US stock futures remained relatively stable on Thursday night, with the Dow Jones Industrial Average futures up 0.08%, while the S&P 500 and Nasdaq 100 futures increased by 0.12%. Elon Musk announced he would be stepping down as the CEO of Twitter, with Tesla’s shares increasing following the news.

On Thursday, the Dow Jones Industrial Average fell by over 200 points, or 0.66%, resulting in its fourth consecutive losing session. The decline was attributed to various factors, including Disney’s poor subscriber numbers and stress in the regional banking sector after PacWest Bancorp reported a drop in deposits. Investors remain concerned about a potential market downturn, despite weaker-than-expected wholesale prices data indicating easing inflation.

Investors are now waiting for preliminary consumer sentiment data and April import prices data, set to release on Friday. The Dow and S&P 500 are heading towards their second negative week in a row, while the Nasdaq Composite is on track for its third straight positive week.

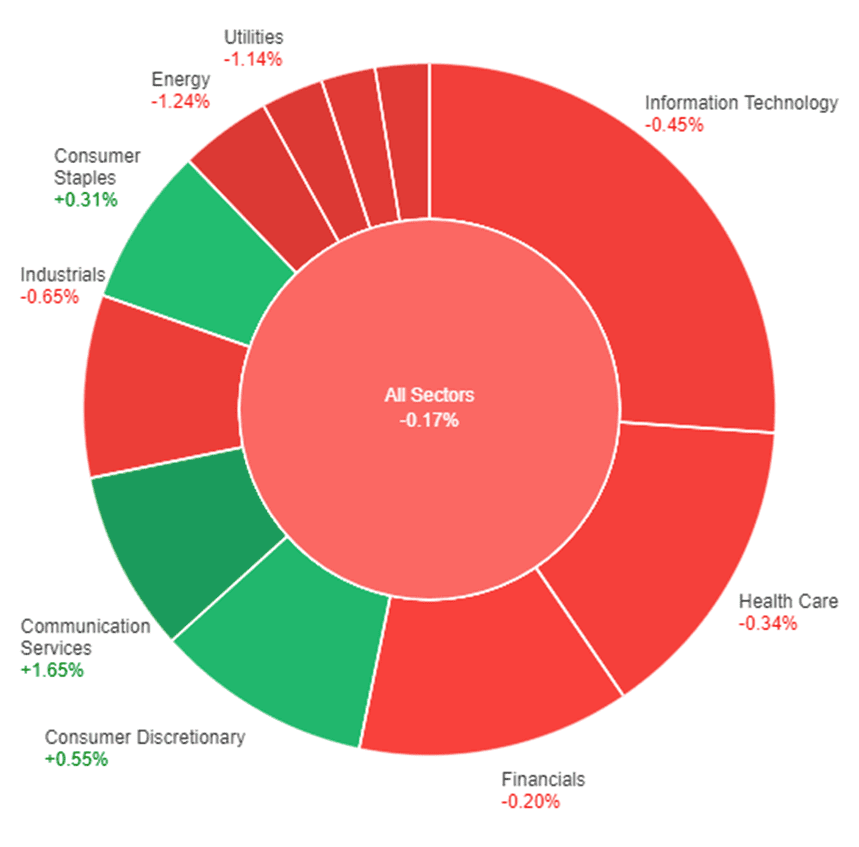

Data by Bloomberg

On Thursday, the overall market experienced a slight decline of 0.17%. However, there were some sectors that performed well. Communication Services showed a positive growth of 1.65%, followed by Consumer Discretionary with a gain of 0.55% and Consumer Staples with a modest increase of 0.31%. On the other hand, several sectors saw decreases in their values. Financials declined by 0.20%, Health Care dropped by 0.34%, and Information Technology experienced a decrease of 0.45%. Industrials, Materials, Real Estate, Utilities, and Energy sectors all had larger declines, ranging from -0.65% to -1.24%.

Major Pair Movement

On Thursday, the trading market saw an increase in demand for the safe-haven currencies such as the US dollar and yen, as investors’ concerns over excess demand and inflation following pandemic reopenings faded. The yields of 10-year Treasuries declined by 4bp, due to several quarters of central bank tightening and yield curve inversion, which increased recession fears and reduced financial risk-taking. Moreover, there was an increase in demand for relatively high-yielding Treasuries and a decrease in regional banks’ pressure.

The Euro fell by 0.6%, and Sterling fell nearly 1% after the Bank of England (BoE) raised interest rates to 4.5%. However, this increase was oddly paired with higher than the previous inflation and growth forecasts, indicating the potential for a future slowdown. UK inflation remains above 10%, which is more than twice the new BoE projection. High beta and commodity-linked currencies experienced a decline due to the dollar’s risk-on rise and China demand doubts. Key risks ahead include US retail sales on Tuesday, as well as banks and the debt ceiling.

