Daily Market Analysis

Market Focus

U.S. equities ended a five-day winning streak on Tuesday as megacap technology stocks including Apple Inc. and Microsoft Corp. tumbled ahead of their earnings reports. The tech-heavy Nasdaq (-1.21%, -180.14) posted its biggest drop in more than two months as all three of the major American equity indexes fell from all-time highs. The Hang Seng Index (-4.22%, −1,105.89) sank the most since May 2020 as speculation swirled that U.S. funds are offloading China and Hong Kong assets. Amid the dismal sentiments, Dow Jones slightly dropped 0.24%, or 85.79.

As Apple’s third-quarter results released and the conference call just ended, we offer you 5 key takeaways from Bloomberg Top Live Blogs:

Main Pairs Movement:

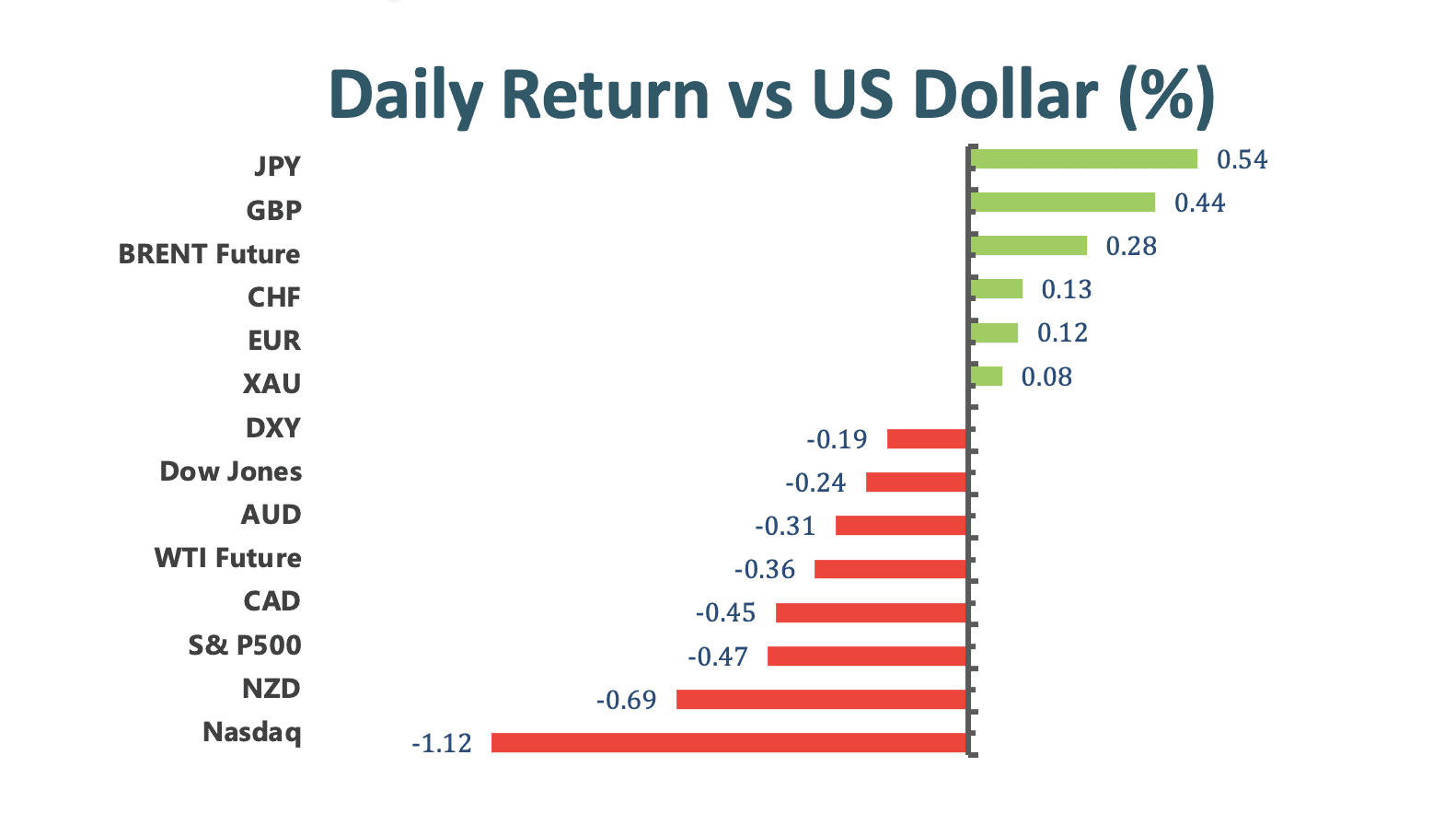

The dollar dropped, despite a generalized dismal mood. Global stocks edged lower, while demand for government bonds increased, pushing yields lower. Market players were cautious ahead of the US Federal Reserve decision on monetary policy. The central bank will likely maintain its monetary policy on hold, with the focus on when and how they will start retrieving monetary support.

