Daily Market Analysis

Market Focus

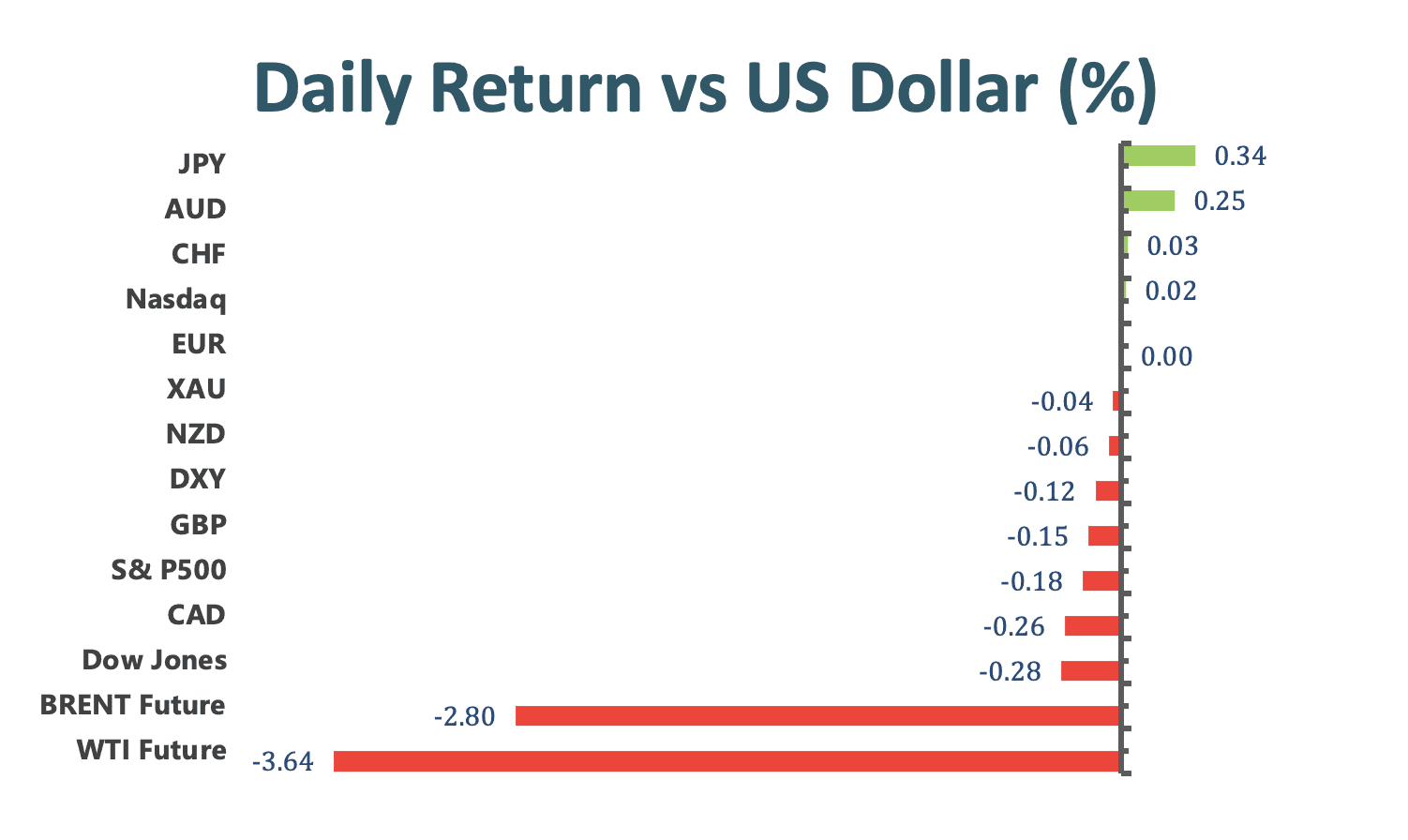

U.S. equities pared back gains on Monday after Treasury yields extended a decline following softer-than-expected U.S. manufacturing growth amid lingering supply constraints. The S&P 500, Dow Jones and Nasdaq all fell from earlier highs as investors considered the impact of the 10-year Treasury yield hitting as low as 1.15% on Monday, putting concerns about growth on display. At the end of the day, Dow Jones dropped 0.28%, while Nasdaq closed green with a little comeback.

