Daily Market Analysis

Market Focus

U.S. technology stocks fell as investors turned their attention to a batch of earnings from industry heavyweights that have helped drive the market to all-time highs.

The Nasdaq 100 dropped for the first time in three sessions, weighed down by declines in tech heavyweights including Tesla Inc. and Alphabet Inc. The S&P 500 closed little changed after swinging between gains and losses throughout the day. United Parcel Service Inc. soared to a record after beating Wall Street’s profit estimates.

Tesla ended a two-day streak of gains after its results failed to impress investors. 3M Co. was the biggest drag on the Dow Jones Industrial Average after it warned that higher costs for raw materials and transportation is a worsening threat. Google parent Alphabet climbed more than 4% post market, erasing its cash-session decline after profit and revenue exceeded Wall Street’s expectations. Microsoft Corp. reversed a gain and dropped 3.5% after reporting revenue that missed the highest analysts’ estimates.

While the earnings season has been generally strong so far, investors may be waiting for more robust beats to fan the next move higher. Four out of five S&P 500 companies that have released results have either met or beaten expectations. On average, shares have gained less than 0.1% after the reports, according to data compiled by Bloomberg.

Meanwhile, U.S. data this week are expected to show growth accelerated to an annualized 6.8% in the first quarter. A Conference Board measure Tuesday showed consumer confidence reached the highest since February 2020 as Americans grew more upbeat about the economy and job market.

Main Pairs Movement:

The dollar advanced while U.S. 10-year yields touched the highest level in a week as Federal Reserve policy makers began a two-day meeting with a decision Wednesday that may provide insight into their views on tapering asset purchases. The Canadian dollar slipped from the highest level in five weeks as traders await comments Tuesday from the central bank governor.

Among Group-of-10 peers, the Norwegian krone and pound led gains; the Australian and New Zealand dollars were among the laggards. The U.S. 10-year Treasury yield climbed as much as 5.9bps to 1.63%

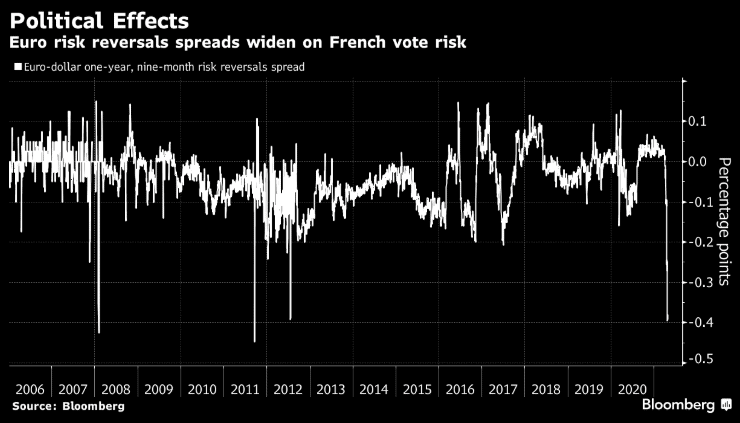

The divergence in sentiment for the euro as shown by its volatility skew has reached levels seen only a handful of times in data going back to 2006. The spread between one-year and nine-month risk reversals is trading around 40 basis points in favor of the longer-term puts.

Technical Analysis:

