate cut expectations. USD/JPY rose as US-Japan yield expectations were influenced by the tighter Fed rate outlook. GBP/USD declined, influenced by the hawkish expectations of the Fed, as traders adjusted their positions ahead of important data releases. Bitcoin traded at $26.8k with minimal movement, while gold and silver prices experienced declines due to higher US yields impacting precious metals.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Holds Steady Amid Central Bank Talks and Debt Limit Negotiations

The EUR/USD remained steady at 1.0800 level after recovering from a month-low, but the overall sentiment remains negative. The focus shifted to central bank discussions and negotiations around the US debt limit. Federal Reserve officials expressed a hawkish stance, suggesting the need for higher interest rates. The market expects a potential rate hike in June, but chances are around 25%. The release of FOMC minutes and the Core Personal Consumption Expenditures Price Index will be crucial for monetary policy expectations. Additionally, attention is on resolving the debt limit crisis. Increased volatility is expected as European PMI numbers are released, providing insight into economic performance in May. The market anticipates another rate hike from the European Central Bank, although consensus on future actions is starting to waver.

According to technical analysis, the EUR/USD pair is currently experiencing a slight upward movement from its lowest price, returning to hover around the middle band of the Bollinger Bands. It is anticipated that the EUR/USD will maintain a consolidation phase during the early session before adjusting its movement based on key events, namely the Flash Manufacturing and Services PMI reports scheduled for today. The Relative Strength Index (RSI) currently stands at 44, indicating that the EUR/USD has returned to a neutral position.

Resistance: 1.0815, 1.0848

Support: 1.0750, 1.0715

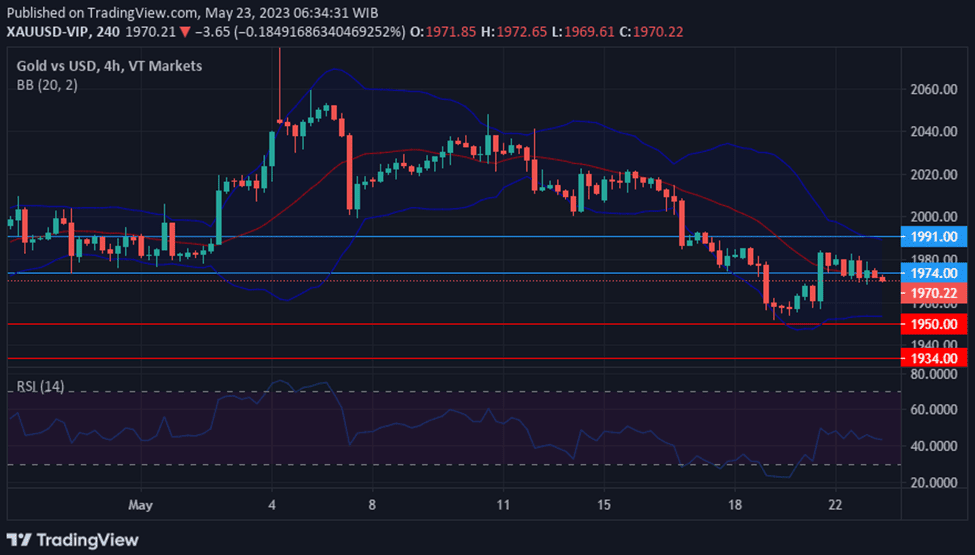

XAU/USD (4 Hours)

Gold (XAU/USD) Under Pressure as Markets Await Catalysts and Monitor US Debt-Ceiling Talks and Fed’s Rate Hike Signals

Spot gold (XAU/USD) is experiencing slight downward pressure as it trades at around $1,975 per troy ounce, although it remains at the higher end of Friday’s trading range. The market is eagerly awaiting a new catalyst while keeping an eye on US debt-ceiling negotiations, as a potential default on June 1 looms. Discussions are ongoing but no significant agreements have been reached yet. Tensions are also rising ahead of the release of the FOMC Meeting Minutes next Wednesday, accompanied by statements from several Federal Reserve speakers. James Bullard believes the central bank will raise the policy rate further with at least two more 25 basis points hikes, while Neel Kashkari sees it as a close call and is willing to maintain rates to assess past rate increases’ effects. Mary Daly suggests that tighter credit conditions could be equivalent to one or two rate hikes and emphasizes the need for data-dependent decision-making. Financial markets predict that the US central bank will avoid raising rates in June and July due to concerns over potential harm to the financial system.

According to technical analysis, on Monday, XAU/USD made a slight upward movement but was unable to maintain its position and dropped below our resistance level, settling around the middle band of the Bollinger Bands. There is a chance that XAU/USD might undergo a modest downward movement and attempt to reach the lower band of the Bollinger Bands. Currently, the Relative Strength Index (RSI) is at 43, signaling that XAU/USD has returned to a neutral stance.

Resistance: $1,974, $1,991

Support: $1,950, $1,934

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| EUR | French Flash Manufacturing PMI | 15:15 | 46.1 |

| EUR | French Flash Services PMI | 15:15 | 54.0 |

| EUR | German Flash Manufacturing PMI | 15:30 | 44.9 |

| EUR | German Flash Services PMI | 15:30 | 55.0 |

| GBP | Flash Manufacturing PMI | 16:30 | 47.9 |

| GBP | Flash Services PMI | 16:30 | 55.5 |

| USD | Flash Manufacturing PMI | 21:45 | 50.0 |

| USD | Flash Services PMI | 21:45 | 52.6 |