Daily Market Analysis

Market Focus

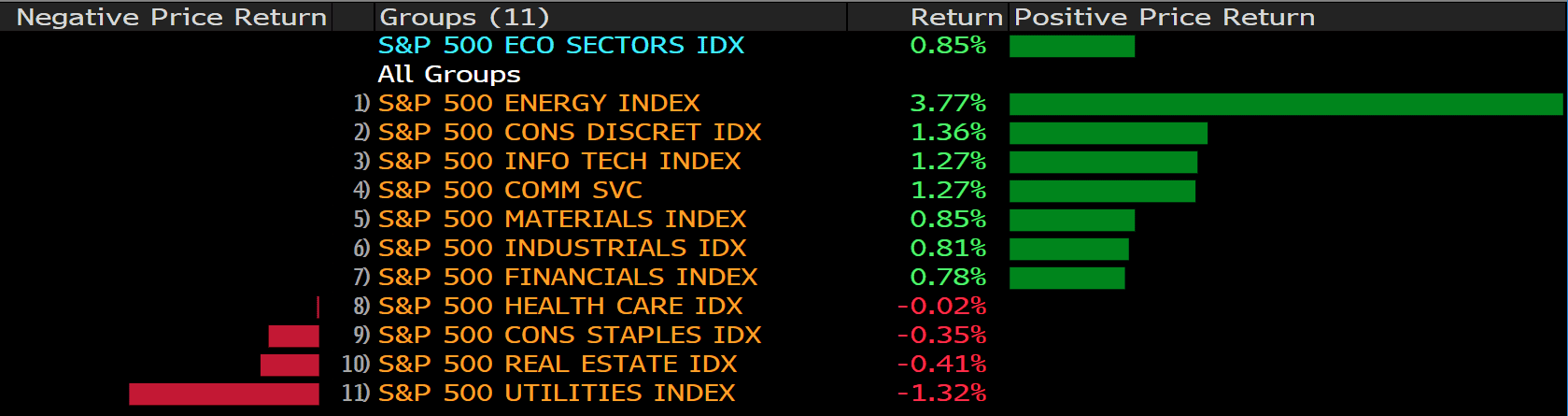

U.S. equities rose Monday as the Covid-19 immunization drive was bolstered by U.S. regulators granting full approval for the vaccine made by Pfizer Inc. and BioNTech SE.

The S&P 500 and Nasdaq 100 rebounded from lows last week as the approval could lead to more vaccine mandates amid a surge in delta variant cases that has threatened the momentum of the global economic recovery. Mixed U.S. data Monday showed July home salescoming in higher than expected while growth at U.S. services and factories slowed to an eight-month low.

The Covid-19 vaccine made by Pfizer Inc. and BioNTech SE was granted a full approval by U.S. regulators, a milestone expected to help bolster the immunization drive amid a renewed surge in infections.

The Covid-19 vaccine made by Pfizer Inc. and BioNTech SE was granted a full approval by U.S. regulators, a milestone expected to help bolster the immunization drive amid a renewed surge in infections.

The Food and Drug Administration said in a statement on Monday that it had cleared the shot for the prevention of the disease caused by the novel coronavirus in people 16 and older. It will be marketed under the name Comirnaty.

The approval is the first for a Covid vaccine in the U.S., and it arrives at a crucial time, as the country is ensnared in a wave of illness sparked by the highly transmissible delta variant. The Biden administration has made increasing vaccinations a priority in its efforts to tamp down the latest outbreak, and hopes the approval will increase confidence in the shot among people who say they are wary of its rapid-fire development.

