Daily Market Analysis

Market Focus

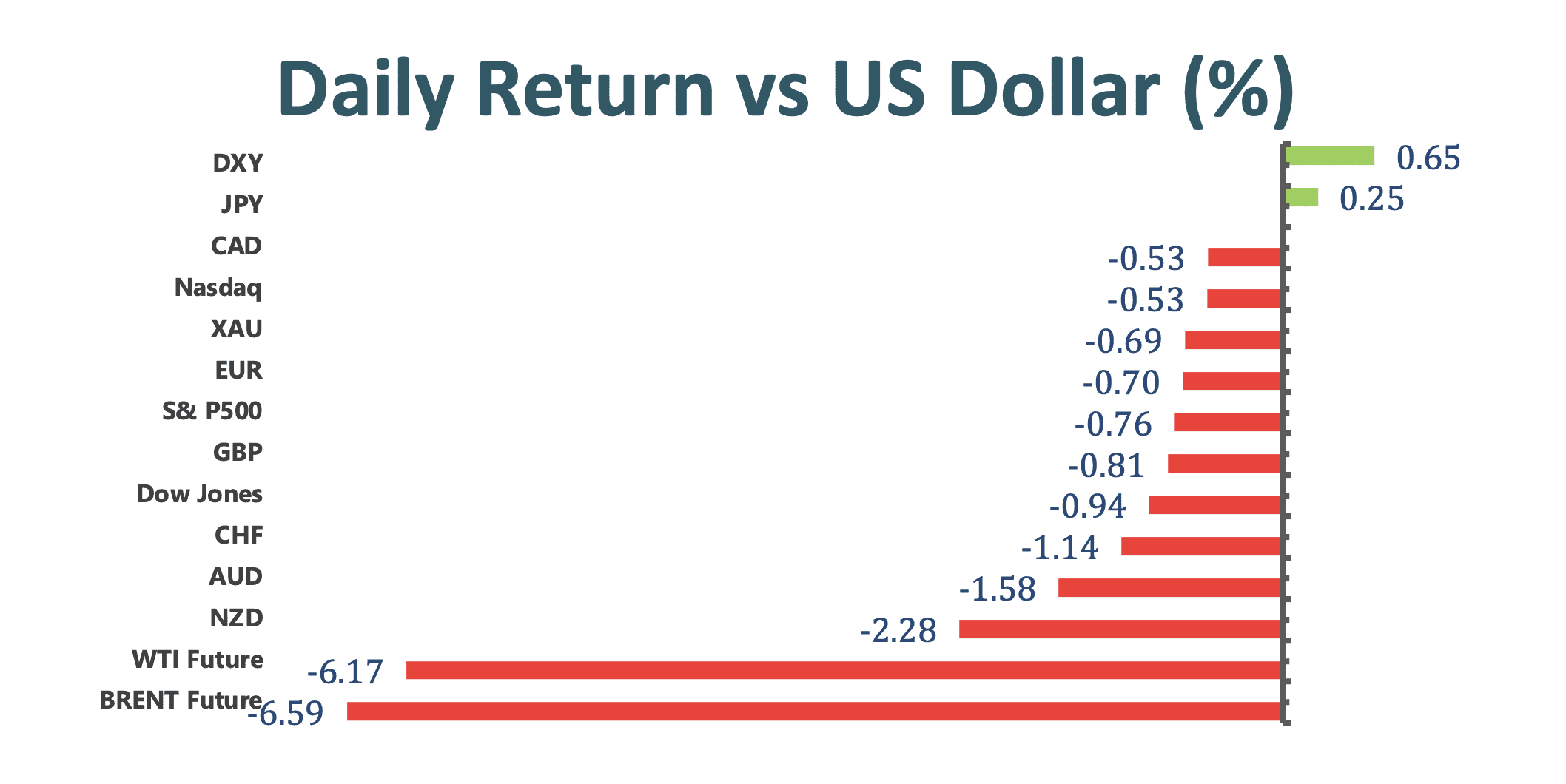

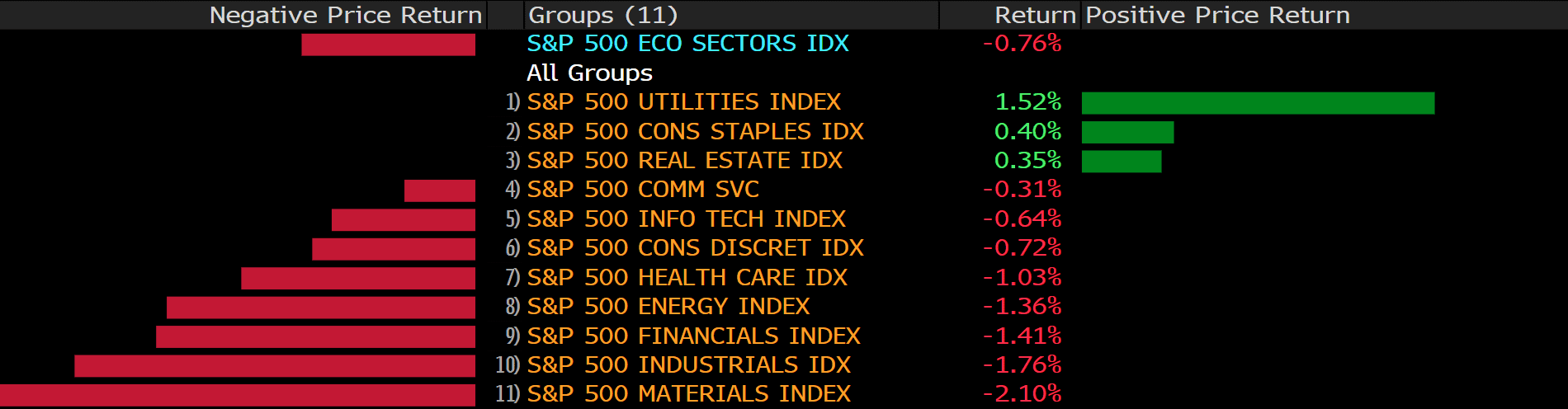

US equity market suffered despite easing bond yields. The three big indexes were on the retreat. The S&P 500 index slumped 0.64%, with industrials and materials stocks led the decline.

Here is Bloomberg’s key takeaways from Janet Yellen and Jerome Powell House CARES act testimony:

Market Wrap

Main Pairs Movement

Dollar was gaining traction on Tuesday, the dollar index ramped up 0.64%. The rally may be motivated by external forces, rather than US greenback itself. New Zealand government unexpectedly announced its move to fight rising house prices with a set of measures. The act will heavily hamper down rentier class as newly rolled out tax code makes housing speculation less profitable. To be specific, capital gains on properties investment will be taxed for any property held less than 10 years, compared to previous 5 years. The bigger implication is perhaps pandemic resilient or recovered countries like New Zealand are already getting their hands on reversing the consequence of a too loosen monetary policy. This synchronized expectation in turn dragged down currency crosses like the Aussie and Cable, where similar steps are followed.

Euro dollar plummeted 0.2% as investors are still digesting Turkey headline. Moreover, lockdown extension from Germany and Netherlands further weighed down on the shared currency. There is little sign of backdown from infection figures in Germany, Chancellor Angel Merkel noted “case numbers are rising exponentially thanks to the British variant of the virus, new British variant of coronavirus means we are effectively in a new pandemic. [lockdowns] will be extended until Easter.”

Renewed lockdown in Europe undermined oil price on Tuesday, the WTI crude and Brent crude futures plunged 6.17% and 6.59% respectively. Investors are worried that sluggish EU vaccination campaign will fall further behind amid resurgence of infections within the Euro Zone, thus decelerate the recovery in oil demand.

Technical Analysis:

