Daily Market Analysis

Market Focus

U.S. equities climbed to a record high amid solid corporate earnings and confidence that the Federal Reserve will remain accommodative even as robust growth takes the world’s largest economy back to pre-pandemic levels.

The S&P 500 rose after notching its first weekly decline since mid-March. Most of the main 11 industry groups gained, with energy and consumer-discretionary shares jumping the most. Small-cap stocks in the Russell 2000 outperformed the broader market. The U.S. 10-year Treasury yield hovered around its 50-day moving average. Copper, seen as a barometer of growth, surged to the highest in a decade.

Investors this week will focus on corporate earnings and U.S. economic data even as the Fed primes them to expect no change to policy at their two-day meeting ending Wednesday. While emerging economies from India to Brazil are grappling with a Covid-19 surge or renewed curbs, the developed world is on a firmer recovery path with a faster pace of vaccination.

Data on Thursday may show U.S. gross domestic product increased at a 6.9% annualized pace from January through March after a more moderate 4.3% rate in the previous quarter. Other reports this week may show a pickup in consumer confidence and robust personal spending. Recent indicators cemented economic optimism, with durable-goods orders rebounding in March and output at manufacturers and service providers reaching a record high in April.

European stocks advanced Monday, as gains for banks and travel companies offset losses for food companies and utilities. The dollar was little changed after initially falling to a two-month low. It was still on course for the biggest monthly drop this year.

Main Pairs Movement:

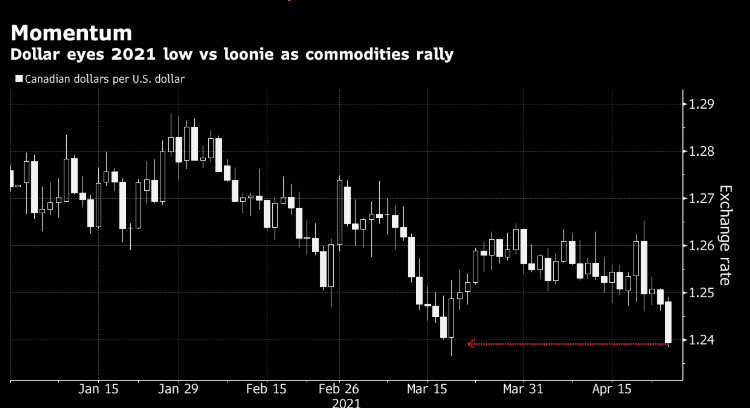

The Canadian dollar touched a five-week high, while the Australian dollar topped all Group-of-10 peers Monday, as a key index of commodities climbed to the highest since June 2018. A gauge of the dollar hit the lowest in two months as the Federal Reserve is set to begin a two-day meeting that ends Wednesday with a decision that could provide clues on its tapering stance.

Among G-10 peers, the Australian, Canadian and New Zealand dollars outperformed amid a surge in copper and iron ore prices; the yen and euro led losses.

EUR/USD -0.1%; earlier climbed to 1.2117, the highest since Feb. 26. Short-dated risk reversals ease with gamma around EUR2.6 billion of 1.20 strikes and EUR2 billion of 1.19 strikes rolling off Wednesday.

AUD/USD advanced 0.8% to 0.7803; NZD/USD rose 0.5% to 0.7238. Pair likely capped by ~AUD1.1 billion of 0.7830 options expiring Tuesday, according to DTCC data. GBP/USD +0.2%; rose as much as 0.4% to 1.3929; a move through 1.40 is likely.

Technical Analysis:

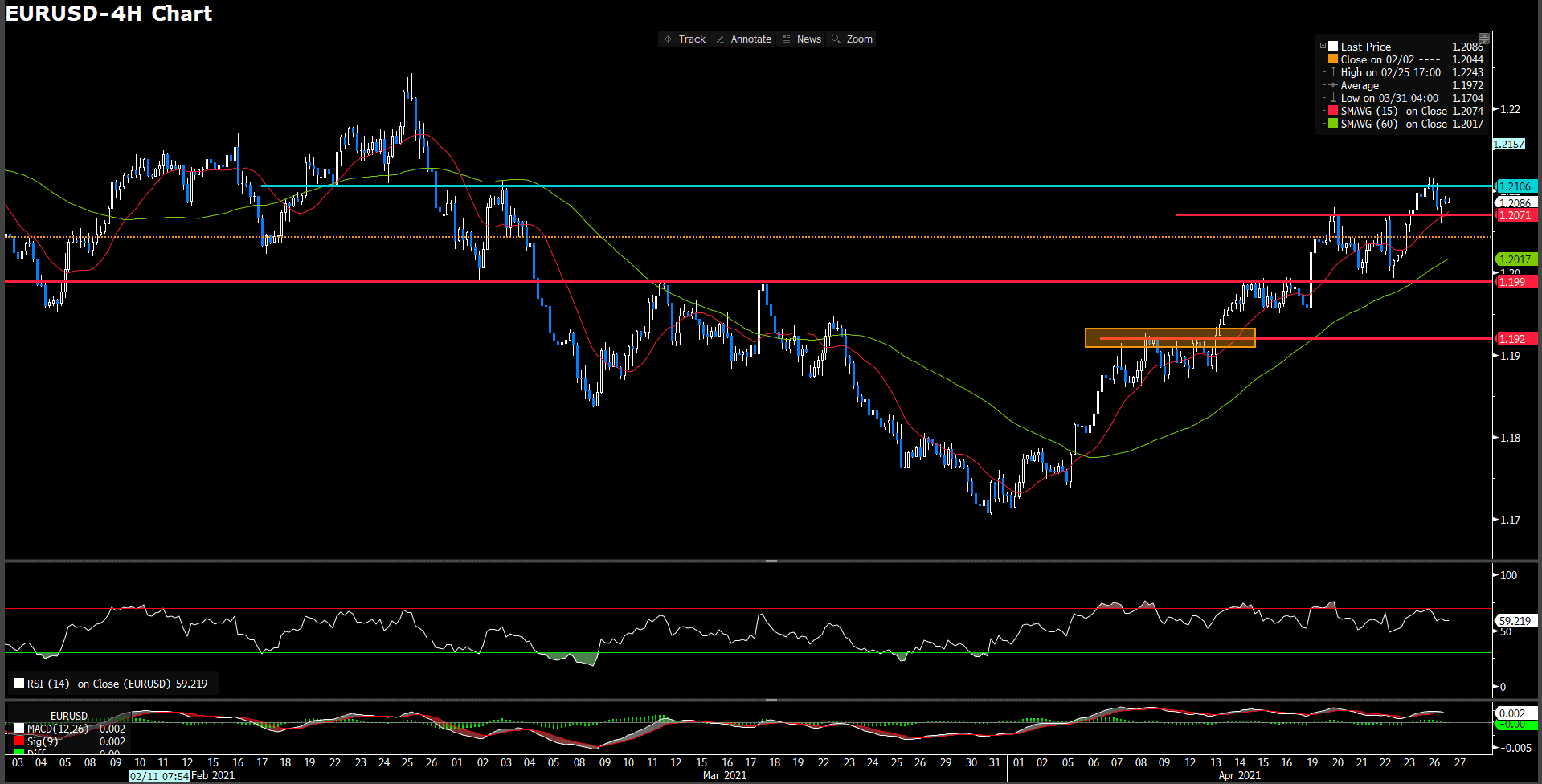

EURUSD (4 hour Chart)

EURUSD slightly move in the day market which gird in tiny horizontal channel, trading at 1.2086 as of writing. As the lastest CFTC report, the EUR net speculator’s positioning increasing sharply. For RSI side, indicator show 59 figure at the moment, suggest a bullish momentum in short run. Furthermore, 15 and 60-long SMAs indicator are remaining acending trend. Therefore, we still optimistic for next bullish momentum that base on currently thread. However, there has a pursuant resistance at 1.2106 on the north side. If euro penetrate the resistance, we believe euro would hold the bull movement ahead.