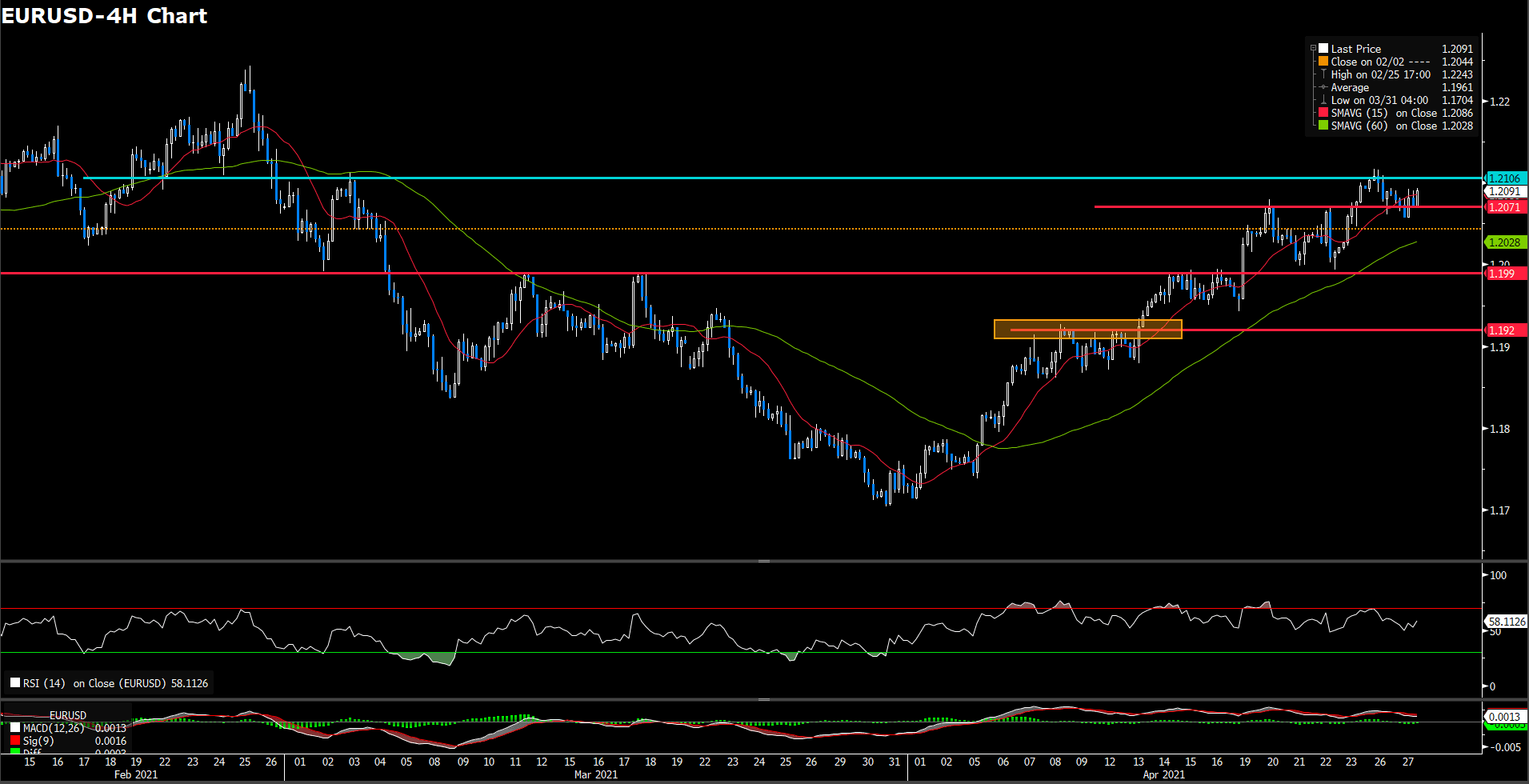

EURUSD (4 hour Chart)

EURUSD consecutive two days slightly move in the day market which gird in tiny horizontal channel, trading at 1.2088 as of writing. Euro dollar bounced back but under 1.21 from intraday low of 1.2060 while investor awaiting ECB chairman speaking, FOMC statement and Fed interest rate decision. For RSI side, indicator shows 58 which suggest a upward momentum ahead of. On average price aspect, 15 and 60-long SMAs are retaining an ascending trend.

In the lights of aforemetional suggestion, we still expect market maintain bull movement at current stage. It is one thing worthnoting that there has a solid threshold at 1.21. In additional, market could face a tumultuous as central bank governor speaking and any decision.