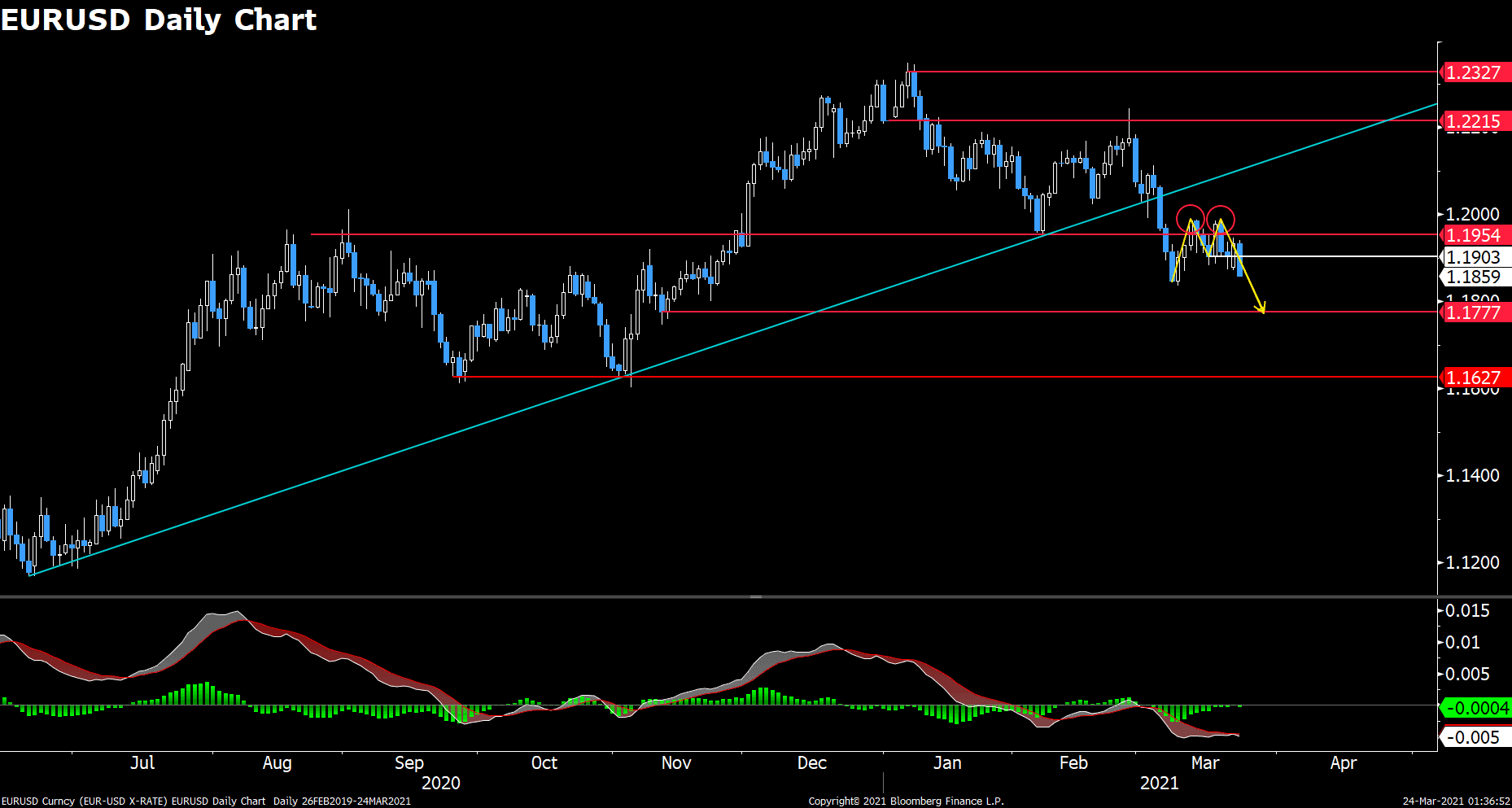

EURUSD (Daily Chart)

Euro dollar looks to close the day with a solid breaish engulfing. Price was very close to climbing back above 1.1954 during yesterday’s session, but today’s recovering dollar strength killed bulls’ hope. More importantly, the double-top pattern is manefesting ifself as price broke through the neckline of 1.19. As we noted in previous analysis, this pair will exit the current consolidation pahse, and the bears will reclaim the driver seat. It is unsurprising to see a retaining selling bias given the breakout from a ascending trend. On the downside, the nearest contestant support lies around 1.1778, following by long standing 1.163. We are also seeing a bear revival from the MACD.