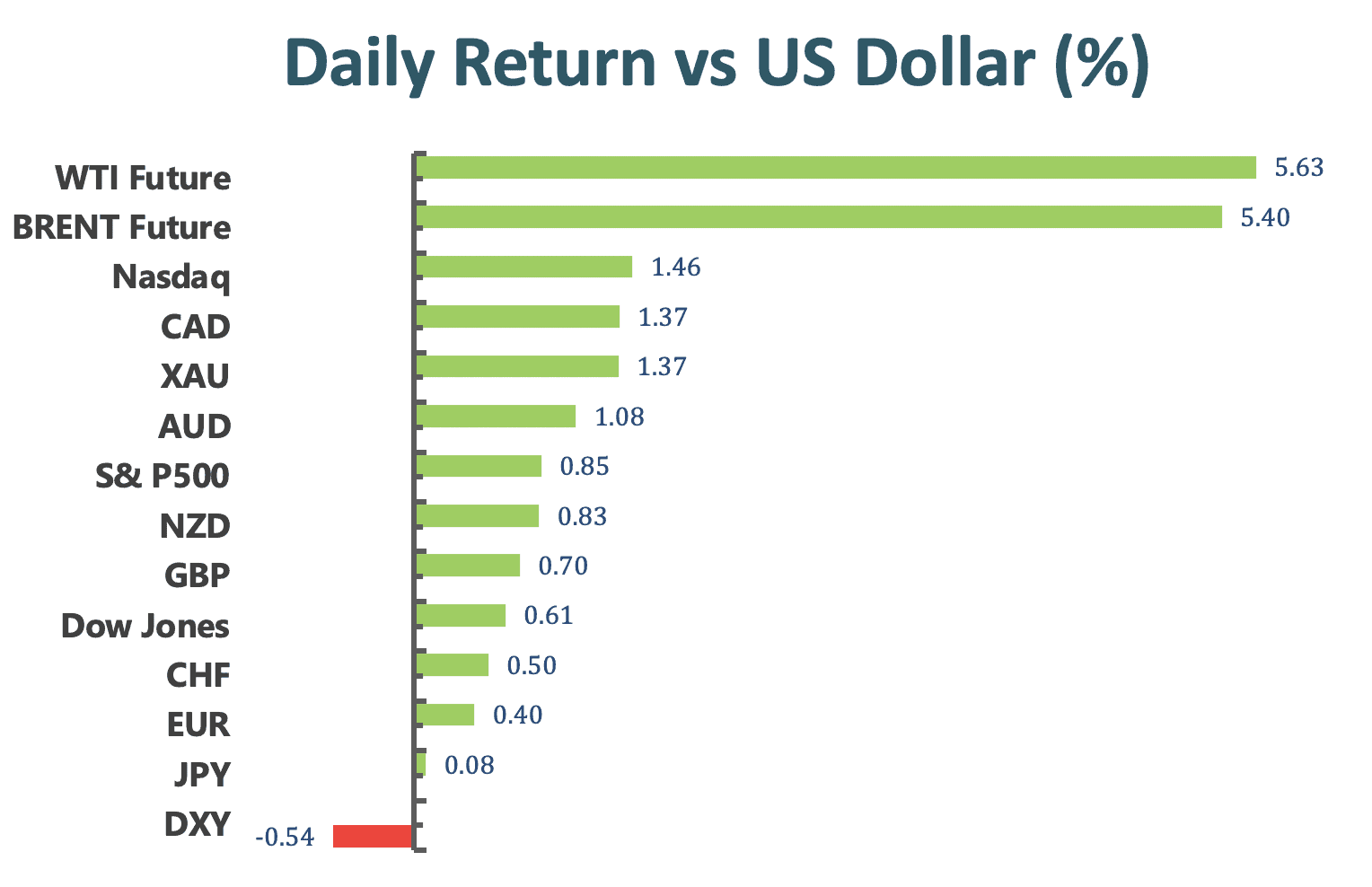

Main Pairs Movement:

The US dollar declined sharply on the first day of a new trading week, surrounding by strong selling pressure. At the time of writing, the greenback is losing 0.52% on the day at 92.971. The depreciation of the greenback is likely due to the negative market mood, as the world is now facing the threat of the Delta variant. Investor worries about that the increasing cases of the Covid-19 could hinder the global economic recovery and impacts the plans of the Federal Reserve to start bond tapering. In addition, the US Manufacturing PMI and Services PMI released on Monday are both lower than expected, which is bearish for the US dollar.

