Daily Market Analysis

Market Focus

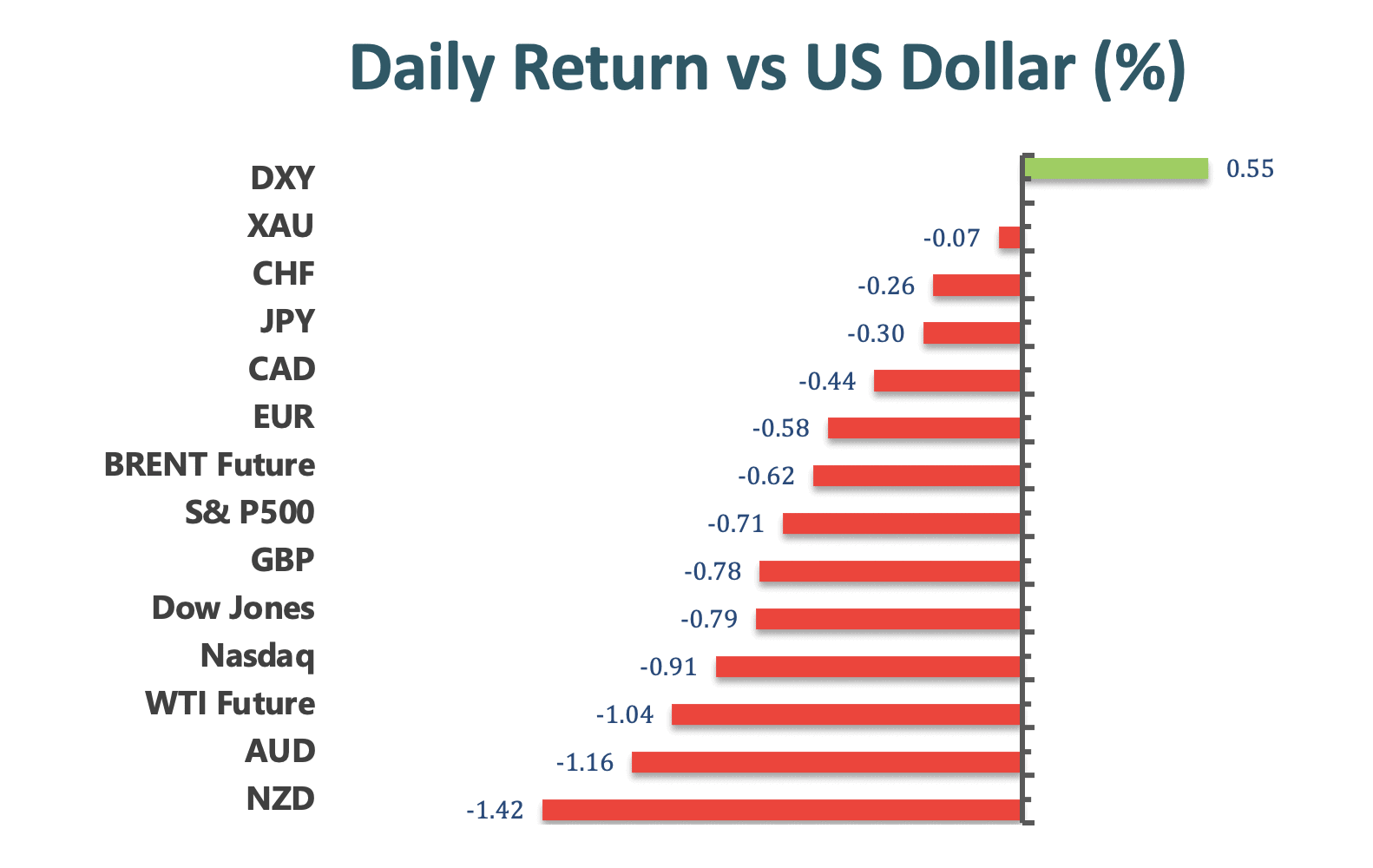

Stocks dropped, while the dollar rose amid concern that the global economic recovery will lose momentum with further shutdowns to contain a fast-spreading pandemic. The S&P 500 snapped a five-day rally. Giants Amazon.com Inc. and Facebook Inc. slid at least 1.7%, while Home Depot Inc. tumbled after the retailer posted weaker-than-expected results. Chinese stocks listed in the U.S. faced another wave of selling as authorities in Beijing ramped up their crackdown on some of the nation’s largest companies. Alibaba Group Holding Ltd., Baidu Inc. and JD.com Inc.slumped more than 2.9%.