Resistance: 1.2106

Support: 1.2071, 1.199, 1.192

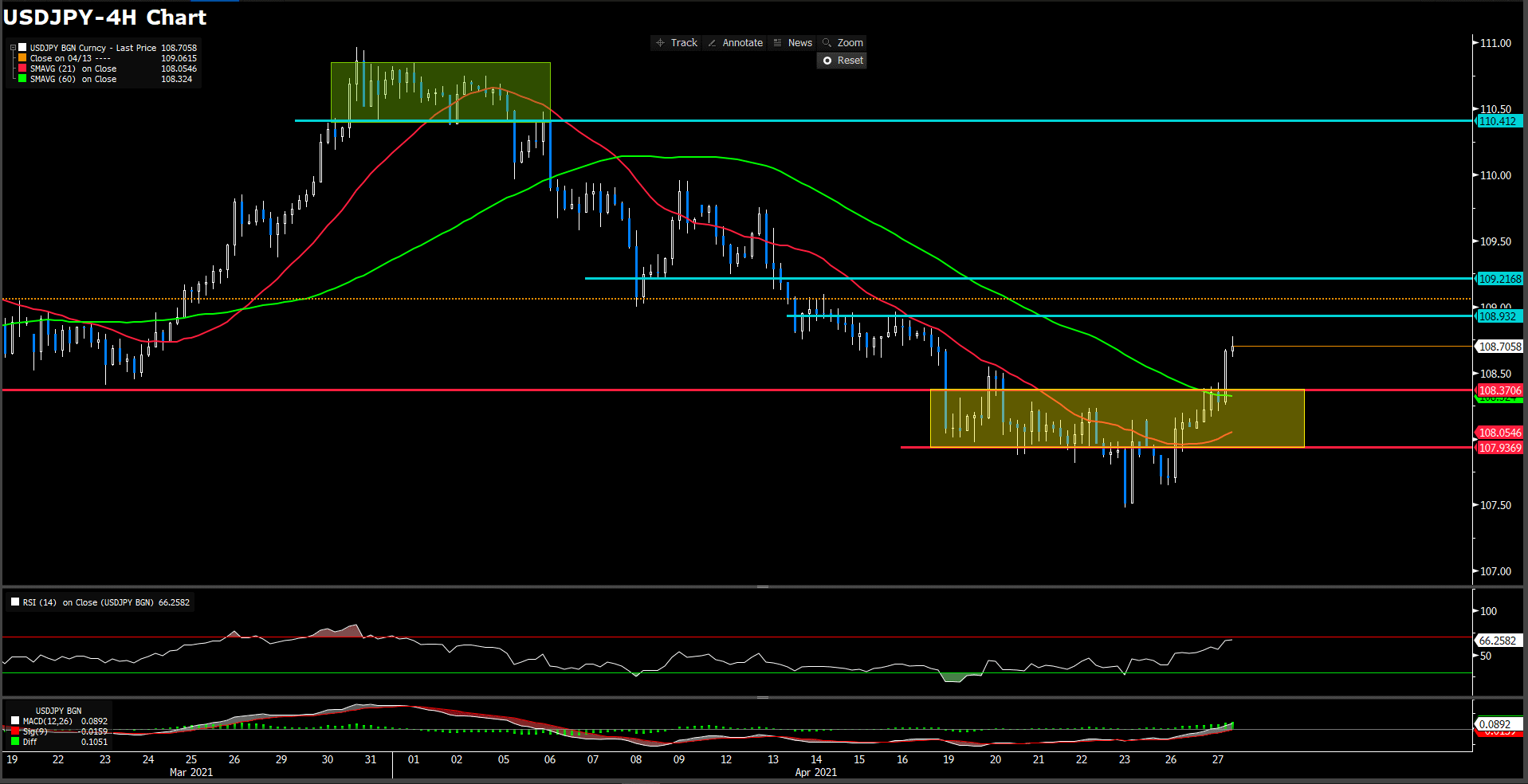

USDJPY (4 Hour Chart)

Japan yen hovered to close the day in the positive territory, trading at 108.756 level as of writing, whilst greenback clings in tiny daily gains. In morning session, the BoJ govorner said that the central bank can achieve a 2% inflation target by continuing powerful money easing as at it post-monetary policy meeting that drive devaluation expectation rising. For RSI side, indicator is locating at 66 figure, suggesting a bull move at short run. On the other hand, yen jumped significantly that drove 15-long SMA indicator turn to upward way and 60-long remaining a slightly move.

At current stage, yen stand above the month-long neckline at 108.37 level as recovery from days ago low. Therefore, we believe market has potential upward indication. However, we see the market momentum was pick up too rapidly in short term that probably will induce some take-profit trade from long position.