Resistance: 1.19, 1.195, 1.2215

Support: 1.1778, 1.163

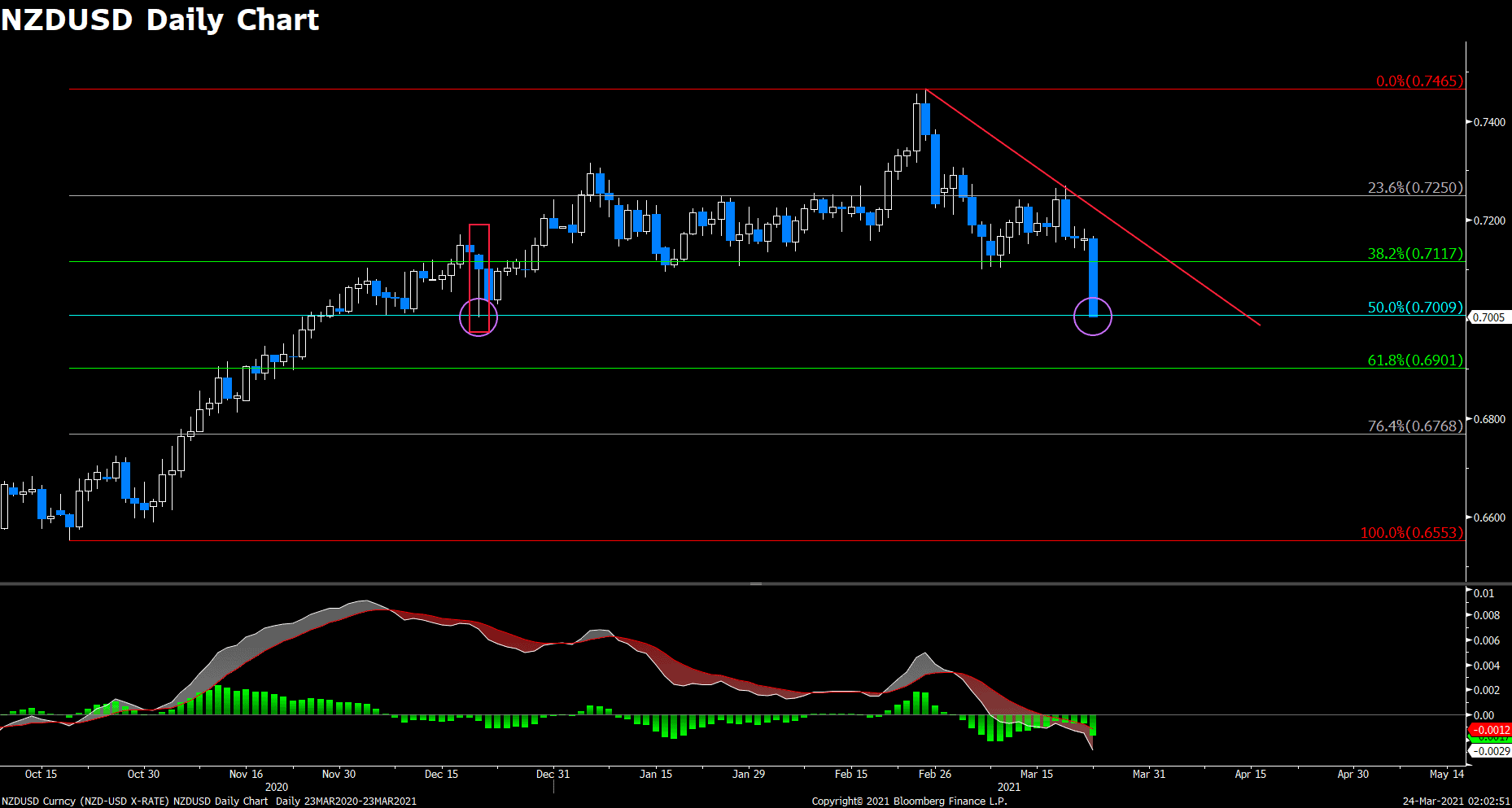

NZDUSD (Daily Chart)

The long waited breakout on the Kiwi finally happened, after stuck inside a tight range between 0.7117 and 0.725. Price relentlessly plunged 2.14% on the news that New Zealand government will fight rising house price with a new set of policy. It is falling onto 50% Fibonacci of 0.7, which is also a significant pyschological support. We witnessed a strong bounce last time when this handle was contested, thus it is reasonable to induce a similar action this time around. However, if price fails to pull away from 0.7, then we suspect the starved bear will take price down to 0.69.