Traders watched closely Federal Reserve Chair Jerome Powell’s remarks during a town hall with educators and students, where he noted the Fed’s “powerful tools” have limitations. Powell also said that Covid-19 will likely stay “for a while,” and we’re not going back to a pre-pandemic economy. Policy makers will gather next week for the Jackson Hole symposium, the central bank’s most-prominent annual conference.

American homebuilder sentiment sank to a 13-month low in August amid high costs as well as continuing supply shortages. U.S. retail sales fell in July by more than forecast, reflecting a steady shift in spending toward services and indicating consumers may be growing more price conscious as inflation picks up. While factory production strengthened the most in four months, manufacturers continued to face higher input prices and a near record number of job vacancies.

The U.S. government is poised to being offering booster shots as soon as next month, with the country facing a renewed wave of infections fueled by the highly transmissible delta variant. New Zealand will enter a lockdown after reporting its first community transmission since February. Switzerland recorded its biggest jump in infections in months, while South Africa expects a fourth wave to start in early December.

Main Pairs Movement:

The dollar rallied on the back of risk-aversion, exacerbated by dismal US data. US Retail Sales fell by 1.1% in July, much worse than anticipated.

Commodity-linked currencies were the worst performers, with Aussie down to a fresh 2021 low of 07242. Loonie peaked at 1.2649, its highest in almost a month. NTD/USD plummeted around 100 pips once to below the 0.6900 threshold, after the New Zealand government announced a lockdown over just one Covid case.

Upbeat UK employment data fell short of backing Cable that trades near a daily low of 1.3725. The EUR/USD pair is once again poised to challenge the 1.1700 threshold.

Gold edged lower after advancing to $1,795.60 a troy ounce, ending the day in the red at around $1,786.00. Crude oil prices also lost ground with WTI currently trading at around $66.55 a barrel, and Brent at $69.10.

Technical Analysis:

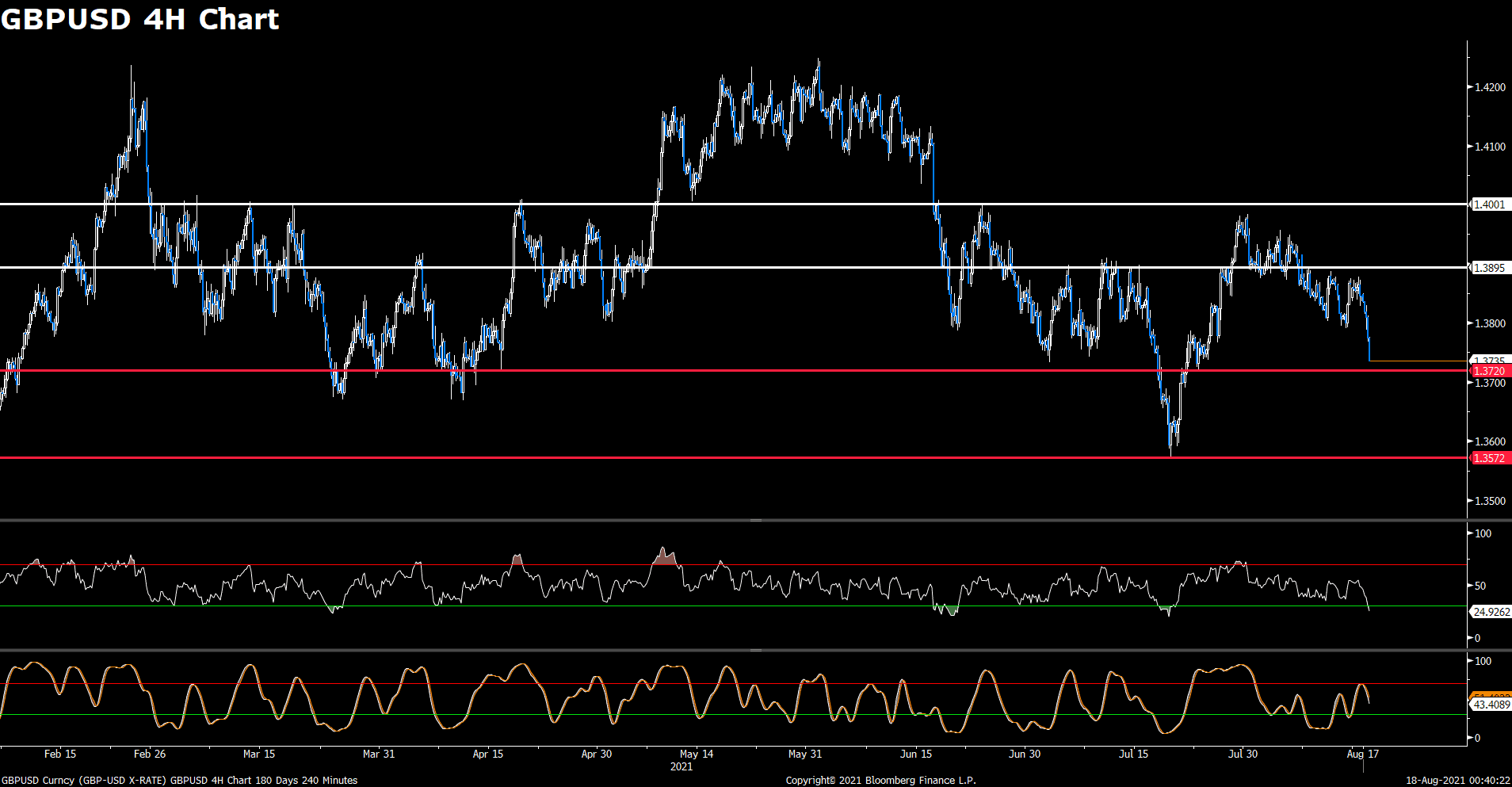

GBPUSD (4-hour Chart)

GBP/USD came off to its lowest level for three weeks this Tuesday, staying under 1.38 level, despite a bumper UK labor market report that showed an 4.7% UK unemployment rate in June, which is lower than economists had expected. In addition, reports showed that UK employment up to 95K, which is also more than economists had expected in May. However, the British pound was being pressured by worries that job losses will rise after the furlough scheme ends in September. This, along with disappointment from the UK Claimant Count Change, overshadowed an unexpected fall in Britain’s unemployment rate and stronger wage growth data.

For technical aspect, RSI indicator 25 figures as of writing, suggesting the market is oversold now, the downward trend may reverse in the near future. If we take a look at Stochastic Oscillator, the fast line lies under 45 level which shows that the market is in a relatively neutral position.

In conclusion, we think market will be mildly bullish as long as the 1.3720 support line holds. UK inflation data released on Wednesday will be next focus for traders, a larger fall might help persuade the Bank of England that a tightening of UK monetary policy is unnecessary near-term and therefore weaken GBP/USD further.