Resistance: 108.93, 109.22

Support: 108.37, 107.936

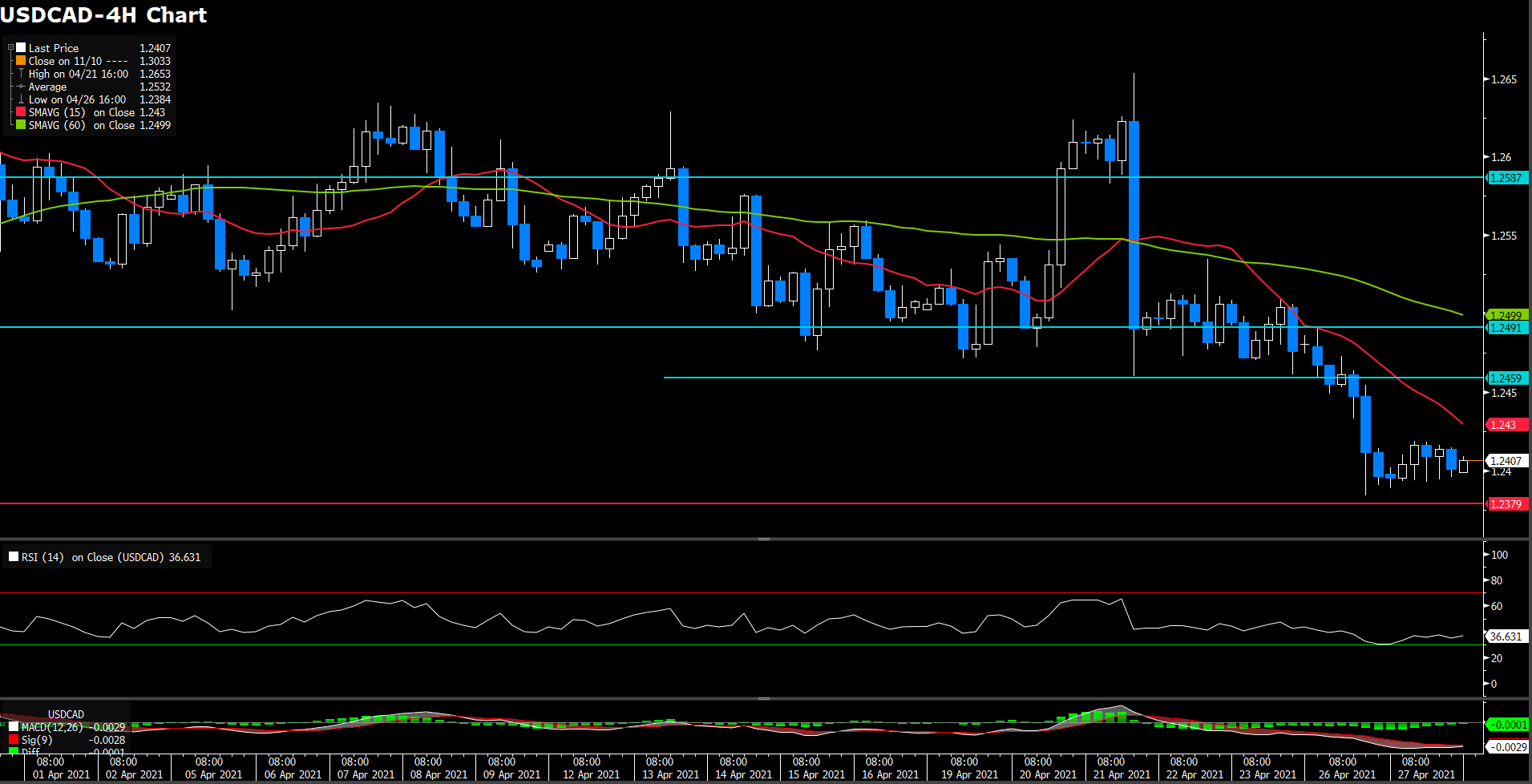

USDCAD (Daily Chart)

Loonie fail to continue it downward momentum as it struggle near by critical support and pan-commoditie market was lack of any direction, modest recovery above 1.24 mark. For RSI side, indicator record 34 figure which suggest a downward sentiment in short term. On moving average side, both SMA indicator are retaining downside movement.

Integrity all spots, we consist our yesterday view that loonie could cling at current stage, at 1.238 level, to waiting other strong bearish signal like greenback devaluation or loose statement from central bank. Moreover, pan-commodities price rising will appreciate for loonie as well.

Resistance: 1.246, 1.2491, 1.2587

Support: 1.238

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

CPI (QoQ)(Q1) |

09:30 |

0.9% |

||||

|

CAD |

Core Retail Sales (MoM)(Feb) |

20:30 |

3.7% |

||||

|

EUR |

ECB President Lagarde Speaks |

22:00 |

– |

||||

|

OIL |

Crude Oil Inventories |

22:30 |

0.659 M |

||||

|

USD |

FOMC Statement |

02:00(4/29) |

– |

||||

|

USD |

Fed Interest Rate Decision |

02:00(4/29) |

– |

||||

|

USD |

FOMC Press Conference |

02:00(4/29) |

– |

||||