GBP/USD and EUR/USD both advanced on Monday, trading at 1.3731 and 1.1747, respectively. GBP/USD picked up today after reaching a monthly low at 1.360 last week, despite a lower UK PMI data in August compared to July. EUR/USD continues to climb higher during American session, rising 0.39% on a daily basis.

USD/JPY was trading higher during Asia session, but then lost its momentum and pulled back from daily high. The pair is now trading at 109.67, losing 0.09% for the day.

Gold price surged 1.32% on Monday owing to the US dollar’s weakness, now trading at 1804.22 at the time of writing. WTI jumped for 5.63% on a daily basis, following last week’s steep decline. The crude oil is rising on Monday as a result of improved market sentiment. Also, China’s covid outbreak is under control, reporting zero local cases in the day.

Technical Analysis:

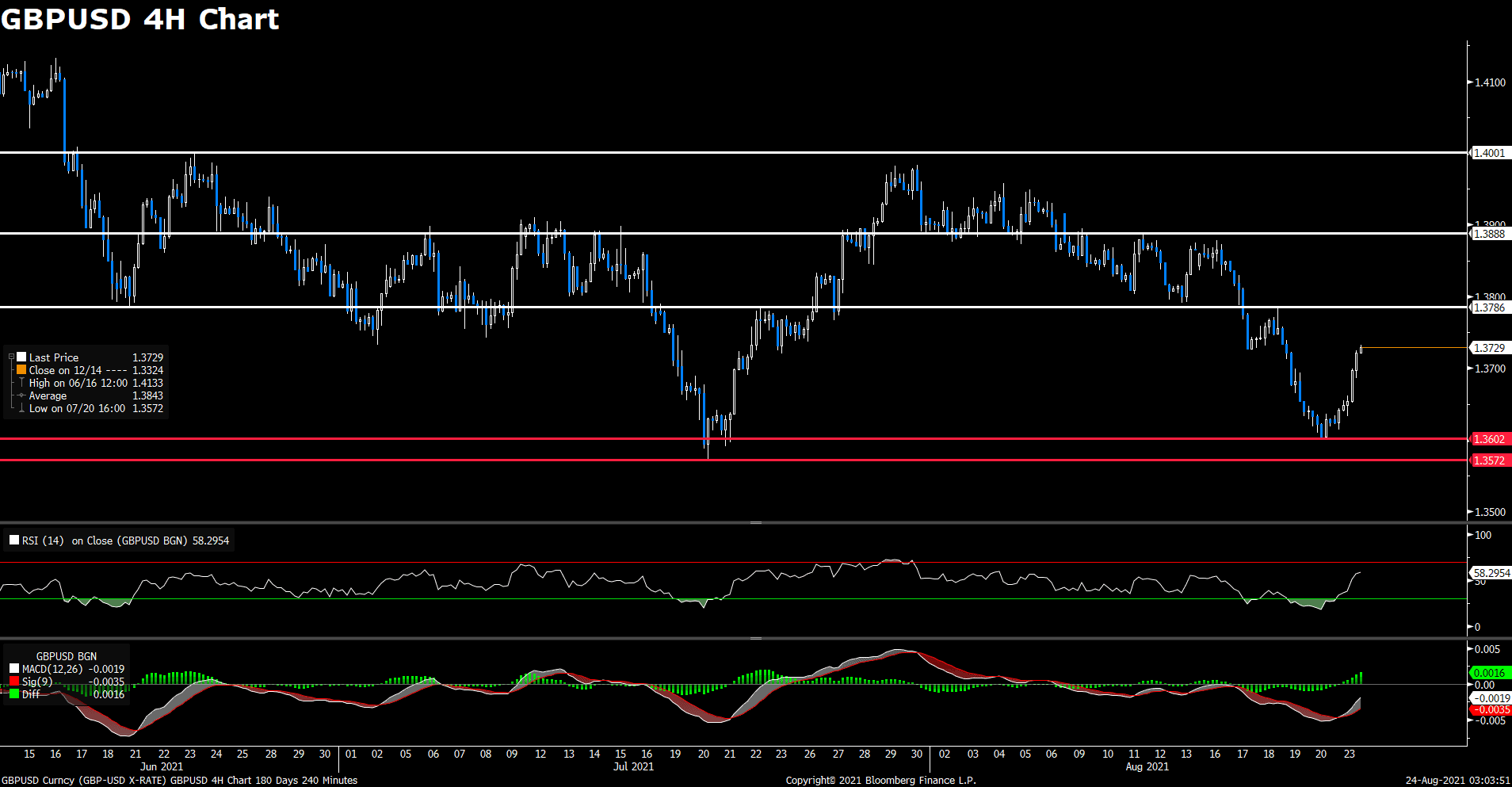

GBPUSD (4-hour Chart)

The GBP/USD pair took a recovery from last week’s one-month lows on the first day of a new trading week, rising 0.7% for the day. The cable surged on US dollar’s weakness, which is now trading around 1.3729 at the time of writing. For technical aspect, RSI indicator 58 figures as of writing, suggesting bull-movement ahead. If we take a look at MACD indicator, a positive MACD histogram shows that the market is bullish.

In conclusion, we think market will be bullish as long as the 1.3786 resistance line holds. If the price breaks above that level, it will open the door for additional near-term profits. And the next resistance is at 1.388. On top of that, The UK Purchasing Managers Index (PMI) released on Monday had a lower reading compared to July’s data, as the Manufacturing PMI fell to a five-month low level of 60.1 in August. Nevertheless, the UK PMI prints for August seems to have only slight influence on the GBP/USD pair.