Resistance: 1.3895, 1.4001

Support: 1.3720 , 1.3572

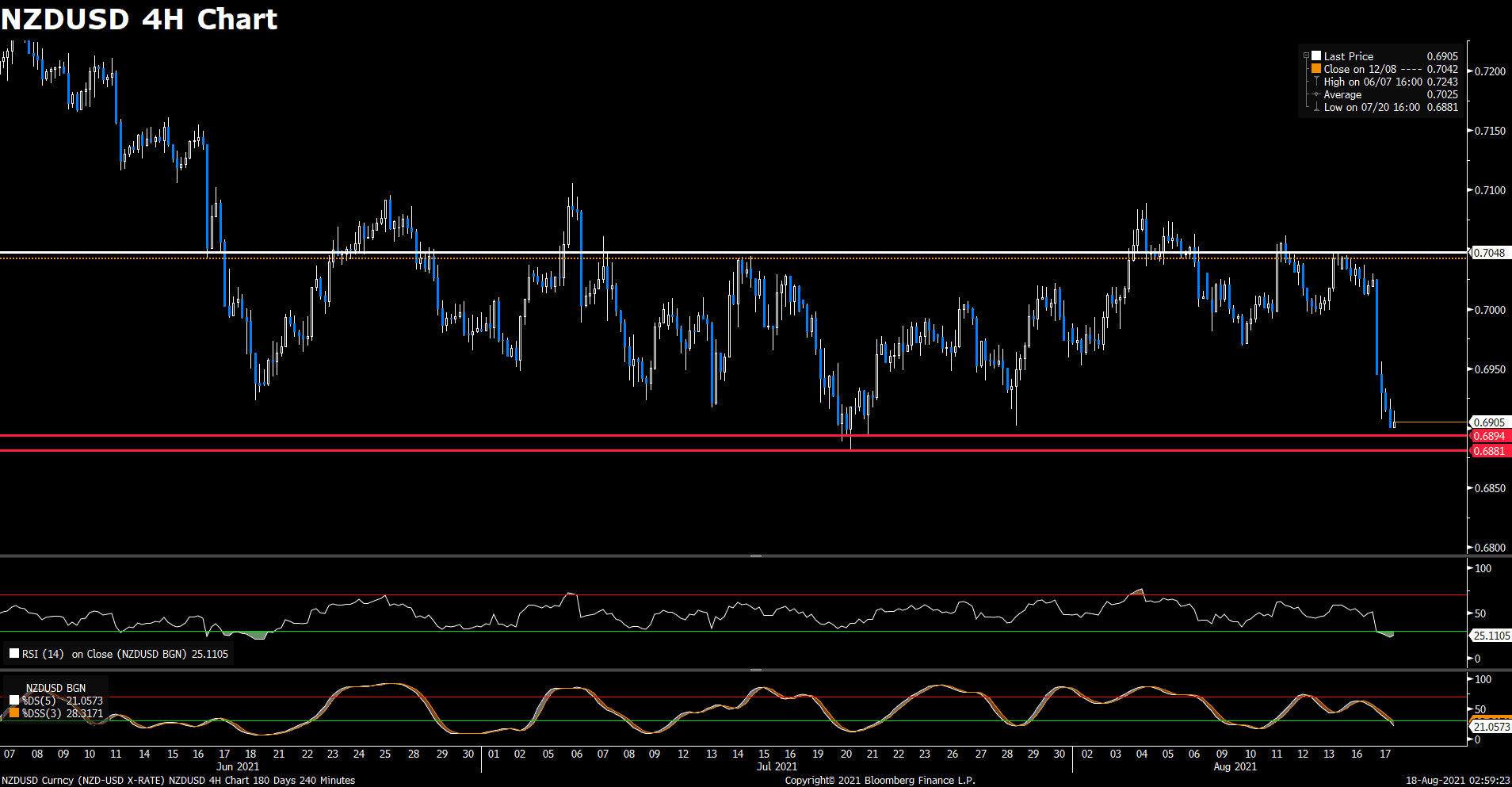

NZDUSD (4- Hour Chart)

The NZD/USD pair is suffering heavy losses on Tuesday. It fell sharply during the Asian trading hours and touched its weakest level in three weeks at 0.6905. The NZD came under strong selling pressure after New Zealand Prime Minister Jacinda Ardern announced a snap three-day nationwide lockdown in light of the first community Covid case detected since February in Auckland. On the other hand, the greenback is capitalizing on safe-haven flows and causing NZD/USD to stay deep in the negative territory.

For technical aspect, RSI indicator 25 figures as of writing, suggesting the market is oversold now, the downward trend may reverse in the near future. If we take a look at Stochastic Oscillator, the fast line lies around 20 which shows that the market is in a weak position.

In conclusion, we think market will be bullish, and chances are high that the pair will rebound from Tuesday’s tumble. For this week, the focus will be on the RBNZ Interest Rate Decision on Wednesday, the three-day nationwide lockdown could force the Reserve Bank of New Zealand to adopt a cautious tone and delay the tightening.

