Daily Market Analysis

Market Focus

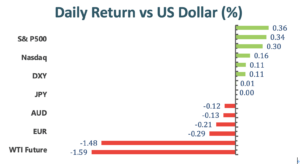

Stocks gained to end at records on Wednesday, closing out a choppy session higher after the FOMC’s June meeting minutes signaled a split on the timing for rolling back crisis-era monetary policies. The S&P 500 and Nasdaq (+0.01%, or +1.42) ticked up to reach record intraday and closing highs, led by a resurgence in growth and technology names. The Dow also rose for about 0.30%, or 104.42.

Biden set a goal for 70% of American adults to get at least one Covid-19 shot by July 4, a symbolic nod to Independence Day. Despite ample vaccine supplies, he missed that target, largely because the government has struggled to give away shots in rural, deeply conservative regions.

Now the delta variant is spreading. While it’s been found across the U.S., hotspots are erupting in less-vaccinated areas, like southern Missouri. As of June 27, for the first time since the U.S. started administering shots, the rate of Covid-19 hospitalizations in less-vaccinated places exceeded the rate in places with the highest proportions of inoculated people.

The main concern about the vaccines is their side effect, to who refused to take. Southern Missouri is nowhere near Biden’s goal of 70% of adults with at least one shot, and even if it was, it might not be enough to stop delta, said Steve Edwards, president and chief executive of CoxHealth, which operates six hospitals in the region.

Main Pairs Movement:

The dollar index closed in the green Wednesday but retreated part of its gains ahead of the close due to the dull FOMC Minutes. The document showed that Fed officials consider the standard of “substantial further progress” needed to adjust monetary policy hasn’t yet been met, added that various FOMC members judged the risks to their inflation projections were tilted to the upside. In general, the document didn’t offer any fresh insights regarding the timing of tapering but showed that some policymakers saw the uncertainty around the economic outlook elevated after the latest data.

The euro pair settled at 1.1790 amid the lower-than-expected Germany industrial data. Loonie stretched further north, trading at 1.2488 as of writing. The antipodean pairs headed to the different directions as Aussie dropped to the 0.748 level, while Kiwi managed to close with mild gains at 0.7015.

Cable ended the day with a slight uplift while the UK reported over 32k new coronavirus cases, the biggest one-day increase since late January. However, the number of those falling into critical conditions or dying is low, reflecting the effectiveness of the immunization campaigns. There is no news so far suggesting restrictive measures will maintain after July 19.

US 10-year Treasury yields remained under selling pressure, hitting an intraday low of 1.29%. Gold prices are up for a sixth consecutive day, with the bright metal trading at around $1,804.00 a troy ounce as the US session came to an end. Crude oil prices came under strong selling pressure on Wednesday, with the US benchmark hitting a fresh two-week low of $71.05 a barrel, its lowest since mid-June. WTI recovered ahead of the close and settled at $72.00. Brent trades at $73.24 at the moment.

Technical Analysis:

XAUUSD (Daily Chart)

Gold hovers around 1800 level ahead of the FOMC meeting’s minutes and falling Treasury yields. From the technical aspect, the dominant momentum looks to shift to the bulls in the near- term as the consecutive days of positive moves have formed an uptrend. Moreover, a successful break of the resisatance at 1802 and the midline of the bollinger band give gold some hope for the bulls. Even though gold still trades below the 50 simple moving averages, there are some potential for gold to continue moving upward amid a postive MACD and a neutral reading of RSI. In order to re- confirm gold’s bullish momentum, gold needs to break the next immediate resistance at 1829.14.

Resistance: 1829.14, 1876.18

Support: 1802, 1771.95, 1676.89

EURUSD (4- Hour Chart)

EURUSD tumbles around 1.1800, the lowest level since April ahead of the FOMC Meeting. From the technical perspective, after failing to hurdle the resistance level at 1.1837 during the European session, the dominant outlook of EURUSD looks bearish on the 4- hour chart. Additionally, the downside is also supported by the negative MACD while the pair trades well below the 20 and the 50 simple moving averages. The pair is expected to continue extending further south toward 1.1704; however, it might consolidate a bit before the decline as the RSI reading is nearly oversold.

Resistance: 1.1837, 1.1919, 1.1985

Support: 1.1704

GBPUSD (4- Hour Chart)

GBPUSD advances modestly, making little progress as an immediate reaction to the FOMC Meeting. On the 4- hour chart, GBPUSD clings above 1.3800 level during the American session. The near- term outlook looks to turn positive because the pair has breached the descending trend line, signaling a reverse from bearish to bullish. The bullish momentum will confirm if the pair can eventually trade above the 20 simple moving averages and the midline of the bollinger band. As the time of writing, the technical indicators, both the MACD and the RSI, seem to lack of directional strength as they are both in the neutral position.

Resistance: 1.3926, 1.4007

Support: 1.38, 1.3675

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

USD |

FOMC Meeting Minutes |

02:00 |

N/A |

||||

|

EUR |

ECB Monetary Policy Statement |

19:30 |

N/A |

||||

|

USD |

Initial Jobless Claims |

20:30 |

350 K |

||||

|

USD |

Crude Oil Inventories |

23:00 |

-4.033 M |

||||