Resistance: 1.3786, 1.3888, 1.4001

Support: 1.3602, 1.3572

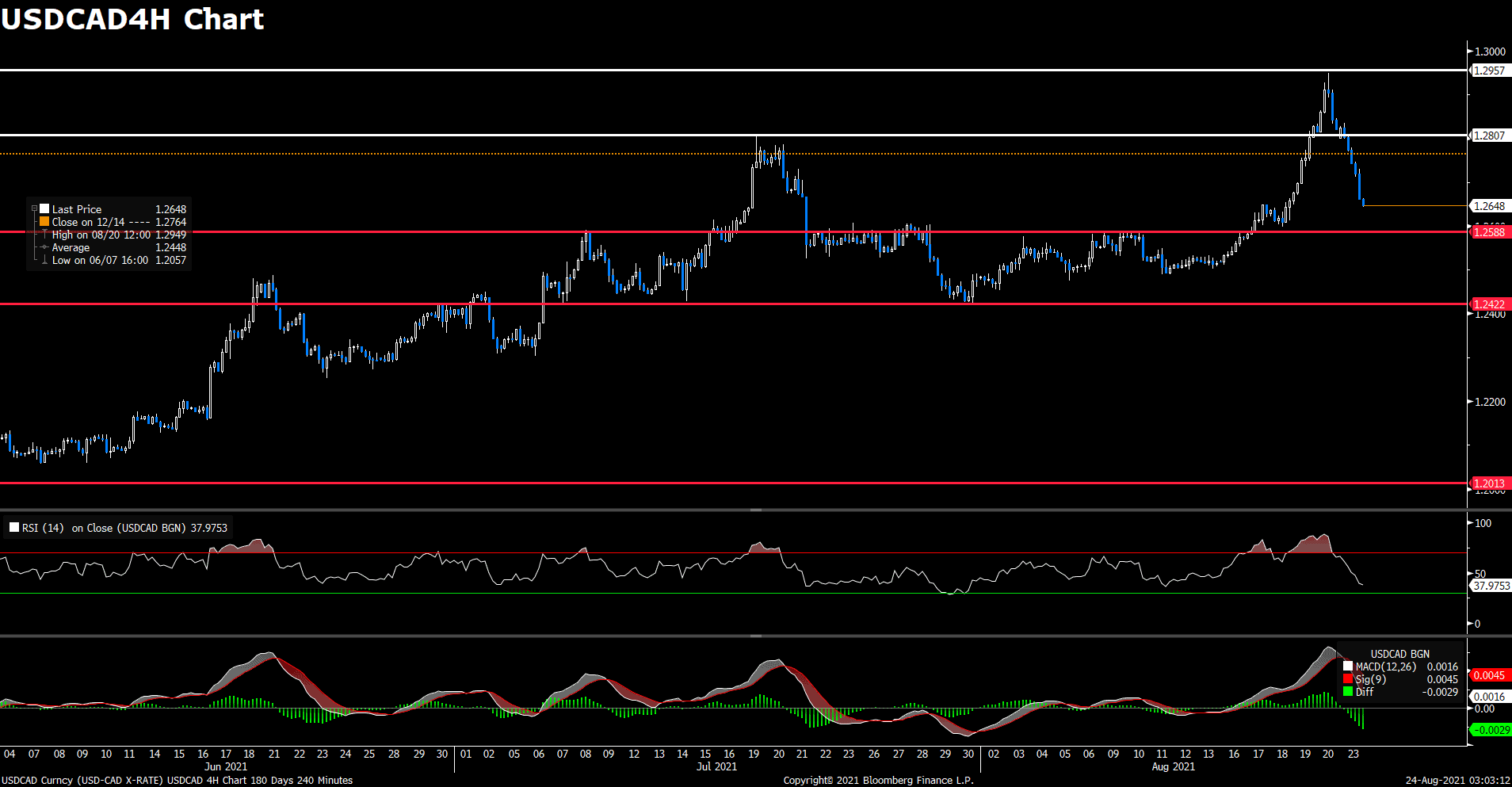

USDCAD (4- Hour Chart)

The USD/CAD pair slumped on Monday, retreating back from a yearly high recorded last week, as it dipped 1.21% for the day. The pair is now trading at 1.2648 at the time of writing while surrounding by strengthened bearish market mood. For technical aspect, RSI indicator 37 figures as of writing, suggesting bear-movement ahead, and the selling pressure is relatively stronger. If we take a look at MACD indicator, a negative MACD histogram indicates that the market is bearish.

In conclusion, we think market will be bearish, as the pair failed to break above the 1.2957 resistance line. The USD/CAD pair is continually heading down and trying to test the 1.2588 support. The depreciation of US dollar and upsurge in crude oil prices made the pair fall deeper during the American session. In addition to that, Canada will release its Wholesale Sales on Wednesday, which is a leading indicator of consumer spending. Investors can take note of what kind of effect it will bring to the Canadian dollar.