Resistance: 0.7048

Support: 0.6894, 0.6881

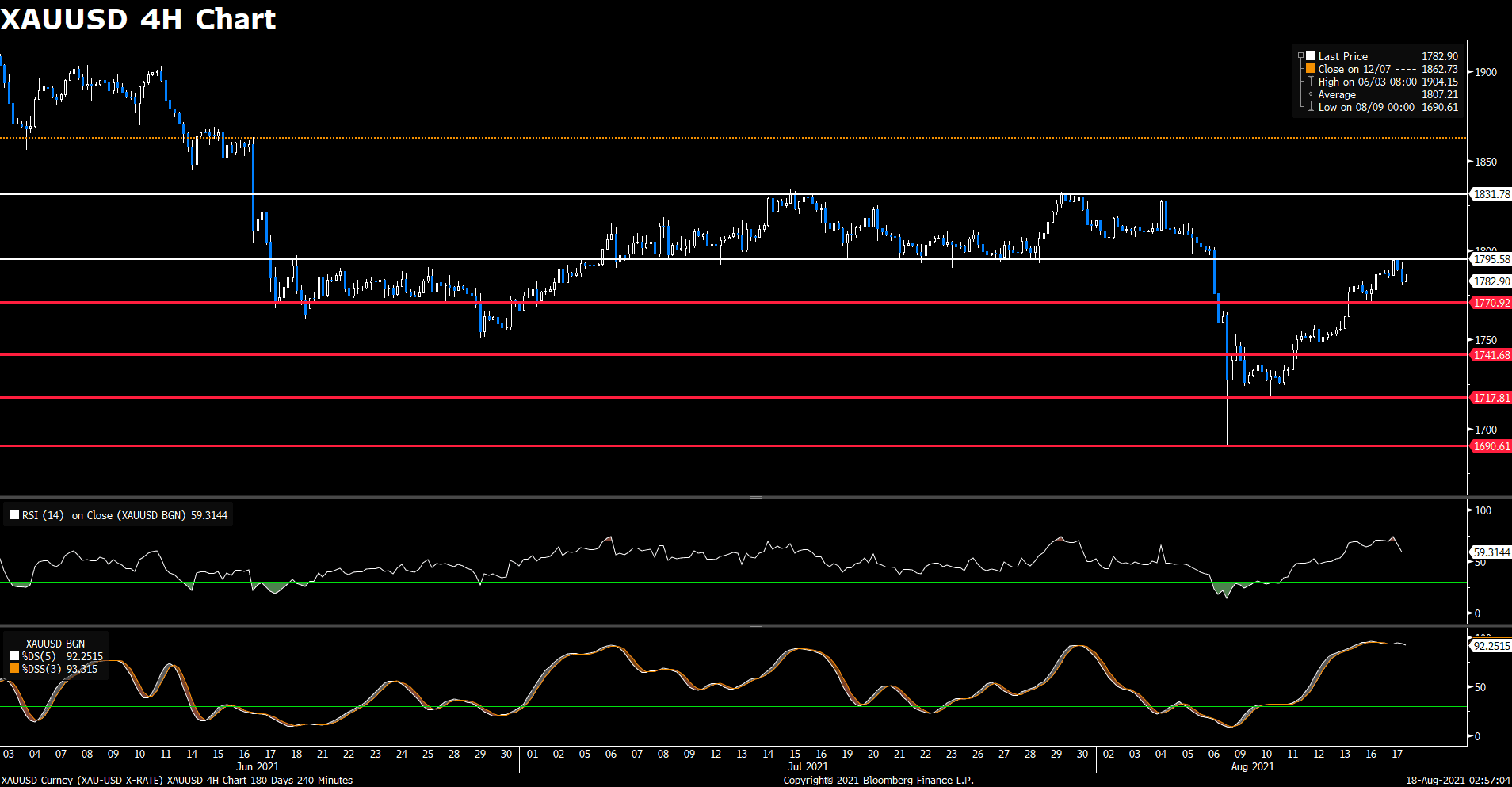

XAUUSD (4- Hour Chart)

The pair XAU/USD is falling on Tuesday, ending a four-day streak of daily gains. Gold approached earlier to the $1,795 level before turning to the downside. A rally of the US dollar across the board weighed on gold, which made the metal retreating from weekly highs. Weaker-than-expected economic data from the US did not affect the dollar. Even US yields rose after the report. Retail sales fell 1.1% in July, against expectations of a decrease of 0.2%.

For technical aspect, RSI indicator 59 figures as of writing, suggesting tepid bull-movement ahead. If we take a look at Stochastic Oscillator, a fast line over 90 level shows that the market is in a strong position.

In conclusion, we think market will be bearish as long as the 1795 resistance line holds. On Wednesday, the Federal Reserve will release the minutes of the latest FOMC meeting. Gold traders should scan for Fed speakers and their outlooks for the US economy, covid risks and looking for clues for when the Fed will taper.

Resistance: 1795, 1831

Support: 1770, 1741, 1717, 1690

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

NZD |

RBNZ Interest Rate Decision |

10:00 |

0.5% |

||||

|

NZD |

RBNZ Rate Statement |

10:00 |

|||||

|

NZD |

RBNZ Press Conference |

11:00 |

|||||

|

GBP |

CPI (YoY) (Jul) |

14:00 |

2.3% |

||||

|

EUR |

CPI (YoY) (Jul) |

17:00 |

2.2% |

||||

|

USD |

Building Permits (Jul) |

20:30 |

1.610M |

||||

|

CAD |

Core CPI (MoM) (Jul) |

20:30 |

|||||

|

USD |

Crude Oil Inventories |

22:30 |

-1.055M |

||||