Resistance: 0.7117, 0.725, 0.7465

Support: 0.7, 0.69, 0.6768

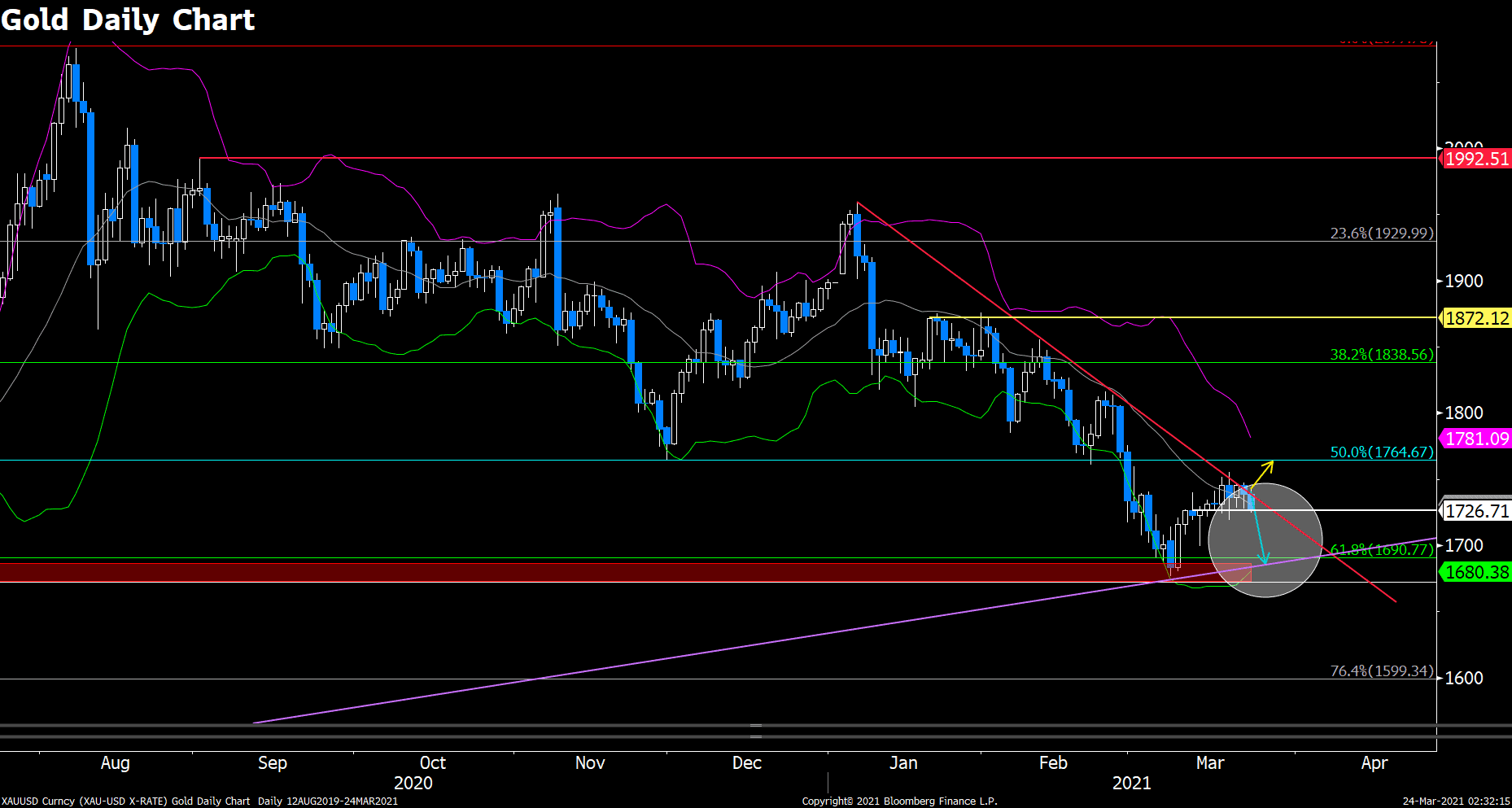

XAUUSD (Daily Chart)

Gold is still clinging to the descending trendline, along with mid-line of Bollinger Band. Price is backed to a corner, and await for signals from the Treasury market. That being said, we remain a bullish stance on the precious metal since stimulus checks are in the rareview mirror, focus has returned to Fed’s dovish view and upcoming Treasury auction, which should eke out Gold. In fact, we are seeing bounce-offs from the frequently visited $1727 soft support, any decisive upward drift could encourage bulls to pile in. At this point, investors should be prudent to wait for a clear breakout from either side.

Resistance: 1765, 1839, 1872

Support: 1727, 1691, 1680

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

GBP |

CPI (YoY) (Feb) |

15:00 |

0.8% |

||||

|

EUR |

German Manufacturing PMI (Mar) |

16:30 |

60.8 |

||||

|

GBP |

Composite PMI (Mar) |

17:30 |

|||||

|

GBP |

Manufacturing PMI (Mar) |

17:30 |

54.9 |

||||

|

GBP |

Services PMI (Mar) |

17:30 |

|||||

|

USD |

Core Durable Goods Orders (MoM) (Feb) |

20:30 |

0.6% |

||||

|

USD |

Fed Chair Powell Testifies |

22:00 |

|||||

|

USD |

Crude Oil Inventories |

22:30 |

-0.272 M |

||||