Resistance: 1.2106

Support: 1.2071, 1.199, 1.192

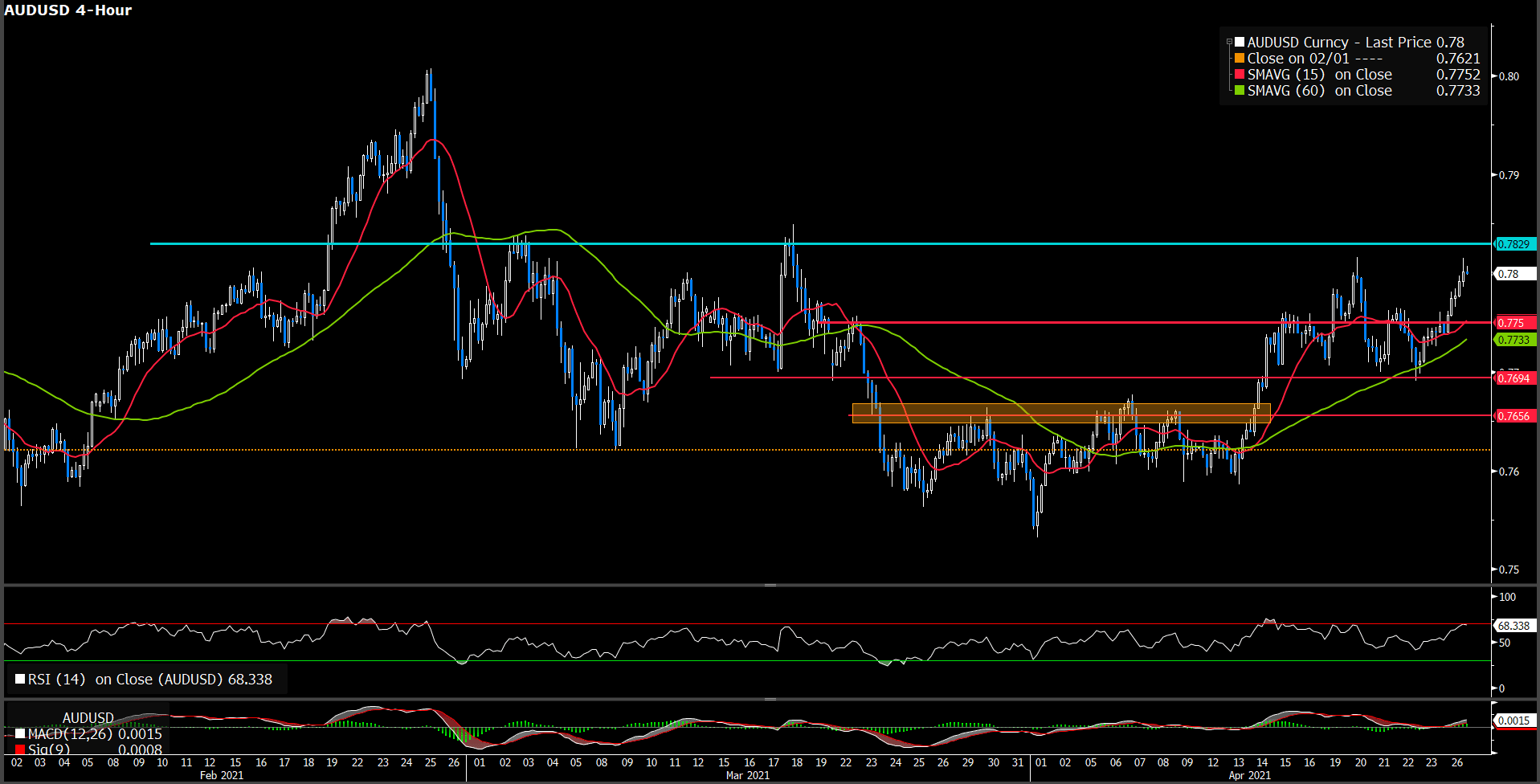

AUDUSD (4 Hour Chart)

Aussie dollar has remians on upward track to post strong daily gains around 0.78 level which amid weakness greenback and benefit by booming commodities price as it commodities-linked characteristic. In the absence of worthnothing news, the pickup witnessed in copper prices provided a boost to the Aussie. For technical side, RSI indicator has risen to 68 figures which suggest a bullish guideline. On average price view, 15 and 60-long SMAs indicator are both sprawling upward trend.

Overall, we expect market still have room for upper side if greenback remaining weak\ness and rising price of commodities marketplace. Elsewhere, we see there has a strong resistance in short distance on 0.783 around. Moreover, unstopable bullish sentiment will drive RSI too quick to over bought threholds that might spur some sell-off order to the market.