Resistance: 1.2807, 1.2957

Support: 1.2588, 1.2422, 1.2013

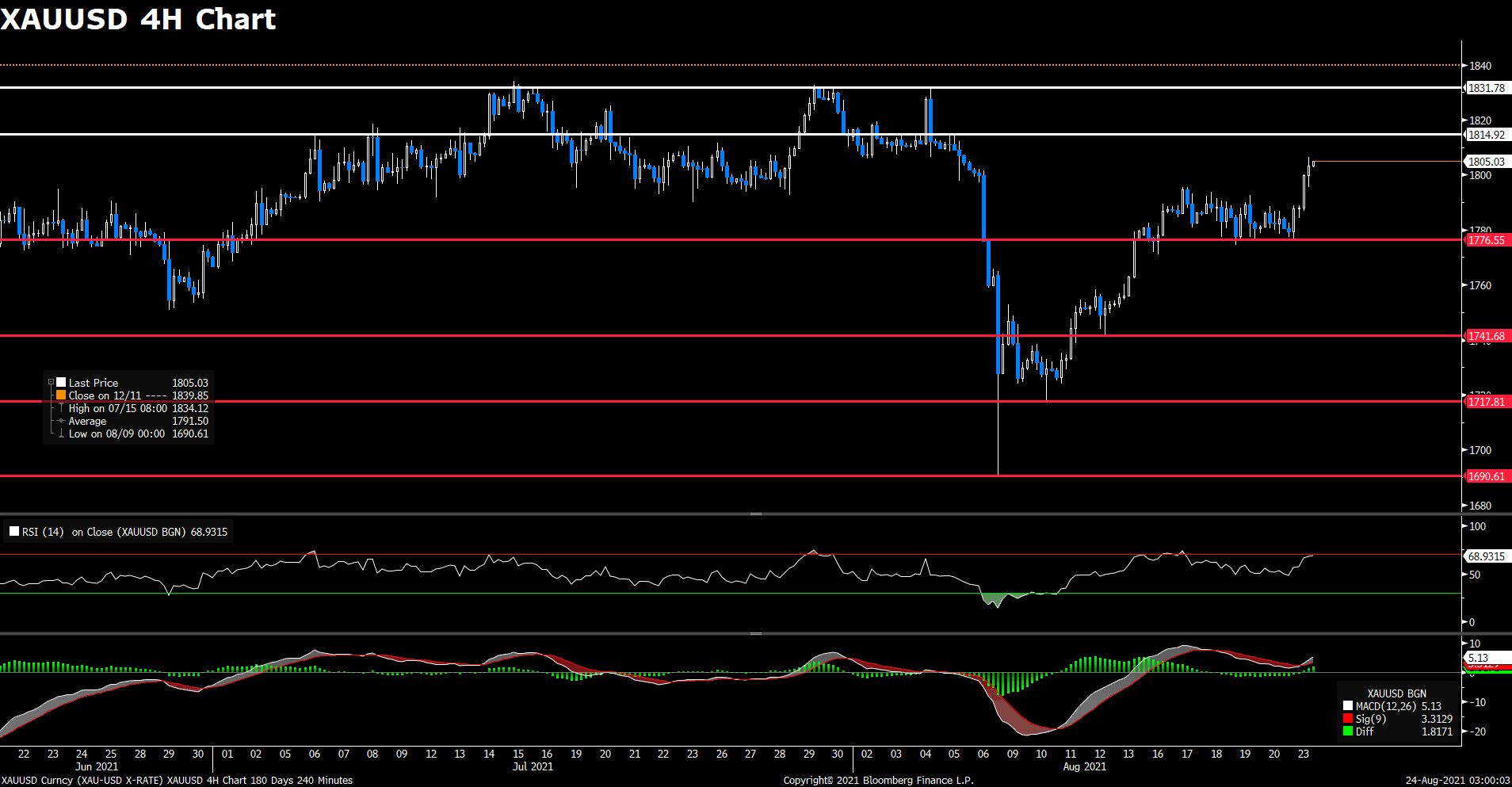

XAUUSD (4- Hour Chart)

The XAU/USD pair surged on Monday, breaking above the 1800 level. The pair is now trading at 1805.03 and rising 1.33% on a daily basis. For technical aspect, RSI indicator 68 figures as of writing, suggesting that the market is near the overbought zone, traders should pay attention to selling signals. If we take a look at MACD indicator, a positive MACD histogram shows that the market is bullish.

In conclusion, we think market will be bullish as it heads to test the 1814.92 resistance line. A break above that level could leads the pair to advance higher, and the next resistance line sits at 1831.78. With the US dollar coming under strong selling pressure, gold is gathering bullish momentum at the start of the week. On top of that, US New Home Sales is scheduled to released on Tuesday, a lower-than-expected reading could help XAU/USD to edge higher.

Resistance: 1814.92, 1831.78

Support: 1776.55, 1741.68, 1717.81, 1690.61

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

EUR |

German GDP (QoQ) (Q2) |

14:00 |

1.5% |

||||

|

USD |

New Home Sales (Jul) |

22:00 |

700K |

||||