November witnessed robust stock market rallies with the Dow Jones surging to a new yearly high, marking an 8.9% gain while the S&P 500 and Nasdaq also experienced significant growth. Cooling inflation figures hinted at a potential shift in the Federal Reserve’s policy, driving investor optimism. Tech stocks like Nvidia, Tesla, Alphabet, and Meta dominated gains, albeit facing slight declines towards month-end. Simultaneously, the dollar rebounded against the euro due to position adjustments and surprising euro zone inflation data, influencing expectations of rate adjustments by both the Fed and ECB. Amidst various currency movements, the anticipation of key economic reports and Fed Chair Powell’s remarks played pivotal roles in market dynamics.

Stock Market Updates

In November, the stock market witnessed a strong rally, with the Dow Jones Industrial Average surging to a new yearly high and closing at 35,950.89, marking an impressive 8.9% gain for the month. The S&P 500 also experienced substantial growth, climbing 8.9%, while the Nasdaq Composite, though slightly lower by 0.2%, still managed a solid 10.7% advance. This surge was primarily fueled by cooling inflation figures, indicating a potential shift in the Federal Reserve’s monetary policy. Despite the broader market’s gains, some profit-taking in Big Tech stocks caused a minor dip in the Nasdaq on Thursday. However, positive earnings reports from Salesforce, driven by its robust cloud data business and AI product, boosted the Dow alongside leading healthcare companies like UnitedHealth Group, Johnson & Johnson, Merck, and Amgen.

The market sentiment was buoyed by indications that inflation might be stabilizing, as the personal consumption expenditures price index rose by 3.5% year-over-year, slightly lower than the previous month’s 3.7% increase. This trend led investors to speculate that the Federal Reserve could potentially halt rate hikes and even consider rate cuts by 2024. Additionally, the 10-year Treasury yield, after reaching above 5% the previous month, dipped to 4.34% in response to the cooling inflation figures, elevating confidence in equities. Technology stocks had dominated November’s gains, with Nvidia, Tesla, Alphabet, and Meta showcasing substantial increases throughout the month, though some investors chose to realize profits as November drew to a close, resulting in slight declines for these tech giants on Thursday.

Data by Bloomberg

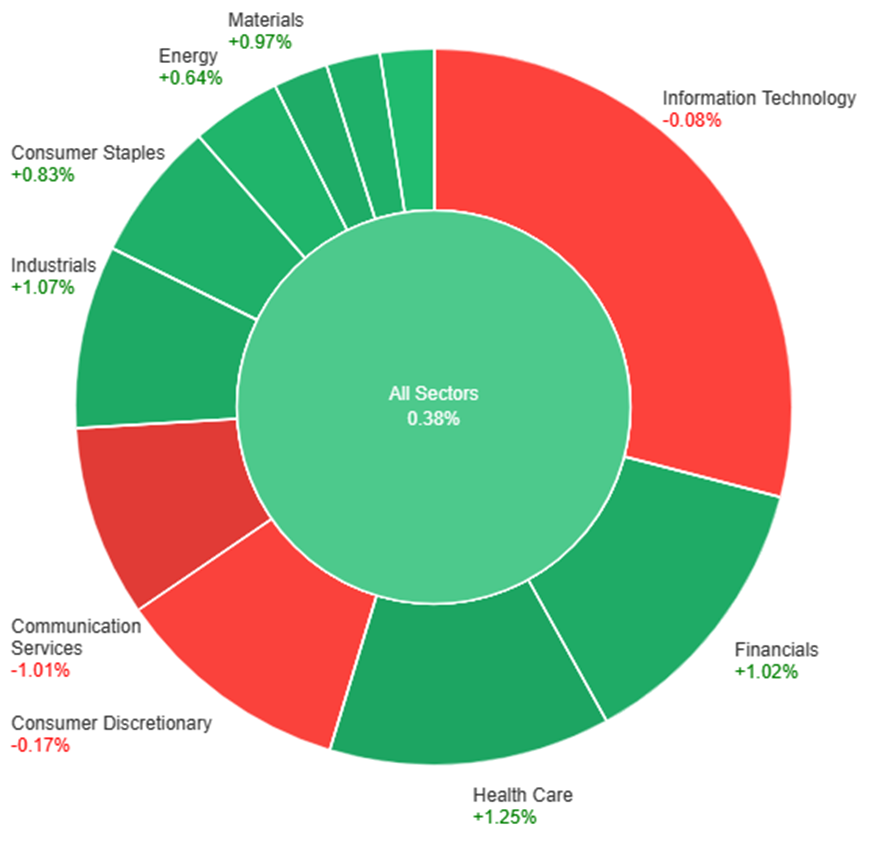

On Thursday, across the various sectors, the market showed a general upward trend with an overall gain of 0.38%. Notably, Health Care exhibited the most substantial growth, rising by 1.25%, followed closely by Industrials and Financials, which saw increases of 1.07% and 1.02%, respectively. Materials and Consumer Staples also experienced notable gains at 0.97% and 0.83%. Real Estate and Energy sectors showed moderate growth at 0.83% and 0.64%, respectively. Conversely, Information Technology experienced a slight dip at -0.08%, while Consumer Discretionary and Communication Services showed more significant declines of -0.17% and -1.01%, respectively.