Resistance: 0.783

Support: 0.775, 0.7695, 0.7656

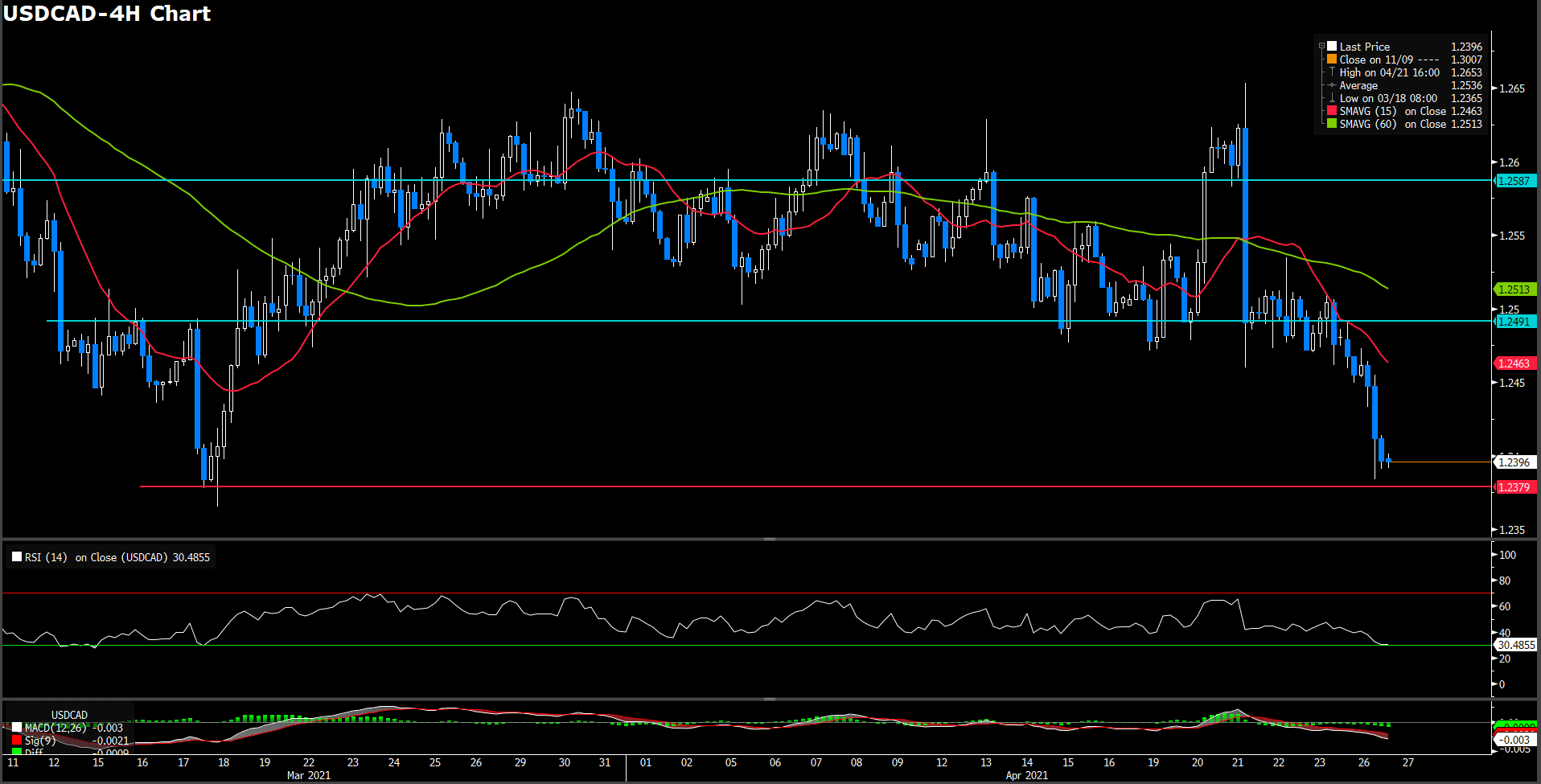

USDCAD (Daily Chart)

Just like other commodities-linked currencies, loonie also driven by weakness greenback and inflation expectation of commodities market. As of writing, loonie tumbled during the north American session, reaching the lowest level since March 18th and also the multi-year low. Pair broke 1.246 then close around 1.2394 level. For RSI perspective, indicator has drop to 30 figure which pretty close to over sought barrier. Moreover, 15 and 60-long SMAs indicator have death cross in recently day.

Integrity all spots, we foresee market will reverse currently movement in short term as trigger the critical support level. On slip side, if market sucessive tamp down over nadir level, there will extend the plummet momentum and sentiment because there lack of a price cluster support.

Resistance: 1.246, 1.2491, 1.2587

Support: 1.238

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

JPY |

BOJ Outlook Report (YoY) |

11:00 |

– |

||||

|

JPY |

BOJ Press Conference |

11:00 |

– |

||||

|

USD |

CB Consumer Confidence (Apr) |

22:00 |

113 |

||||