A surge in Covid-19 cases across the U.S. brought on by the fast-spreading delta variant is increasing pressure on U.S. drug regulators to fully approve Pfizer Inc.’s vaccine, the first one to apply for full licensure in the U.S.

Full approval could help the Biden administration ramp back up its immunization drive and reassure vaccine holdouts that the shots are safe. It could also make it easier for more schools and workplaces to put immunization mandates in place.

Meanwhile, breakthrough cases that penetrate the shot’s defenses are being monitored by health officials. While the Pfizer-BioNTech SE mRNA-based vaccine, cleared in the U.S. via an emergency-use authorization late last year, remains highly effective at preventing severe disease, the question of whether booster shots will be needed looms as fall approaches.

Main Pairs Movement:

Market players were optimistic at the beginning of the day, with dollar easing against its major rivals. The sentiment turned sour during American trading hours, as the latest official ISM index contracted from 60.6 to 59.5, a sign of slowing economic progress.

The euro pair hovers around 1.1870, while cable stands below 1.3900. The performances of commodity-linked currencies were mixed. The AUD rose, the NZD fell, and the CAD lost demand amid plunging oil prices.

With renewed demand for safety, the US treasury yields plummeted to their 2-week low, and the safe haven JPY surged against the greenback. Gold jumped to the intraday high amid the dismal market mood, but somehow dropped back to familiar levels at the end of the day. Crude oils plunged, with WTI retreated to $71.50 a barrel, and Brent traded at $73.20, 2.60% off than the previous day.

In general, major pairs held within familiar levels as investors await first-tier data scheduled for later in the week. In the US, employment is taking the center stage with the Nonfarm Payroll report.

Technical Analysis:

GBPUSD (4-hour Chart)

After reaching five-week high of 1.398 level on last Friday, closing it best week against the weakening greenback since early May, the sterling bears have piled in again as the week gets underway. As of writing, sterling is trading at 1.3885 and down 0.14% in the day market. On economy side, U.K. Marketing Manufacturing PMI improved to 60.4 in July, following the expectation. For technical aspect, RSI indicator correct it momentum then set 47 figure, suggesting slightly bear movement ahead. For moving average side, 15 long SMA indicator has turned it slope to south way with sterling slightly moving downward and 60 long SMA indicator remaining upway traction.

All in all, most possibility for sterling is a south way momentum as short term SMA and RSI show a bearish suggestion. Moreover, sterling fell below 1.3896 which is a neckline according to price action.

Resistance: 1.3896,1,3985, 1.4

EURUSD (4- Hour Chart)

The pair advanced higher toward 1.19 during the European session but failed to defend the upside momentum. At the end of the day, pair was virtually unchanged on the day at 1.187. As U.S. ISM Manufacturing PMI came lower than expected in July that reversed risk-positive market circumstance, directly finding buy-in demand for greenback. From the technical perspective, RSI indicator close 55 figures as of writing, suggesting slightly-bull movement for a short term. For moving average side, 15 long SMA indicator shows flat movement side and 60 long SMA remaining acending movement.

For price action, market seems finding a comfortable support level at 1.1848 and flirting around 1.1848~1.188. As current stage. If price could breach 1.188 firmly again, it could heading to higher level. On downside, we deem the most strong support level will be 1.1766 level. Moreover, it seems like building a double head price action and neckline will be on 1.1848.

Resistance: 1.188, 1.19

Support: 1.1848, 1.18, 1.1766

USDCHF (4- Hour Chart)

The USDCHF pair closed in the negative territoru for consecutive 5 straight days and lost more than 100 pips last week. On Monday, the pair stays in a consolidation phase following the data realeases from Switzerland. As of writing, pairs was flat in the day market at 0.905. At the same time, U.S. and E.U. share markets were pull back from the daily high spot, fueling momentum for swiss franc.

For technical side, RSI indicator rebound from over sought zone to 36 figure, suggesting a bearish movement ahead. For moving average perspective, both 15 and 60 long SMAs indicator are moving to south way.

For price action, if price slip under 0.9047, we expect the momentum will lead it to further way on 0.9 level. On upside, price seem building a comfort resistance cluster area at 0.90756, 0.91 following.

Resistance: 0.9075, 0.9134

Support: 0.9047, 0.9

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

RBA Interest Rate Decision (Aug) |

12:30 |

0.1% |

||||

|

AUD |

RBA Rate Statement |

12:30 |

– |

||||