Currency Market Updates

In the latest currency market updates, the dollar rebounded at month-end, benefitting from position adjustments and a surprising drop in eurozone inflation compared to forecasts. Despite soft U.S. economic data, including personal income, spending, and core PCE figures, EUR/USD declined by 0.7%. The market’s anticipation of Federal Reserve Chair Jerome Powell’s forthcoming comments and the impending jobs report next week contributed to the dynamics. The dollar index experienced a 0.7% decline while finding support near the 61.8% retracement of the July-October advancement, yet the rebound was capped by the 200-day moving average at 102.57.

EUR/USD’s downward movement overlooked the subdued U.S. economic data, alongside expectations in the futures market of potential earlier and more substantial European Central Bank (ECB) rate cuts compared to the Fed’s projections for next year. The bearish trend in 2-year bund-Treasury yield spreads, diverging from rising EUR/USD prices since mid-November, added to the downward pressure. The currency pair may find support around the previous week’s low of 1.08525 and the November 17 swing low, as investors await further U.S. data.

Additionally, other major currencies reacted to the dollar’s resurgence: Sterling fell by 0.58%, while USD/JPY rose by 0.65% in its month-end rebound. These movements were influenced by technical levels, such as Fibonacci retracements, and the interplay between key moving averages. The broader scenario was influenced by the anticipation of yield spread dynamics between the Treasury and JGB (Japanese Government Bonds) and the Fed’s gradual shift towards easing, contributing to the possibility of substantial losses into 2024. Economic events such as the U.S. ISM manufacturing data for November, Powell’s policy comments, ISM non-manufacturing, JOLTS, and Friday’s non-farm payrolls report were anticipated as market movers in the coming days.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Faces Consolidation Amid Divergent Economic Data and Central Bank Speculations

The EUR/USD pair witnessed a notable pullback, hitting a low of 1.0883 after a recent surge past 1.1000. With the Eurozone CPI registering a slower annual increase in November, lingering below the ECB’s target, speculation looms regarding potential rate cuts. This news, coupled with the Euro’s lag against the Swiss Franc, hints at a short-term downside risk for the Euro. Meanwhile, the US Dollar, bolstered by recovering Treasury yields despite mixed US data, showcased resilience. As the market eyes the upcoming US ISM Manufacturing PMI release and ECB monetary policy, the pair remains poised for consolidation amidst divergent economic trends and central bank anticipations.

On Thursday, the EUR/USD experienced a downward movement, creating a push to the lower band of the Bollinger Bands. Currently, the price moving slightly above the lower band, suggesting a potential upward movement, potentially reaching the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 40, signaling a neutral with a slight bearish outlook for this currency pair.

Resistance: 1.0945, 1.1041

Support: 1.0842, 1.0760

XAU/USD (4 Hours)

XAU/USD Edges Down as Inflation Data Favors Rate-Cut Speculations

Gold prices slightly declined on Thursday as investors pivoted away from safe-haven assets in response to the release of US inflation data. The Core PCE Price Index rose by 0.2% MoM and 3.5% YoY in October, aligning with expectations but falling below September’s figures. This news was embraced by financial markets as an indication of the Fed’s likely shift toward a rate-cut monetary policy. Simultaneously, major economies like the Eurozone witnessed diminishing price pressures, evidenced by a decline in HICP figures. This trend bolstered hopes that central banks may forego additional rate hikes, averting a severe economic downturn. The flight from safety also impacted government bonds, propelling yields upwards, with the 10-year Treasury note at 4.32% and the 2-year note at 4.69%, although notably lower than previous peaks recorded in October.

On Thursday, XAU/USD moves in a period of consolidation, currently oscillating between the middle and upper bands within the Bollinger Bands. This current movement suggests a potential upward trend, potentially reaching the upper band once again. The Relative Strength Index (RSI) stands at a level below 63, indicating that the bullish sentiment for this pair remains robust.

Resistance: $2,052, $2,079

Support: $2,038, $2,012

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| CAD | Employment Change | 21:30 | 14.2K |

| CAD | Unemployment Rate | 21:30 | 5.8% |

| USD | ISM Manufacturing PMI | 23:00 | 47.9 |