On Wednesday, the stock market witnessed a downturn triggered by the Federal Reserve’s decision to maintain interest rates while signaling a looming rate hike. The S&P 500 and Nasdaq Composite both declined, with tech giants such as Microsoft, Nvidia, and Alphabet experiencing significant drops. The Federal Reserve’s cautious approach to rate hikes due to inflation concerns sent shockwaves through the markets, particularly impacting tech stocks that had been performing well earlier in the year. The increase in Treasury yields also raised concerns about the tech sector’s vulnerability to higher rates. Meanwhile, the US dollar had mixed movements in the currency market as the Fed’s hawkish stance influenced market sentiment but concerns about limited rate hike potential limited further gains.

Stock Market Updates

On Wednesday, the stock market experienced a decline in response to the Federal Reserve’s announcement of leaving interest rates unchanged but hinting at an impending rate hike. The S&P 500 dropped by 0.94% to 4,402.20, while the Nasdaq Composite slid by 1.53% to 13,469.13. This decline was primarily driven by significant drops in tech giants like Microsoft, which saw a drop of over 2%, and Nvidia and Google-parent Alphabet, which both experienced declines of around 3%. The Dow Jones Industrial Average also lost 76.85 points, or 0.22%, closing at 34,440.88, with all three major indexes ending the day at session lows.

The Federal Reserve’s decision to keep interest rates steady, while expected, raised concerns among investors as the central bank indicated that one more rate hike is likely before the end of the year. The Fed’s economic projections suggested that after this increase, they would begin cutting rates next year, although rates would remain higher than previously signaled in June. Fed Chair Powell emphasized the need to proceed cautiously in raising rates further due to ongoing concerns about inflation. This news sent shockwaves through the markets, particularly impacting tech stocks, which had been performing well earlier in the year based on the expectation of a less aggressive monetary policy. Additionally, the increase in Treasury yields, with the 2-year yield reaching levels not seen since July 2006 and the 10-year yield hitting a high not seen since November 2007, raised concerns about the potential adverse effects of higher rates on the tech sector.

Data by Bloomberg

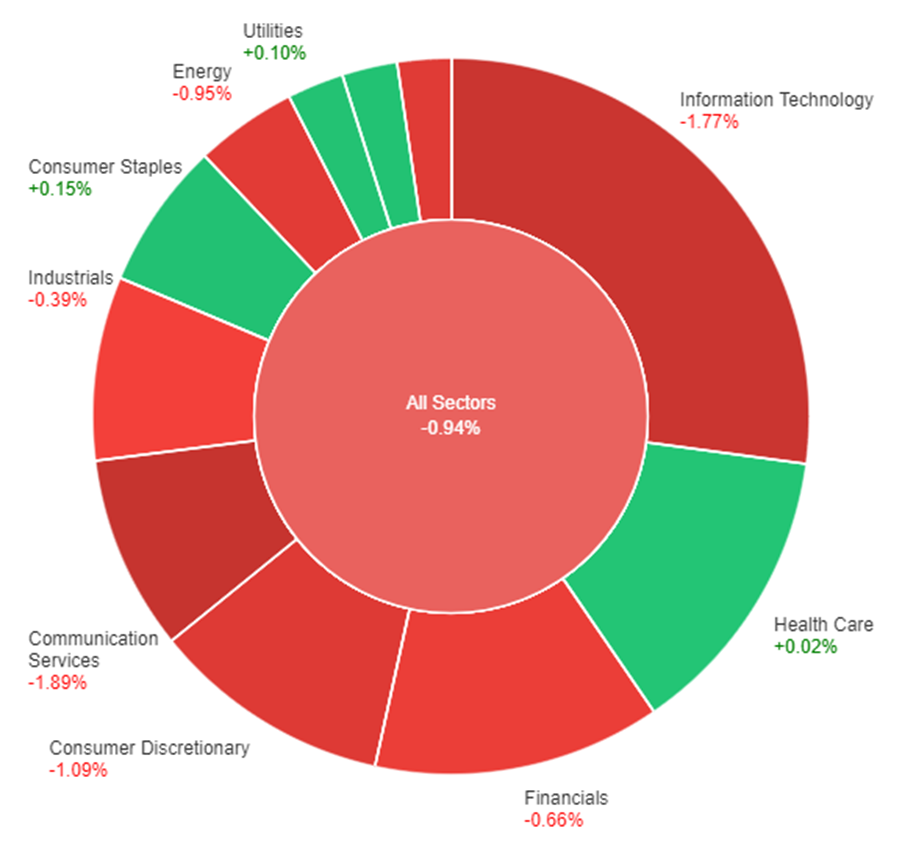

On Wednesday, across all sectors, the market experienced a decrease of 0.94%. Some sectors showed modest gains, with Consumer Staples up by 0.15%, Real Estate by 0.13%, Utilities by 0.10%, and Health Care by 0.02%. However, several sectors saw declines, including Industrials (-0.39%), Financials (-0.66%), Energy (-0.95%), Materials (-1.03%), Consumer Discretionary (-1.09%), Information Technology (-1.77%), and Communication Services (-1.89%).