Technical Analysis

EUR/USD (4 Hours)

EUR/USD Drops to One-Month Low Amid Stronger US Dollar and Deteriorating Market Sentimen

The EUR/USD pair is heading towards its lowest daily close in a month due to a stronger US Dollar and worsening market sentiment. The pair has retreated from near 1.1100 and briefly dipped below 1.0900. The European Central Bank (ECB) Vice President, Luis de Guindos, expressed concerns about service and core inflation but did not provide any commitment on rates, while Joachim Nagel mentioned that decisions would be made on a meeting-by-meeting basis. Risk aversion benefited the US Dollar, and government bond yields rebounded during the American session.

US data indicated a slowdown in inflation and an increase in the labor market, with Initial Jobless Claims reaching the highest level since October 2021. Market sentiment will continue to be the main driver, and if concerns persist, the EUR/USD pair may experience further losses, contributing to increased volatility.

According to technical analysis, the EUR/USD pair is currently trending lower after reached the lower band of the Bollinger band. It is expected that the EUR/USD will continue to move lower and push the lower band. The Relative Strength Index (RSI) is presently at 37, suggesting a lower trend in the EUR/USD market.

Resistance: 1.0950, 1.0986

Support: 1.0911, 1.0881

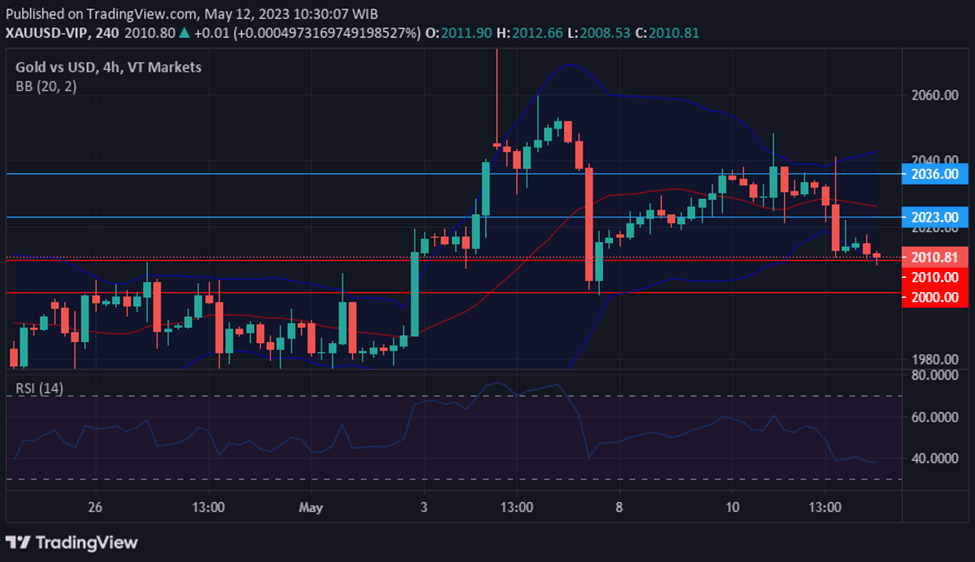

XAU/USD (4 Hours)

Gold (XAU/USD)Prices Plunge on Surge in US Dollar and Market Sell-Off Amidst Banking Issues and US Debt Ceiling Concerns

Gold (XAU/USD)prices experienced a sharp decline on Thursday, hitting a new weekly low of $2,011.09, due to a surge in the US dollar amid a persistent dismal mood, resulting in a sell-off in the stock markets. The mood was impacted by banking issues, as the FDIC proposed extra fees for large banks to cover the $16 billion lost on the rescue of Silicon Valley Bank and Signature Bank in March. Furthermore, concerns around the US debt ceiling continued to undermine the sentiment, as Republican lawmakers are reluctant to back President Joe Biden’s plan. Additionally, government bond yields remain depressed, with the 10-year Treasury note yields at 3.38%, down 5 basis points, and the 2-year note offers at 3.86%, shedding 3 bps, due to the easing of inflation-related figures in April, as the PPI increased by 2.3% YoY.

The technical analysis indicates that XAU/USD is moving lower on Thursday. The price is currently pushing the lower band of the Bollinger Band, indicating the potential for a slight lower movement for XAU/USD. Moreover, the Relative Strength Index (RSI) is currently at 38, indicating that XAU/USD is considered in bearish trend.

Resistance: $2,023, $2,036

Support: $2,010, $2,000

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Gross Domestic Product | 14:00 | 0.0% |

| USD | Monetary Policy Summary | 22:00 | 63.0 |