US data was mixed. Durable Goods Orders were up 0.8% MoM in June, much worse than the 2.1% expected. The core reading, Nondefense Capital Goods Orders ex Aircraft, surged 0.5%, also missing expectations. On a positive note, CB Consumer Confidence improved to 129.1 from an upwardly revised 128.9 in June.

The euro pair reached a weekly high of 1.1840, retreating afterwards to close the day at 1.1815. Cable hovers near 1.3870 retaining intraday gains. Commodity-linked currencies were the worst performers, losing grounds despite the weakened greenback. Safe haven yen were sharply appreciated, while CHF gained a little bit.

Gold struggles around $1,800, while crude oil prices eased. WTI settles around $71.90 a barrel, and Brent trades at $74.70.

Technical Analysis:

GBPUSD (4-hour Chart)

Pound bulls picking up the recently with risk off sentiment on shares market, as of writing hover 0.45% topping to 1.388 level, mostly conquer last highest level around 1.39 psychological spot.

For technical aspect, RSI indicator close around 66.9 figure which suggest strong-bull guideline extend recently momentum at least for short term. For moving average side, 15 long SMA indicator continuing it ascending momentum and 60 long SMA indicator turn sideway traction in daily market.

As price action, pound is holding on a powerful resistance at 1.3896~1.39 around. if market exceed immediately resistance, it would heading to higher stage. For downside, 1.3475 level still a defend line for bid buyer.

Resistance: 1.3896

XAUUSD (4- Hour Chart)

Gold is choppying in a tight range on Tuesday market, within a channel after break into 1800. However, still gained around 0.16% 1799.7 as of writing. At the meantime, the greenback has given back more ground as real U.S. bond yields hit all-time lows, as known as TIPS, supporting the yellow metal. Forthcoming day, investor is awating outcome of FOMC meeting. From the technical perspective, RSI indicator settle at 46 figures as of writing, suggesting slioghtly bearish movement ahead. For moving average side, 15 long SMA indicator shows slightly went down and 60 long SMA remained flat.

In lights of aforementional, we expect gold market will high probability struggle in a consolidation range. To the downside, we expect 1795 will be powerful support. If market penetrate the first immediately support, it would move to lower lows which eye on 1765.5 level. On the up way, 1811 around shows price cluster resistance as first pivotal checkpoint.

Resistance: 1811, 1830.5

Support: 1795, 1765.5

EURUSD (4- Hour Chart)

Euro dollar shed some 20 pips from fresh weekly highs at 1.1842, holding on to modest daily gains. Forex market is awaiting to U.S. Fed’s rate decision looms. On Tuesday, greenback saw its picking up extra pace after U.S. headline Durable Goods Orders expanded at montly 0.8% and Core one slightly surged 0.3%, both loss previously estimates. For technical side, RSI indicator set 57 figure suggesting a bull movement guidance for short term. For moving average perspective, 15 long SMA indicator moving in flat with modest momentum in reccent and 60 long SMA turn into north way, 2 lines seem nearly gold cross.

Following recently suggestion, euro dollar has stand above the 1.1804 level, a critical resistance level as price pattern. For now, the most important thing for euro fiber is to defend on current momentum. if price could propel to higher, than next price level would eye on 1.1848~1.188. On contrast, we see market was stop by 1.1848 level in day market and still expect 1.1804 is the short run pivot support. If market reverse to down way the first support, it would fall into quagmire between 1.1766 and 1.18040 as tiny volatility.

Resistance: 1.1848, 1.188

Support: 1.1804, 1.1766, 1.17

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

CAD |

Core CPI (MoM)(Jun) |

20:30 |

0.4% |

||||

|

OIL |

Crude Oil Inventories |

22:30 |

-2.928 M |

||||

|

USD |

FOMC Statement |

02:00 (7/29) |

– |

||||

|

USD |

Fed Interest Rate Decision |

02:00 (7/29) |

0.25% |

||||

|

USD |

FOMC Press Conference |

02:30 (7/29) |

– |

||||