Currency Market Updates

In the latest currency market update, the US dollar experienced a day of mixed movements. Initially facing losses, the dollar index managed to stabilize as the Federal Reserve’s hawkish stance boosted market confidence. However, its ability to advance further was limited due to market consensus that there is limited room for the US central bank to raise rate expectations. The Fed’s dot plots indicated a preference for one more rate hike in the current year, reducing the median projection for rate cuts in 2024 from 100 basis points to 50 basis points. Federal Reserve Chair Jerome Powell emphasized the data-dependent nature of their decisions, noting that policy is already restrictive, and the full impact of previous tightening measures has yet to be felt. This announcement led to a sharp decline in the EUR/USD pair as 2-year Treasury yields rebounded to new highs for 2023.

Despite these developments, the dollar index is still grappling with overbought pressures that have arisen from its 6% increase since July. GBP/USD also saw fluctuations, initially dropping following below-forecast CPI data but rebounding ahead of the Federal Reserve’s announcement. To reverse the downtrend, GBP/USD would need to close above the 200-day moving average at 1.2434. Meanwhile, USD/JPY held relatively steady after the Fed events and briefly exceeded the 148 hurdle earlier in the day. The focus now turns to upcoming U.S. data releases and the Bank of Japan’s policy decisions, with potential tension between U.S. and Japanese officials regarding the timing of Japanese FX intervention. Overall, high-beta currencies like the Australian dollar retreated from their pre-Fed risk-on gains, stemming from expectations that major central banks’ tightening cycles are reaching their peaks.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Falls as FOMC Meeting Spurs Stronger US Dollar, Fed Signals Hawkish Stance

The EUR/USD experienced a significant decline, dropping from its weekly highs above 1.0730 to 1.0650 in response to the FOMC meeting’s outcome. The Federal Reserve unanimously maintained its interest rate target range at 5.25-5.50%, with minimal changes in the statement compared to the previous month. The Summary of Economic Projections suggests the likelihood of another rate hike by year-end, although Fed Chair Powell emphasized that the dot plot is not a firm plan. The market perceived the meeting as hawkish, causing US bond yields to surge to multi-year highs and Wall Street to turn bearish, subsequently strengthening the US Dollar. Upcoming US data releases and decisions from central banks like the Swiss National Bank and the Bank of England will remain pivotal for market dynamics.

According to technical analysis, the EUR/USD moved in high volatility on Wednesday and able to reach the upper band but then moves back lower and reach the lower band of the Bollinger Bands. This movement suggests the possibility of further consolidation. The Relative Strength Index (RSI) is currently at 39, indicating that the EUR/USD is in a neutral stance with a slight bearish bias.

Resistance: 1.0687, 1.0759

Support: 1.0605, 1.0523

XAU/USD (4 Hours)

XAU/USD Drop Amid Fed’s Hawkish Stance on Rates

Gold prices fell for the third consecutive day, trading around $1,925 during Asia’s early trading hours on Thursday. The US Federal Reserve (The Fed) kept its benchmark interest rate at 5.5%, but projected more rate hikes in 2023, leading to pressure on precious metals. The Fed’s revision of 2024 interest rate projections, from 4.6% to 5.1%, unexpectedly boosted the US Dollar, causing the US Dollar Index (DXY) to reach a six-month high at 105.60. US bond yields also rose, with the 10-year bond hitting 4.43%, its highest since 2007. Precious metals slipped after Fed Chair Jerome Powell’s press conference, where he reiterated The Fed’s commitment to a 2% inflation target and emphasized data-driven future decisions. More US data, including Weekly Jobless Claims, the Philadelphia Fed Manufacturing Survey, and Existing Home Sales Changes, will impact markets on Thursday.

According to technical analysis, XAU/USD moved in high volatility on Wednesday and able to reach the upper band then moving back lower. Currently, the price is trading between the middle and lower bands. The Relative Strength Index (RSI) is currently at 48, indicating that the XAU/USD pair is back in neutral stance.

Resistance: $1,939, $1,951

Support: $1,922, $1,915

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CHF | SNB Monetary Policy Assessment | 15:30 | |

| CHF | SNB Policy Rate | 15:30 | 2.00% |

| CHF | SNB Press Conference | 15:30 | |

| GBP | Monetary Policy Summary | 19:00 | |

| GBP | MPC Official Bank Rate Votes | 19:00 | 7-0-2 |

| GBP | Official Bank Rate | 19:00 | 5.50% |

| USD | Unemployment Claims | 20:30 | 224K |